- United States

- /

- Trade Distributors

- /

- NYSE:QXO

Why QXO (QXO) Is Up 7.1% After Revenue Surges to $1.91B but Net Loss Widens

Reviewed by Simply Wall St

- QXO, Inc. recently announced its second quarter 2025 earnings, reporting sales of US$1.91 billion compared to US$14.5 million in the prior year, alongside a net loss of US$58.5 million.

- This dramatic jump in revenue paired with a higher net loss highlights a period of significant operational transformation for QXO.

- We’ll explore how QXO’s extraordinary revenue growth and larger net loss could shape the company’s investment narrative moving forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is QXO's Investment Narrative?

To own shares in QXO right now, you have to believe in its ability to harness an ambitious operational transformation into future profitability and sustained growth. The move from just US$14.5 million in sales a year ago to US$1.91 billion this quarter clearly shows the company is capable of scaling fast, likely through its aggressive acquisition strategy and push into building products distribution. Yet, the surge in losses to US$58.5 million and recent heavy equity dilution signal that growth is coming at a high cost. This news event shifts the short-term focus from just top-line momentum to questions about how quickly management can integrate acquired assets and control costs amid rapid expansion. The main near-term catalysts now revolve around demonstrating operational synergies and progress toward profitability. But with a new leadership team and ongoing acquisition risk, a key question is whether all this scale can actually deliver bottom-line improvement before the market’s patience runs out.

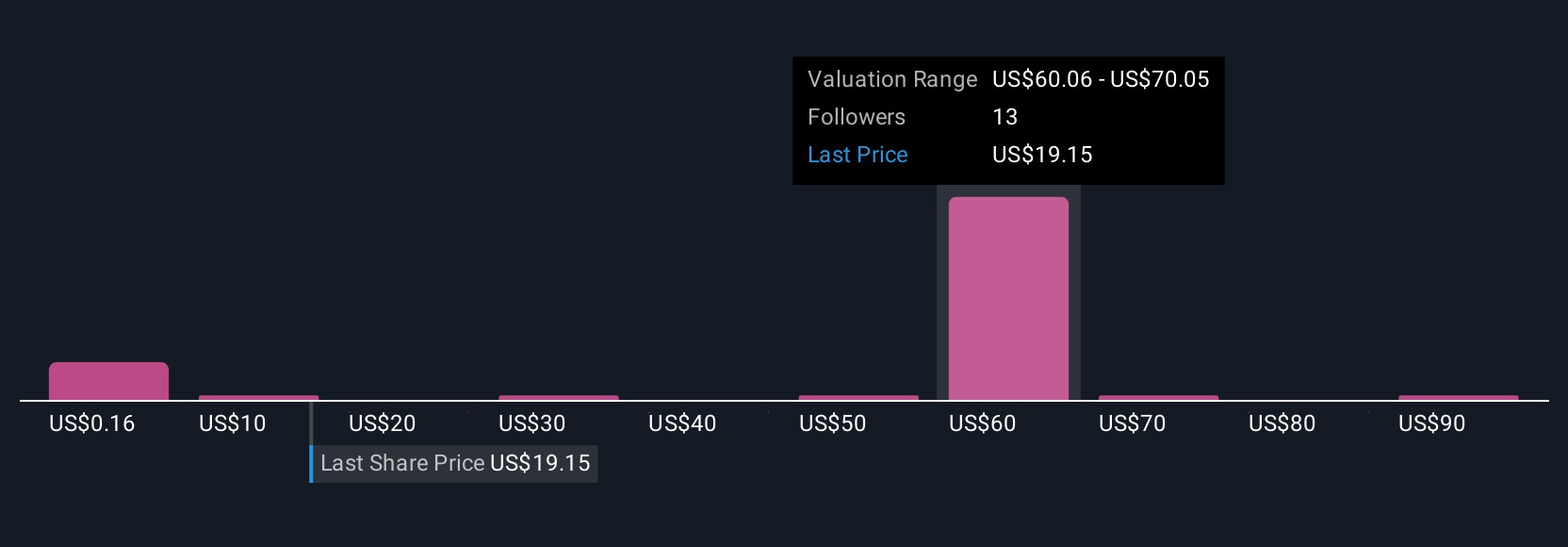

On the other hand, dilution remains an unresolved concern every shareholder should keep an eye on. QXO's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 10 other fair value estimates on QXO - why the stock might be worth over 4x more than the current price!

Build Your Own QXO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QXO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QXO's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QXO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QXO

QXO

Distributes roofing, waterproofing, and other building products in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives