- United States

- /

- Aerospace & Defense

- /

- NYSE:SPR

Spirit AeroSystems (SPR): Assessing Valuation After Recent Gains and Sales Metrics

Reviewed by Simply Wall St

Spirit AeroSystems Holdings (SPR) has remained fairly steady over the past week, with shares closing at $38.56. The stock is up 1% during the past month and has climbed about 18% over the past year, reflecting gradual momentum.

See our latest analysis for Spirit AeroSystems Holdings.

Momentum seems to be building for Spirit AeroSystems. The latest 1-year total shareholder return sits at 18.1%, suggesting investors are gaining confidence in the company’s recovery and growth prospects after a turbulent stretch in the aerospace sector.

If the aerospace rebound has your attention, you might want to see which other companies could benefit from the upswing. See the full list for free.

But with shares hovering near their recent highs and the latest gains factored in, the key question remains: Is Spirit AeroSystems still trading at an attractive price, or have markets already priced in future growth?

Price-to-Sales of 0.7x: Is it justified?

Spirit AeroSystems is currently trading at a price-to-sales (P/S) ratio of 0.7x, which places it at a premium relative to its own estimated fair P/S ratio of 0.4x. Since the most recent closing price was $38.56, this ratio suggests that the market is attaching more value to each dollar of revenue than what the fair ratio would indicate.

The price-to-sales ratio measures how much investors are willing to pay per dollar of the company’s sales, making it especially useful when companies have volatile or negative earnings. For an unprofitable company like Spirit AeroSystems, P/S can offer a clearer picture of relative value than profit-based multiples.

While Spirit AeroSystems’ sales metric looks expensive compared to its own fair value benchmark, it appears attractively valued when compared to both its peer group (average 11.6x) and the broader US Aerospace & Defense industry (average 3.1x). This significant gap suggests the market may be skeptical about the company’s path to sustainable profits, or is discounting potential risks more sharply than it does for industry peers. If the market moves closer to the fair ratio, investors could see a shift in sentiment.

Explore the SWS fair ratio for Spirit AeroSystems Holdings

Result: Price-to-Sales of 0.7x (OVERVALUED)

However, persistent net losses and a recent pullback in the last quarter could dampen investor enthusiasm, even though the company’s revenue growth is improving.

Find out about the key risks to this Spirit AeroSystems Holdings narrative.

Another View: What Does the SWS DCF Model Say?

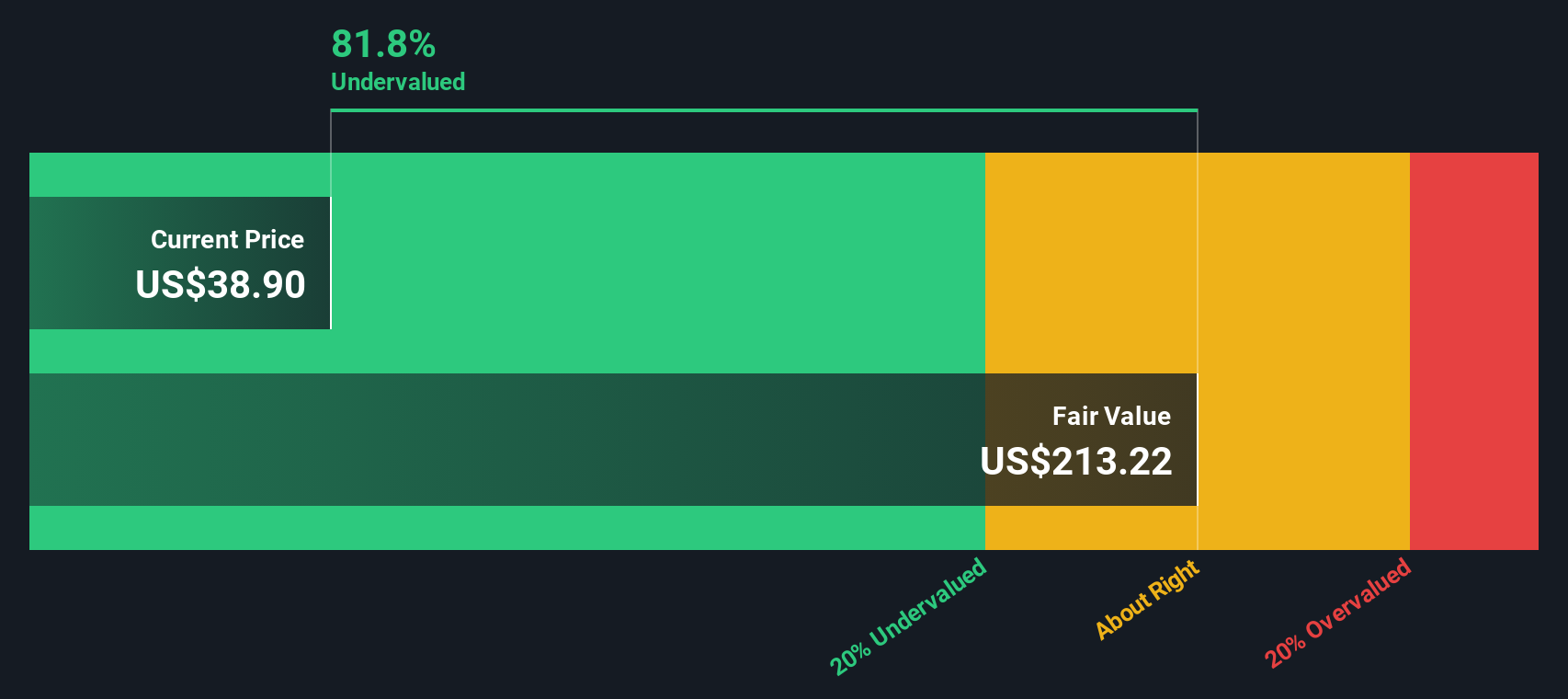

Looking from a different perspective, our SWS DCF model estimates Spirit AeroSystems’ fair value at $211.93 per share, which is significantly higher than its current price of $38.56. This indicates the stock could be deeply undervalued if our cash flow assumptions are accurate. However, questions remain about the reliability of DCF projections when the company has not yet reached profitability.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Spirit AeroSystems Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Spirit AeroSystems Holdings Narrative

If you want a different perspective or like to dig into the numbers yourself, you have the option to build your own view of Spirit AeroSystems in just a few minutes: Do it your way.

A great starting point for your Spirit AeroSystems Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Open the door to fresh opportunities you might be overlooking. Don’t let the momentum pass you by. These smart screens can help you spot your next winning stock.

- Generate passive income streams by checking out these 17 dividend stocks with yields > 3% offering reliable yields above 3% for income-focused investors.

- Capitalize on the booming potential of healthcare technology by reviewing these 33 healthcare AI stocks driving advances in diagnostics, treatments, and patient outcomes.

- Ride the wave of financial innovation with these 80 cryptocurrency and blockchain stocks leading exciting breakthroughs in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPR

Spirit AeroSystems Holdings

Engages in the design, engineering, manufacture, and marketing of commercial aerostructures worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives