- United States

- /

- Building

- /

- NYSE:REZI

Why Did Resideo Technologies (REZI) Post a Strong Quarter but Still Guide for Full-Year Losses?

Reviewed by Sasha Jovanovic

- Resideo Technologies recently reported its third quarter financial results with sales of US$1.86 billion and net income of US$156 million, alongside updated guidance for both the upcoming quarter and full year 2025.

- A key insight is the significant turnaround in quarterly net income compared to the previous year, contrasting with a full-year net loss so far in 2025 despite higher nine-month sales.

- We'll explore how Resideo's improved quarterly earnings and raised guidance may influence the company's future earnings outlook and growth assumptions.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Resideo Technologies Investment Narrative Recap

To be a shareholder in Resideo Technologies, you need conviction in the company's ability to leverage smart home trends, capitalize on energy efficiency demand, and regain consistent profitability despite ongoing competitive and cyclical pressures. The recent Q3 earnings beat and raised guidance support its growth catalysts in the near term but do not fully resolve the largest risk: sustained earnings volatility from housing market softness and increasing competition. The positive news offers a temporary boost, though uncertainty in key end markets and distribution remains a factor for investors.

The recent announcement of Q4 and full-year 2025 revenue guidance, targeting US$7,430 million to US$7,470 million, directly addresses forward growth expectations. It reinforces that near-term results and recurring demand for energy-saving, connected products remain the central driver for performance, even as longer-term pressures persist from evolving business models and direct-to-consumer competition.

However, despite this momentum, investors should be aware that persistent softness in Resideo’s key end markets could still...

Read the full narrative on Resideo Technologies (it's free!)

Resideo Technologies' narrative projects $8.0 billion revenue and $597.5 million earnings by 2028. This requires 2.6% yearly revenue growth and a $1.41 billion increase in earnings from -$816.0 million today.

Uncover how Resideo Technologies' forecasts yield a $41.50 fair value, a 31% upside to its current price.

Exploring Other Perspectives

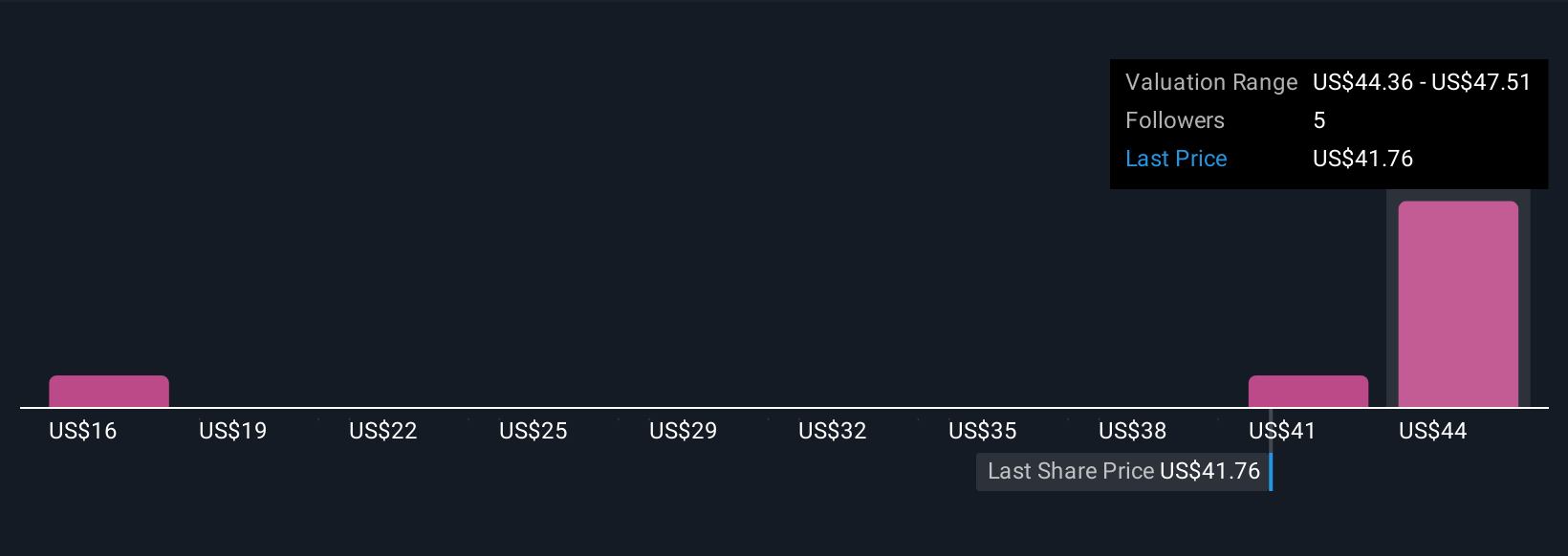

Two community members in the Simply Wall St Community placed Resideo’s fair value between US$40.06 and US$41.50. While forward revenue guidance has improved recently, risks from ongoing industry competition and market shifts may affect longer-term valuation potential. Consider how various investor viewpoints can highlight very different expectations, explore more perspectives to gain the full picture.

Explore 2 other fair value estimates on Resideo Technologies - why the stock might be worth just $40.06!

Build Your Own Resideo Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Resideo Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Resideo Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Resideo Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REZI

Resideo Technologies

Develops, manufactures, sells, and distributes comfort, energy management, and safety and security solutions in the United States, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives