- United States

- /

- Electrical

- /

- NYSE:SMR

Does ENTRA1 Energy's 6-Gigawatt SMR Deal Redefine the Bull Case for NuScale Power (SMR)?

Reviewed by Sasha Jovanovic

- ENTRA1 Energy announced a major agreement to deploy up to 6 gigawatts of NuScale Power's small modular reactors across the Tennessee Valley Authority's seven-state service region, marking the largest commitment of its kind in the U.S. to date.

- This partnership milestone arrives as NuScale's largest shareholder, Fluor Corp, has recently made significant share sales, drawing attention to both the company's commercial progress and capital structure dynamics.

- We'll explore how this unprecedented commercial deployment agreement shapes NuScale's future as the only NRC-certified SMR provider poised for large-scale execution.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NuScale Power Investment Narrative Recap

NuScale Power’s investment story centers on delivering the first U.S. Nuclear Regulatory Commission-certified small modular reactor technology into widespread commercial use, with significant near-term attention on revenue generation and customer conversion. The recent ENTRA1/TVA deployment agreement boosts long-term visibility, but it does not materially change NuScale’s central short-term catalyst, securing definitive power purchase contracts, or resolve the main operational risk tied to delays in customer commitments and project start dates.

The most relevant announcement is NuScale’s Partnership Milestones Agreement with ENTRA1 Energy, which commits the company to supply SMR technology, unlocking up to US$55 million in milestone payments. This agreement underpins near-term revenue potential, reinforcing commercial momentum, but it is contingent on future project milestones and execution, with ongoing risks in contract finalization and customer follow-through.

On the flip side, investors should be aware that supply chain or manufacturing delays could still threaten...

Read the full narrative on NuScale Power (it's free!)

NuScale Power's narrative projects $402.3 million revenue and $42.2 million earnings by 2028. This requires 121.5% yearly revenue growth and a $178.8 million earnings increase from the current earnings of -$136.6 million.

Uncover how NuScale Power's forecasts yield a $41.69 fair value, a 6% upside to its current price.

Exploring Other Perspectives

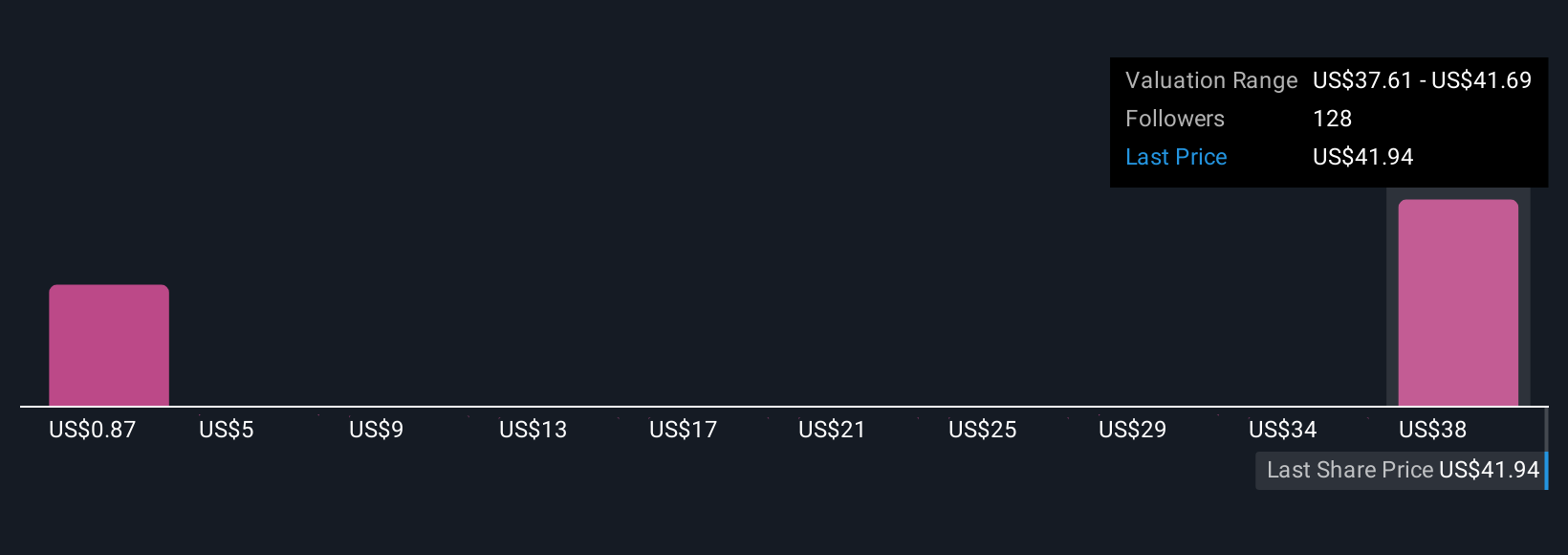

Simply Wall St Community members suggest fair values for NuScale Power ranging from US$0.87 to US$41.69 across 13 individual estimates. With operational risks from delayed customer commitments and project timelines in focus, you can see how opinions may sharply differ on NuScale’s outlook, consider all these viewpoints when weighing the company’s future potential.

Explore 13 other fair value estimates on NuScale Power - why the stock might be worth as much as 6% more than the current price!

Build Your Own NuScale Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NuScale Power research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NuScale Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NuScale Power's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NuScale Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMR

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives