- United States

- /

- Electrical

- /

- NYSE:RRX

How Investors May Respond To Regal Rexnord (RRX) Dividend Announcement and Data Center Expansion

Reviewed by Sasha Jovanovic

- On October 22, 2025, Regal Rexnord Corporation announced that its Board of Directors declared a US$0.35 per share quarterly dividend, payable January 14, 2026, to shareholders of record as of December 31, 2025, continuing an unbroken streak of quarterly dividends since January 1961.

- Beyond this established capital return, recent developments highlight the firm’s expanding exposure to high-growth sectors like data centers and humanoid robotics, which may be underappreciated by the market.

- Let's explore how Regal Rexnord’s growing presence in data center technology may reshape its investment outlook following these recent updates.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Regal Rexnord Investment Narrative Recap

To be a Regal Rexnord shareholder, you must believe in its ability to capture sustained demand from megatrends like data center and automation growth while managing cyclical end-market exposures and supply chain risks. The continued quarterly dividend announcement reinforces stability but does not materially impact the immediate catalyst: conversions of backlog in high-efficiency electrification and automation projects. For now, rare earth supply chain volatility remains the primary risk to short-term margin and revenue performance.

Among recent updates, Regal Rexnord’s showcase at Data Centre World Asia, featuring the highly efficient COPRA EC plug fan, spotlights its push into advanced technology segments. This event ties directly to the main near-term catalyst: increased participation in mission-critical infrastructure buildouts and the associated backlog conversion into sales, key to offsetting any near-term market softness.

However, investors should also be aware that, despite these tailwinds, sustained rare earth supply disruptions could still...

Read the full narrative on Regal Rexnord (it's free!)

Regal Rexnord is projected to reach $6.5 billion in revenue and $695.5 million in earnings by 2028. This outlook is based on an anticipated 3.5% annual revenue growth rate and an increase in earnings of about $445 million from the current $250.4 million.

Uncover how Regal Rexnord's forecasts yield a $180.40 fair value, a 22% upside to its current price.

Exploring Other Perspectives

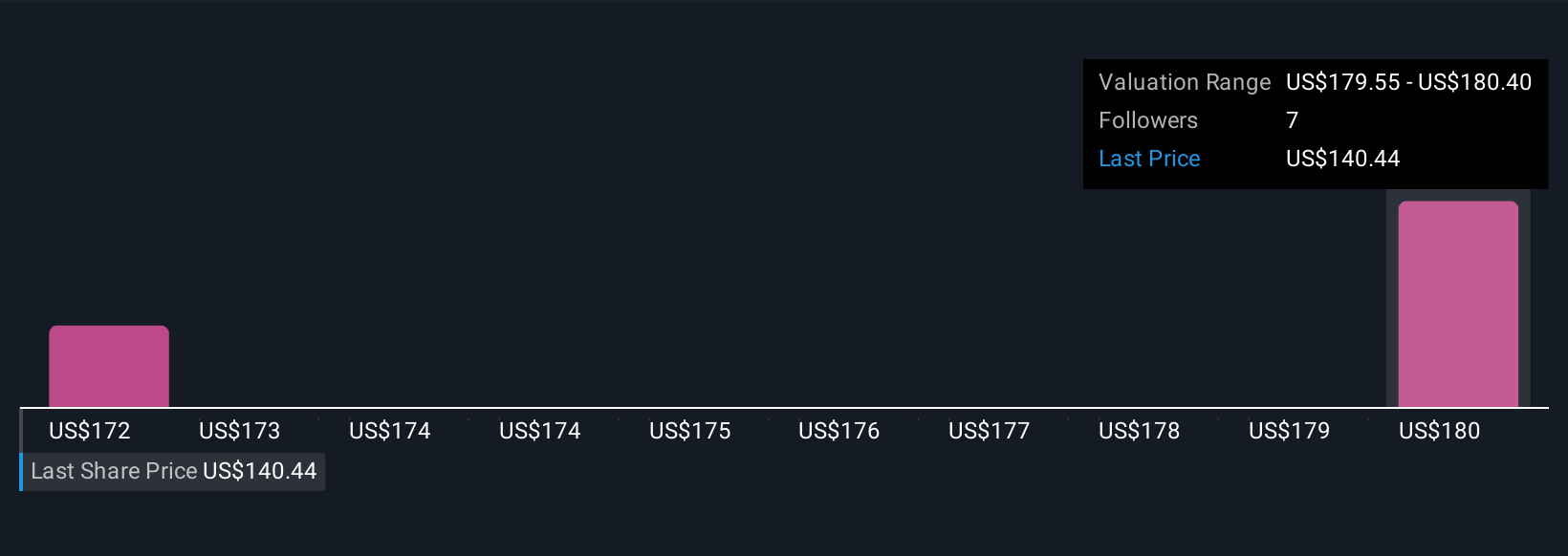

Simply Wall St Community members estimate fair value for Regal Rexnord between US$174.53 and US$180.40, with two unique perspectives represented. While participants highlight diverse opinions, ongoing supply chain risks could shape how these views evolve and influence the company’s near-term earnings outlook.

Explore 2 other fair value estimates on Regal Rexnord - why the stock might be worth as much as 22% more than the current price!

Build Your Own Regal Rexnord Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regal Rexnord research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Regal Rexnord research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regal Rexnord's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRX

Regal Rexnord

Provides sustainable solutions for power, transmit, and control motion products in the North America, Asia, Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives