- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (RTX): Assessing Valuation After Q3 Earnings Beat and Upgraded Full-Year Guidance

Reviewed by Simply Wall St

RTX (RTX) delivered its third-quarter 2025 results this week, surpassing expectations and revising its full-year guidance upward. Management emphasized sustained growth across all divisions, supported by steady aftermarket and defense demand, as well as key contract wins.

See our latest analysis for RTX.

RTX’s share price has rallied impressively, jumping more than 13% over the past week and up 54% year-to-date, as third-quarter earnings smashed expectations and momentum picked up across both its commercial aerospace and defense businesses. With a five-year total shareholder return topping 270%, both short-term and long-term investors have benefited from the company’s accelerating growth, new product launches, and strong execution.

If RTX’s current run has you thinking about what other defense and aerospace leaders are achieving, now’s the perfect time to explore See the full list for free.

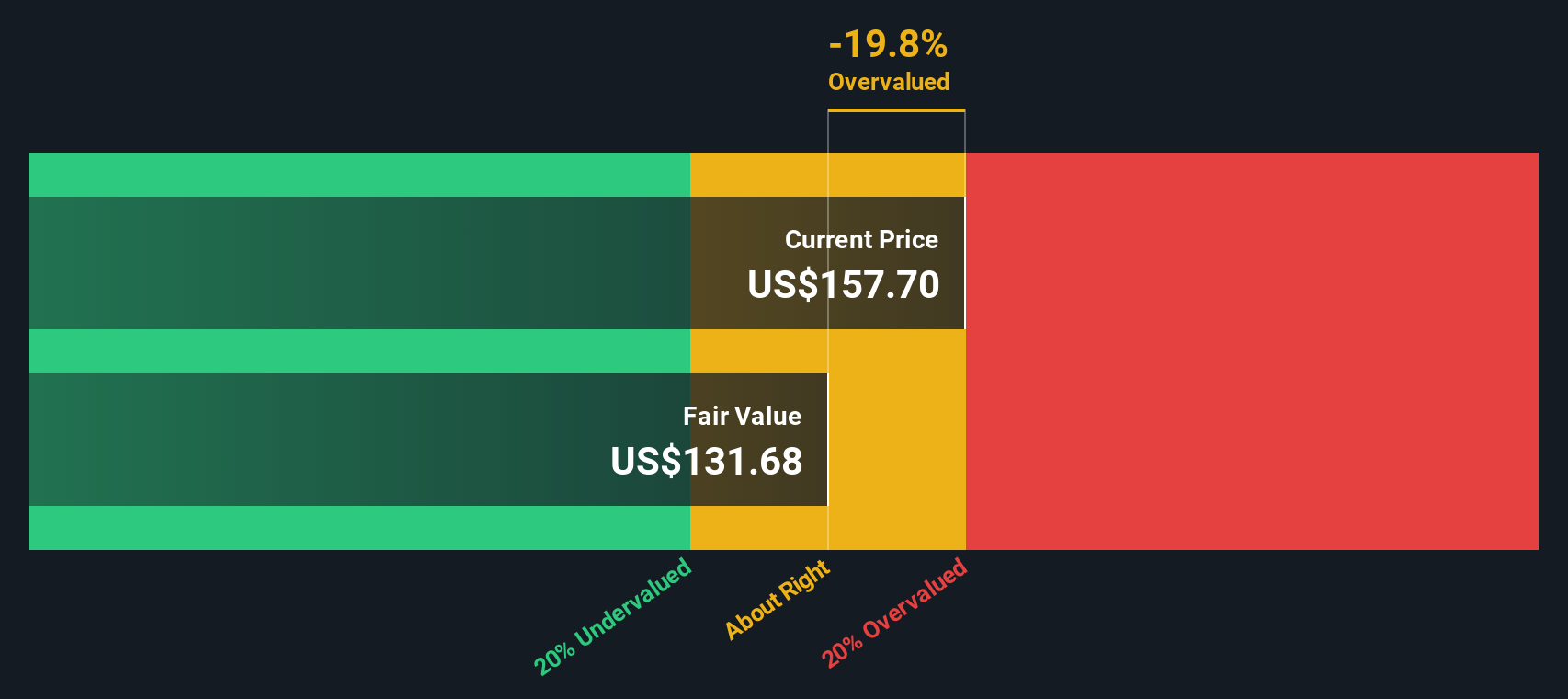

With the stock now trading near all-time highs after a remarkable year of earnings growth and guidance upgrades, investors face a crucial question: is RTX still undervalued with room to run, or has the market already priced in its future growth trajectory?

Most Popular Narrative: 1.9% Overvalued

With RTX’s fair value estimate set just below its latest closing price, the consensus narrative points to a stock that may have outpaced fundamentals, at least for now. What is driving this bold view? Consider the following catalyst behind the narrative’s fair value rationale.

Robust and growing backlog, highlighted by a 1.86 quarter book-to-bill ratio, $236 billion backlog (up 15% year-over-year), and major new international contracts (e.g., EU, MENA, Asia-Pacific) indicate RTX is well-positioned to benefit from sustained increases in global defense spending and heightened geopolitical tensions, setting up strong visibility for future revenue growth.

What numbers underpin this forward-looking assessment? There is a set of bold assumptions about future earnings growth, higher margins, and just how much the market is willing to pay for profit. The bar is high. Are you curious about which headline figures and financial logic hold up the entire valuation argument? The answers might surprise you.

Result: Fair Value of $175.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff volatility or unexpected cost overruns in jet engine programs could weaken RTX's margin growth and reduce future earnings potential.

Find out about the key risks to this RTX narrative.

Another View: What About Future Cash Flows?

Of course, looking beyond earnings multiples, our SWS DCF model offers a different perspective. This approach values RTX by forecasting future cash flows instead of profits. The result is that RTX emerges as overvalued, with shares trading well above our estimate of fair value based on these long-term projections. Does this change the story for investors taking the long view?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own RTX Narrative

If the valuation arguments don’t match your perspective, or you want to dig into the numbers and reach your own conclusion, you can easily build a personalized RTX narrative in just a few minutes. Do it your way

A great starting point for your RTX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to find the hidden winners, fast movers, and tomorrow’s leaders. If you miss out, you could be leaving opportunity on the table while others get ahead.

- Uncover overlooked companies with solid fundamentals by evaluating these 879 undervalued stocks based on cash flows that show potential for strong returns beyond the obvious choices.

- Tap into powerful trends shaping healthcare by monitoring these 33 healthcare AI stocks making breakthroughs in diagnostics, treatment, and next-gen medical solutions.

- Boost your income strategy by reviewing these 17 dividend stocks with yields > 3% that deliver steady yields and may help cushion your portfolio during market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives