- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

RTX (NYSE:RTX) Secures Follow-On Contract Enhancing Army's Rapid Innovation Abilities

Reviewed by Simply Wall St

Raytheon, a unit of RTX (NYSE:RTX), recently secured a follow-on contract from the U.S. Army to enhance its Rapid Campaign Analysis and Demonstration Environment, reinforcing its role in defense innovation. This event, along with RTX's agreements with JetZero and several major defense contracts in January, including significant deals with the Netherlands and Romania for air defense systems, likely influenced the company's stock's 15% rise over the last quarter. Despite the market rebounding mildly, RTX's share performance surpasses general market movements, indicating strong investor confidence in its strategic initiatives and robust defense portfolio.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

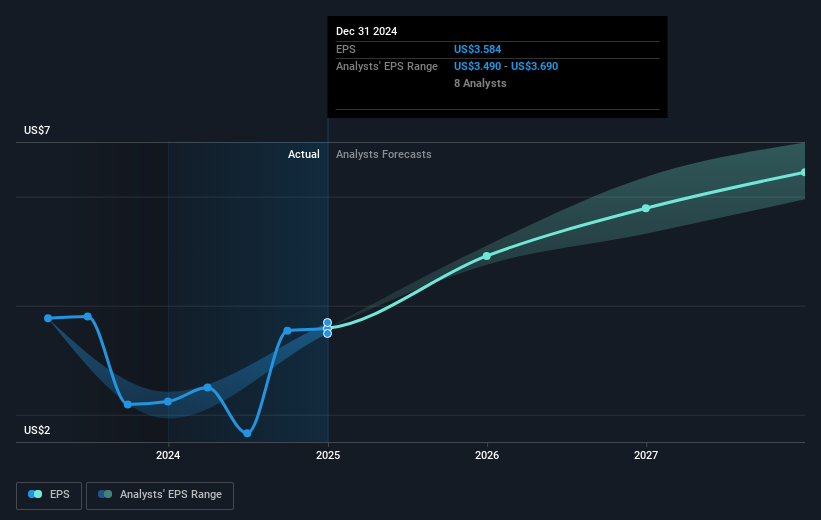

RTX Corporation's total shareholder return over the past five years reached 162.67%, reflecting robust confidence in its long-term strategy. This remarkable performance stands out even as it outperformed both the broader market and the US Aerospace & Defense industry over the past year. Several developments played a significant role in supporting this growth. In 2024, RTX embarked on critical investments in AI and automation, positioning itself for competitive advantage in the defense and commercial sectors, while international demand in both segments further bolstered revenue streams.

Additionally, RTX made significant advancements in its defense portfolio. These include substantial contracts, like the $529 million Patriot system for the Netherlands in January 2025 and the $946 million Patriot systems deal with Romania. Investing in digital infrastructure also improved operational efficiency. Moreover, the 2024 partnership with Array Labs and Umbra Space showcases their commitment to fostering innovation in geospatial technology, enhancing both commercial and defense capabilities.

Upon reviewing our latest valuation report, RTX's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives