- United States

- /

- Machinery

- /

- NYSE:RBC

RBC Bearings (RBC) Is Up 10.6% After Accelerating Revenue Growth and Upbeat Demand Outlook

Reviewed by Sasha Jovanovic

- In recent news, RBC Bearings reported an impressive 18.9% annual revenue growth over the past five years and is forecasting further robust revenue gains driven by accelerated demand.

- This sustained financial momentum highlights RBC’s strengthening position in the precision bearings and motion control components industry, fueling positive expectations for future operating performance.

- We’ll examine how this accelerating revenue growth outlook may reinforce the company’s investment narrative and long-term demand prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

RBC Bearings Investment Narrative Recap

To be a shareholder in RBC Bearings, you need confidence that its multi-year revenue momentum, robust order backlog, and growing demand in aerospace and industrial markets will continue to drive earnings growth. The recent news of sustained 18.9% annual revenue growth adds weight to this conviction, but the biggest near-term catalyst remains management’s ability to scale up production efficiently. The most pressing risk continues to be supply chain constraints in specialty materials, and the latest news does not materially reduce this exposure.

Of RBC’s recent announcements, the Q2 2026 sales guidance (US$445.0 million to US$455.0 million) is directly relevant, highlighting both management’s confidence in rising demand and the challenge of delivering on higher volume targets. Whether this will be enough to offset ongoing headwinds linked to supply constraints and customer concentration is closely tied to future financial performance.

Conversely, investors should also be mindful of RBC’s exposure to global supply chain risks, particularly with specialty alloys needed for aerospace production, since…

Read the full narrative on RBC Bearings (it's free!)

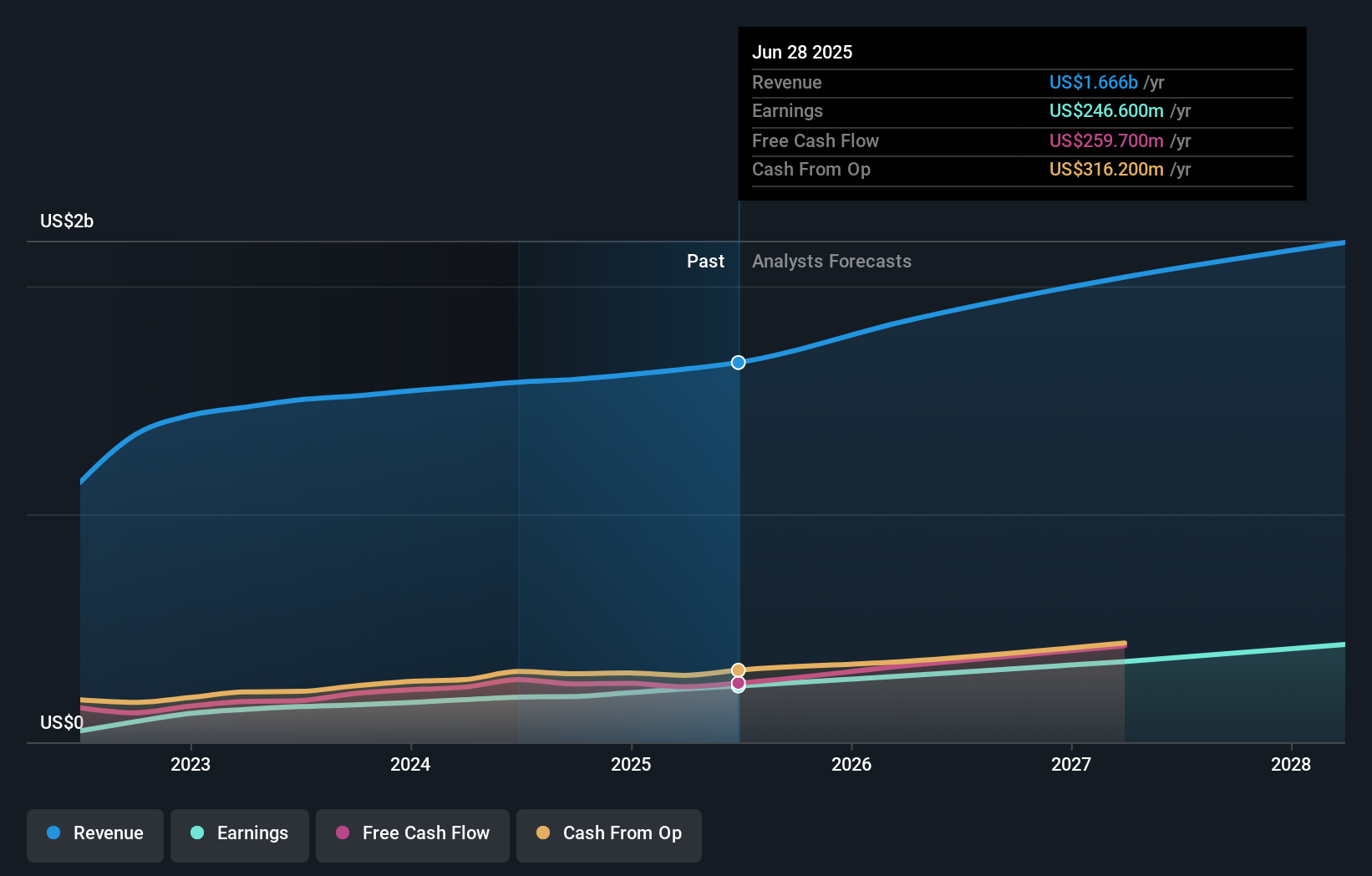

RBC Bearings' narrative projects $2.3 billion in revenue and $445.8 million in earnings by 2028. This requires 11.1% yearly revenue growth and a $199.2 million earnings increase from the current $246.6 million.

Uncover how RBC Bearings' forecasts yield a $452.67 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community estimate RBC’s fair value from as low as US$329.33 to as high as US$452.67, with 2 distinct perspectives. While some see opportunity, others caution that persistent supply chain risks could weigh on RBC’s pace of growth, explore what this could mean for your outlook.

Explore 2 other fair value estimates on RBC Bearings - why the stock might be worth 20% less than the current price!

Build Your Own RBC Bearings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RBC Bearings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free RBC Bearings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RBC Bearings' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBC

RBC Bearings

Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives