- United States

- /

- Aerospace & Defense

- /

- NYSE:RTX

How Investors Are Reacting To RTX (RTX) Surging Q3 Sales and Profitability in Aerospace and Defense

Reviewed by Sasha Jovanovic

- RTX Corporation reported its third-quarter 2025 results, revealing sales of US$22.48 billion and net income of US$1.92 billion, both up significantly from a year earlier, with strong gains in earnings per share as well.

- This robust earnings performance highlights ongoing operational momentum and underscores RTX's ability to generate higher profitability amid a competitive aerospace and defense sector.

- We'll examine how RTX's substantial year-over-year sales and earnings growth could influence its long-term investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

RTX Investment Narrative Recap

RTX appeals to investors who believe in the long-term demand for advanced aerospace and defense solutions, supported by robust earnings growth and a substantial order backlog. The latest quarterly results, with sales of US$22.48 billion and net income of US$1.92 billion, affirm the company’s operational momentum, but do not materially shift the short-term focus: sustaining aftermarket engine reliability and managing warranty expenses at Pratt & Whitney remains the most important near-term catalyst and risk. Of the recent company developments, the announcement that Raytheon has launched initial production of its new SharpSight multi-domain surveillance radar stands out. While not directly tied to the earnings release, this aligns with RTX’s ongoing ability to convert R&D investments into next-generation tech, reinforcing the company’s potential to capture future defense spending and help offset risk from commercial market volatility. But while this operational momentum is promising, investors should also be aware that despite RTX’s efforts to improve GTF engine fleet management...

Read the full narrative on RTX (it's free!)

RTX's narrative projects $97.7 billion revenue and $8.9 billion earnings by 2028. This requires 5.3% yearly revenue growth and a $2.8 billion earnings increase from $6.1 billion today.

Uncover how RTX's forecasts yield a $175.33 fair value, a 9% upside to its current price.

Exploring Other Perspectives

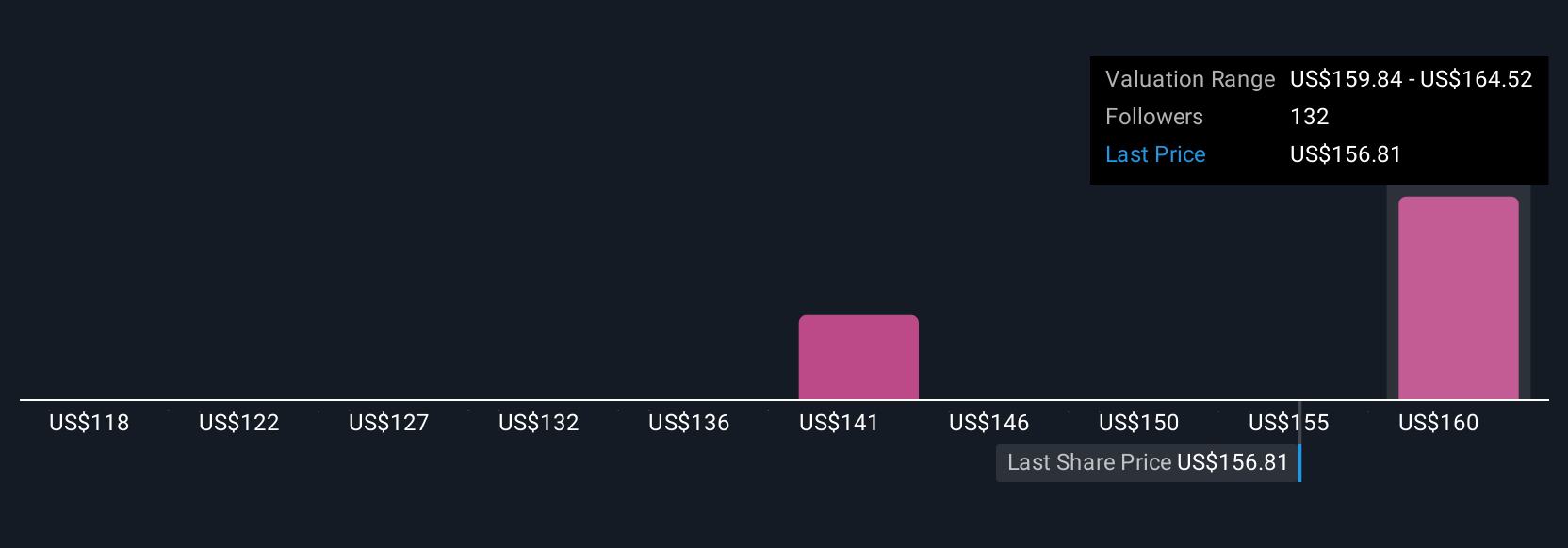

Seven individual fair value estimates from the Simply Wall St Community put RTX’s worth between US$131 and US$175 per share. With heightened focus on engine reliability and aftermarket cost risk, your view on RTX’s potential could differ meaningfully from the market consensus.

Explore 7 other fair value estimates on RTX - why the stock might be worth as much as 9% more than the current price!

Build Your Own RTX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RTX research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RTX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RTX's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RTX

RTX

An aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives