- United States

- /

- Building

- /

- NYSE:REZI

Resideo Technologies (REZI): Evaluating Valuation After Strong Earnings Beat and Honeywell Agreement

Reviewed by Simply Wall St

Resideo Technologies (REZI) delivered stronger-than-expected quarterly results, surpassing forecasts on organic revenue, EBITDA, and adjusted EPS. In addition to raising its guidance, the company also finalized an agreement with Honeywell, removing future financial obligations.

See our latest analysis for Resideo Technologies.

Momentum for Resideo Technologies has clearly accelerated following its better-than-expected results and new Honeywell agreement. Investors sent the shares soaring, with a 7.7% one-month share price return and an impressive year-to-date surge of 95%. Looking longer term, total shareholder return stands at 121% over the past year and 341% for five years, underlining the company's ability to deliver both near-term gains and substantial long-term value as it builds on recent wins and industry visibility.

If Resideo’s strong run has you curious, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership.

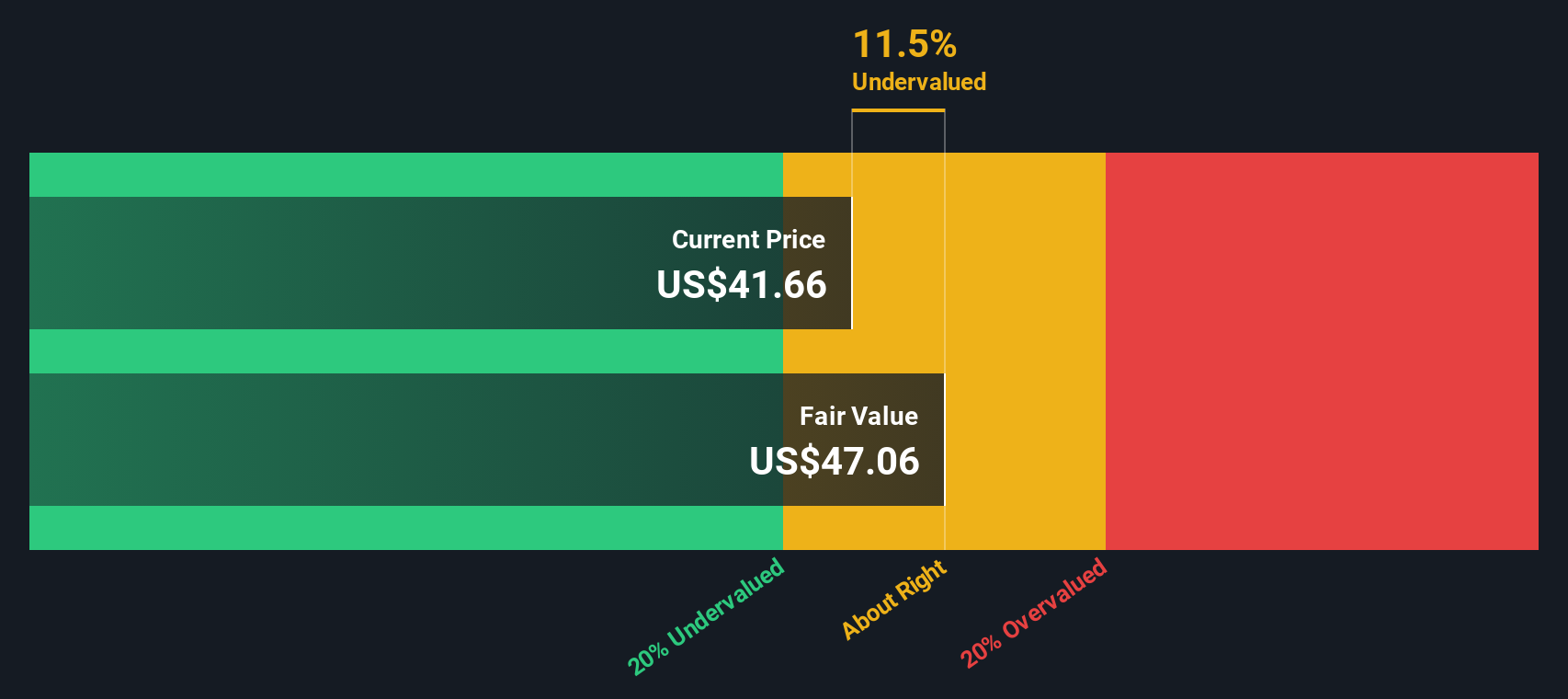

With shares soaring to new highs and forecasts raised, the real question now is whether Resideo Technologies remains undervalued or if the market has already priced in the company’s future growth potential. Could a buying opportunity still exist?

Most Popular Narrative: 7.2% Overvalued

Resideo Technologies closed at $44.50, slightly above the narrative's fair value estimate of $41.50. The market seems to have moved ahead of analyst projections, setting the stage for debate over whether recent catalysts are fully reflected in the current price.

The planned separation of the ADI segment and portfolio optimization are expected to sharpen strategic focus and resource allocation. This would enable both entities to better address evolving industry needs and potentially unlock value, with positive implications for operating leverage, margin profile, and long-term earnings power.

Curious what revenue, margin, and market ambitions fuel this higher price target? There is bold math behind the optimism and surprising convictions baked in. Ready to see the assumptions turning heads? The full narrative peels back the layers on the numbers Wall Street is watching.

Result: Fair Value of $41.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition from tech giants and Resideo’s reliance on older product lines could quickly challenge the optimism surrounding its growth story.

Find out about the key risks to this Resideo Technologies narrative.

Another View: Discounted Cash Flow Paints a Different Picture

While the market’s current price looks lofty compared to analyst estimates, our DCF model suggests Resideo Technologies may actually be undervalued. The fair value is closer to $47.66 per share. Does the market see something the models miss, or is optimism just catching up to fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Resideo Technologies Narrative

Want a second opinion or prefer to work through the details your own way? In just minutes, you can dive in and craft your own perspective: Do it your way.

A great starting point for your Resideo Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let standout opportunities pass you by. Go beyond the obvious and push your portfolio further with unique stocks that others might be missing.

- Spot companies shaping tomorrow’s healthcare breakthroughs by scanning these 33 healthcare AI stocks, featuring proven results in medical AI and digital health.

- Boost your portfolio’s income potential when you assess steady performers using these 17 dividend stocks with yields > 3%, which identifies yields over 3% alongside reliable financials.

- Ride the innovation wave and capture growth in future technology sectors by selecting among these 28 quantum computing stocks and explore pioneering advancements in computing frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REZI

Resideo Technologies

Develops, manufactures, sells, and distributes comfort, energy management, and safety and security solutions in the United States, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives