- United States

- /

- Machinery

- /

- NYSE:RBC

Assessing RBC Bearings’s Valuation Following Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for RBC Bearings.

While RBC’s share price has softened over the past month, zooming out shows a much steadier story. Total shareholder returns are up nearly 28% over the last year. This hints at solid long-term momentum with some recent cooling as investors reassess the outlook following earlier gains.

If you’re weighing up what’s next for your portfolio, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The big question on investors’ minds now is whether RBC’s recent dip signals an undervalued opportunity or if upbeat results and growth expectations have already been reflected in the stock price.

Most Popular Narrative: 17.4% Undervalued

Compared to the last close of $373.99, the most widely followed narrative suggests a fair value closer to $452.67 for RBC Bearings, pointing to notable upside if these bullish assumptions play out. The case is supported by long-term contracts and a strong backlog that could drive durable top-line growth.

Robust multi-year increases in defense spending, driven by mounting global geopolitical tensions and fleet modernizations, are fueling unprecedented demand for RBC's aerospace components. This demand supports a record $1B+ backlog and positions the company for durable top-line growth and long-term contract visibility, which may drive sustained revenue and orderbook expansion.

Curious what could supercharge this potential? The narrative hinges on ambitious profit and revenue growth targets, as well as a bold future earnings multiple usually seen in high-growth sectors. Want to see what’s powering these forecasts? Unpack the narrative’s key financial bets and see if you agree with the blockbuster assumptions behind this price target.

Result: Fair Value of $452.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain constraints or weakness in key industrial end markets could quickly challenge these optimistic growth projections for RBC Bearings.

Find out about the key risks to this RBC Bearings narrative.

Another View: High Price Tags Raise Eyebrows

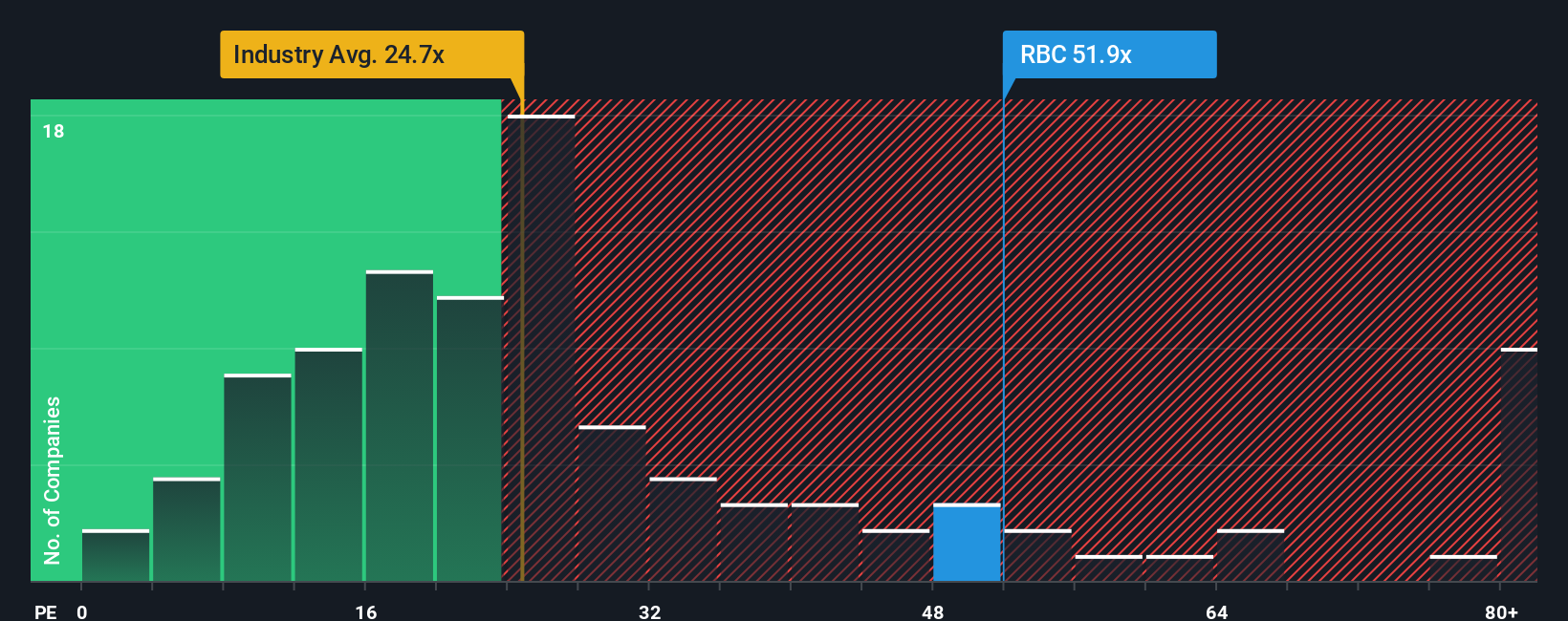

Looking at this from a different angle, RBC trades at a price-to-earnings ratio of 47.7 times, almost double the US Machinery industry average (24.5x) and much higher than both its peer average (27.2x) and its own fair ratio (28.2x). This suggests investors are paying a big premium for growth, which raises the stakes if future results disappoint. Is the optimism fully justified by the company’s outlook?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RBC Bearings Narrative

If you see things differently or want to dig into the numbers yourself, it's easy to formulate your own RBC Bearings narrative in just a few minutes. So why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding RBC Bearings.

Looking for more investment ideas?

Don’t miss your chance to get ahead of the crowd. Use Simply Wall Street's powerful Screener to pinpoint stocks with standout growth and untapped opportunities.

- Unlock impressive yields by exploring these 19 dividend stocks with yields > 3%, which offers over 3% on payouts and features robust financials that support sustainable income.

- Catalyze your portfolio’s tech exposure by targeting the top advances in artificial intelligence with these 24 AI penny stocks, which highlight tomorrow’s leaders today.

- Ride the next wave of financial innovation with these 78 cryptocurrency and blockchain stocks as you spot companies that are shaping the blockchain and digital asset landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBC

RBC Bearings

Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives