- United States

- /

- Trade Distributors

- /

- NYSE:QXO

QXO’s Surging Sales and Sector Moves Could Be a Game Changer For QXO (QXO)

Reviewed by Simply Wall St

- In August 2025, Benchmark initiated coverage of QXO, Inc., highlighting the company’s expansion plans and its recent acquisition of Beacon Roofing, while analysts emphasized upcoming executive appointments and sector consolidation trends.

- An interesting insight is that QXO’s significant rise in reported sales, from US$14.5 million last year to US$1.91 billion this quarter, coincides with increasing analyst optimism about its broader growth opportunities beyond its initial acquisition.

- We’ll explore how analysts’ focus on QXO’s ambitious expansion goals is shaping its investment narrative and sector positioning.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is QXO's Investment Narrative?

Owning QXO shares means believing in the company’s ability to execute on massive expansion and integration goals at a scale rarely seen in its segment. After QXO’s dramatic jump in quarterly sales to nearly US$1.91 billion, largely reflecting the consolidation of Beacon Roofing, the biggest short-term catalyst remains additional major acquisitions and management’s progress in aligning new leadership following a string of recent executive appointments. Despite no share buybacks this quarter, which signals a continued focus on growth rather than returning capital to shareholders, the market’s confidence seems fueled by expansion potential and sector consolidation activity. The latest earnings also underscore longstanding risks: QXO continues to operate at a net loss, its board and management team are relatively inexperienced, and aggressive equity raises have led to substantial shareholder dilution. While the new earnings report confirms robust top-line momentum, it does little to ease concerns about profitability and the company’s ability to generate returns on recent investments.

However, not everyone will be comfortable with QXO’s high board turnover and ongoing losses, and this is something investors should be aware of.

Exploring Other Perspectives

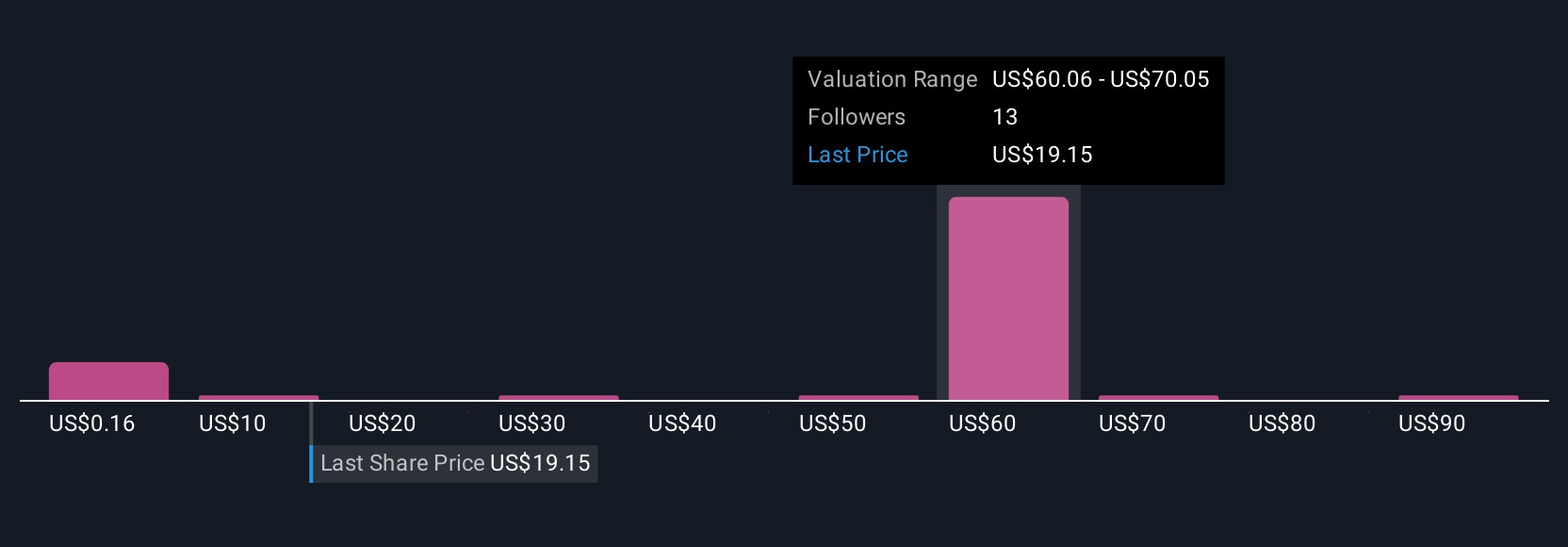

Explore 10 other fair value estimates on QXO - why the stock might be worth over 4x more than the current price!

Build Your Own QXO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QXO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QXO's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QXO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QXO

QXO

Distributes roofing, waterproofing, and other building products in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives