- United States

- /

- Machinery

- /

- NYSE:RBC

Assessing RBC Bearings (RBC) Valuation Following Recent Strong Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for RBC Bearings.

Momentum has really taken hold for RBC Bearings, with its share price up 16% in the last month and year-to-date gains of 45%. The company’s 1-year total shareholder return stands at a robust 38%, and over the past five years investors have seen their total return compound more than twofold. Strong performance like this can signal renewed investor confidence in the company’s outlook, whether that is driven by growth expectations or changes in risk perception.

If you’re weighing what else is showing strong momentum lately, this is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

But with shares marching ever higher, the big question now is whether RBC Bearings is still trading at an attractive price or if recent gains mean future growth is already baked in. Is there a real opportunity here?

Most Popular Narrative: 5.7% Undervalued

With RBC Bearings closing at $432.04 and the narrative fair value marked at $458.17, the consensus points to a modestly attractive upside. This positions the stock just above analysts’ threshold for undervaluation and puts the spotlight on the earnings profile driving this view.

Robust multi-year increases in defense spending, driven by mounting global geopolitical tensions and fleet modernizations, are fueling unprecedented demand for RBC's aerospace components. This underpins a record $1B+ backlog and positions the company for durable top-line growth and long-term contract visibility, which should drive sustained revenue and orderbook expansion.

What’s powering this price target? It’s not just growth hype. Dive in to see which forecasted profit margins and top-line expectations set this narrative apart from the usual playbook. The details may surprise you, especially the future multiple analysts are willing to assign here.

Result: Fair Value of $458.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major supply chain disruptions or a slowdown in key industrial end markets could quickly shift RBC Bearings’ outlook and affect future profitability.

Find out about the key risks to this RBC Bearings narrative.

Another View: Market Signals a Lofty Valuation

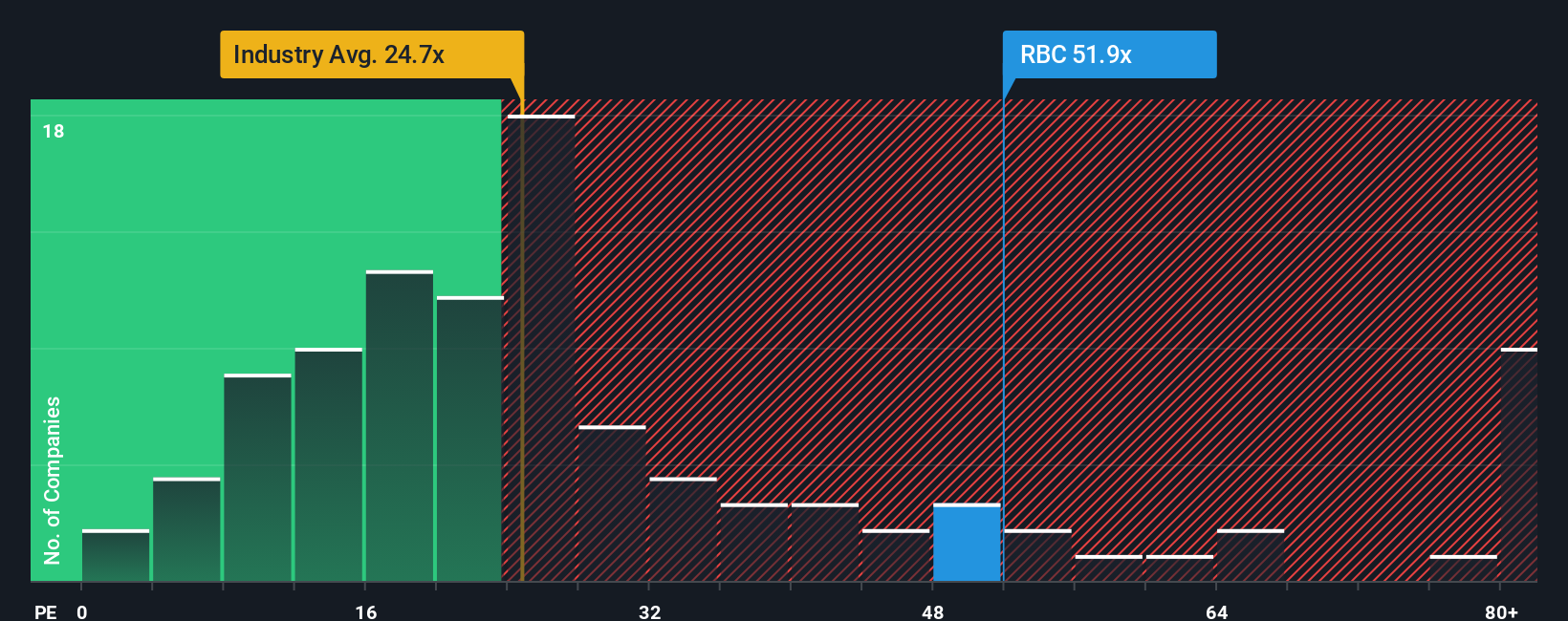

While the fair value estimate suggests upside for RBC Bearings, a look at the price-to-earnings ratio tells a different story. RBC's ratio stands at 52.7x, which is significantly higher than both the peer average of 27.2x and the fair ratio of 29.5x. This sharp premium raises questions about potential downside risk if market optimism cools. Will RBC’s growth be strong enough to justify this elevated multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RBC Bearings Narrative

If you see things differently or want to dig deeper into RBC Bearings' numbers, crafting your personalized narrative is quick and easy. Get started in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding RBC Bearings.

Looking for More Investment Inspiration?

Don't let amazing opportunities slip through your fingers. Access industry-shaping ideas right now and spot standout stocks before the crowd catches on.

- Secure income streams and watch your portfolio grow by checking out these 16 dividend stocks with yields > 3% with consistent high yields above 3%.

- Catalyze your strategy with these 25 AI penny stocks that are making headlines for innovations in artificial intelligence and future-defining tech sectors.

- Capitalize on untapped value by targeting these 886 undervalued stocks based on cash flows with potential upside based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBC

RBC Bearings

Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives