- United States

- /

- Machinery

- /

- NYSE:RBC

Assessing the Valuation of RBC Bearings (RBC) Following Strong Share Price Gains and Growth Momentum

Reviewed by Simply Wall St

See our latest analysis for RBC Bearings.

RBC Bearings’ strong year-to-date share price return of 38% speaks to increasing market confidence in its ability to sustain growth, especially following its robust double-digit revenue and profit expansion. Momentum has been building steadily, with the one-year total shareholder return reaching nearly 43%, while the long-term performance stands out even more with a remarkable five-year total return of over 220%.

If RBC’s momentum has your attention, it’s the perfect moment to see what else is out there. Broaden your search and discover fast growing stocks with high insider ownership

But with shares sitting just below their average analyst target and strong historical gains in the books, investors have to ask: Is RBC Bearings still trading at an attractive valuation, or is the market already factoring in all of its future growth?

Most Popular Narrative: 8.9% Undervalued

RBC Bearings closed the most recent session at $412.19, while the narrative's fair value estimate sits higher at $452.67. This gap has fueled debate about whether the company’s impressive growth justifies its premium rating.

“Robust multi-year increases in defense spending, driven by mounting global geopolitical tensions and fleet modernizations, are fueling unprecedented demand for RBC's aerospace components. This underpins a record $1B+ backlog and positions the company for durable top-line growth and long-term contract visibility that should drive sustained revenue and orderbook expansion.”

Want to know what powers this ambitious valuation? Hint: analysts are baking in aggressive growth in earnings, margins, and revenue, propelled by huge end-market demand and a future profit multiple more often seen in tech giants. Curious to see the precise forecasts and assumptions supporting this price target? Unpack the full narrative to see what’s driving analyst conviction.

Result: Fair Value of $452.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain constraints or unexpected demand slowdowns in key industrial sectors could threaten both revenue growth and margin expansion for RBC Bearings.

Find out about the key risks to this RBC Bearings narrative.

Another View: Market Multiple Perspective

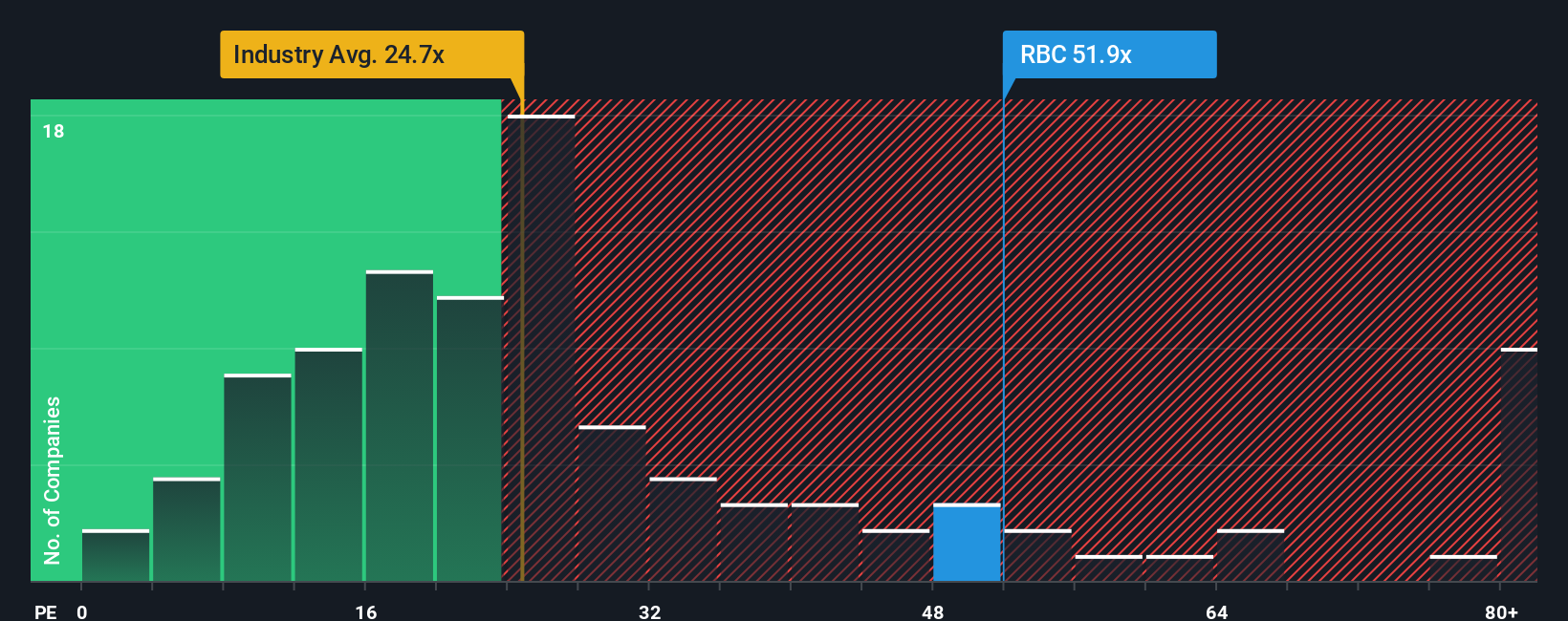

While analyst models suggest RBC Bearings is undervalued, its current price-to-earnings ratio is a steep 52.5x. This is much higher than both its industry peers at 24.6x and the fair ratio of 28.8x. This sizable premium signals either exceptional confidence in RBC’s future or potential valuation risk ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RBC Bearings Narrative

Not convinced or eager to run the numbers yourself? Crafting your own investment narrative takes just minutes. See for yourself with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding RBC Bearings.

Looking for more investment ideas?

Skip the guesswork and jump on new opportunities today. Don't leave potential gains on the table. The right insights could transform your next move.

- Unlock fresh growth potential by tracking these 27 AI penny stocks that are reshaping entire industries with artificial intelligence breakthroughs.

- Capture reliable passive income when you sift through these 17 dividend stocks with yields > 3% offering healthy yields and consistent payouts above 3%.

- Ride the cutting edge in fintech as you compare these 80 cryptocurrency and blockchain stocks paving the way in digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBC

RBC Bearings

Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives