- United States

- /

- Aerospace & Defense

- /

- NYSE:SARO

How StandardAero's (SARO) New MRO Deals Could Shape Its Role in Global Aviation

Reviewed by Sasha Jovanovic

- StandardAero announced new and extended maintenance, repair, and overhaul (MRO) agreements in October 2025 with Mauritania Airlines and Oman’s SalamAir to support CFM International engine families, strengthening its presence in the global commercial aviation aftermarket.

- These collaborations underscore StandardAero’s role as a key provider of CFM LEAP and CFM56 MRO services, highlighted by its investment in technician training and component repair innovation.

- We’ll examine how StandardAero’s expanded global partnerships signal ongoing demand for its specialized MRO capabilities within commercial aviation.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is StandardAero's Investment Narrative?

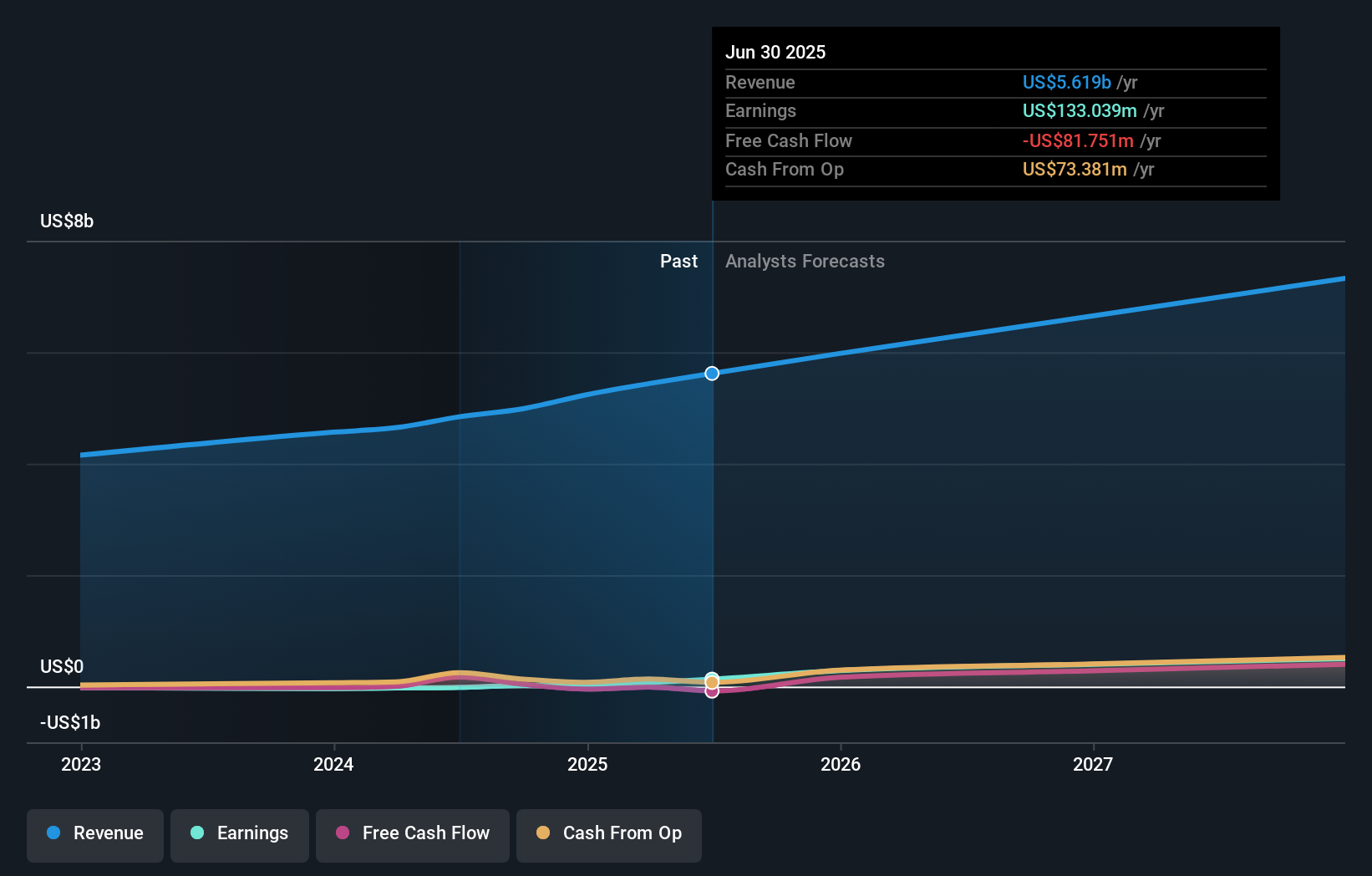

To invest confidently in StandardAero, shareholders need to believe in the company's ability to capture ongoing demand for maintenance, repair, and overhaul (MRO) services, especially as airlines modernize their fleets and rely on newer engine platforms like CFM International's LEAP and CFM56. The latest agreements with Mauritania Airlines and SalamAir reinforce StandardAero's competitive position in the global MRO market, reflecting positive short-term catalysts such as greater workshop utilization and an expanded customer base. However, while these new deals support the company’s growth outlook, they are unlikely to materially shift the near-term risk profile as assessed before the announcement, given that StandardAero’s forecasts already assumed a pipeline of new contracts and strong commercial aerospace demand. The company’s premium valuation and high price-to-earnings ratio remain key risks, especially if future contract wins slow or margins are pressured. Yet, this consistent contract momentum may offer incremental reassurance to investors watching for signs of durable earnings growth.

On the flip side, high valuation metrics still pose important risks investors should keep in mind.

Exploring Other Perspectives

Explore 3 other fair value estimates on StandardAero - why the stock might be worth 18% less than the current price!

Build Your Own StandardAero Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StandardAero research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StandardAero research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StandardAero's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SARO

StandardAero

Provides aerospace engine aftermarket services for fixed and rotary wing aircraft in the United States, Canada, the United Kingdom, Rest of Europe, Asia, and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives