- United States

- /

- Trade Distributors

- /

- NYSE:QXO

Can Wall Street’s Endorsement of QXO (QXO) Reveal Deeper Confidence in Its Consolidation Strategy?

Reviewed by Sasha Jovanovic

- Major investment firms, including KeyBanc, Morgan Stanley, and Raymond James, recently initiated positive analyst coverage on QXO Inc., highlighting the company's prospects in building products distribution and its consolidation strategy under industry veteran Brad Jacobs.

- This wave of bullish sentiment from multiple analysts underscores growing confidence in QXO's experienced leadership and disciplined approach to capital allocation, setting it apart within the sector.

- With analysts emphasizing QXO's consolidation strategy, we'll explore how these developments shape the company's investment narrative moving forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is QXO's Investment Narrative?

For anyone considering QXO, the big picture to believe in is the company’s ability to become a leading consolidator in building products distribution under Brad Jacobs, leveraging operational scale and capital allocation to drive profit growth from a recently acquired platform. The recent flood of analyst endorsements, paired with visible M&A ambitions, injects fresh momentum into this story, potentially making near-term catalysts like new acquisitions or further executive hires more influential to the share price than before. On the risk side, the company remains unprofitable and is absorbing steep losses while aggressively expanding, diluting shareholders (as seen with the US$2 billion follow-on offering) and assembling a largely untested leadership team. The latest analyst coverage reinforces bulls’ focus on leadership and growth, but does little to shift the underlying risks: QXO remains an expensive, highly speculative bet. The real impact of this coverage is likely sentiment-driven rather than materially altering the business trajectory just yet.

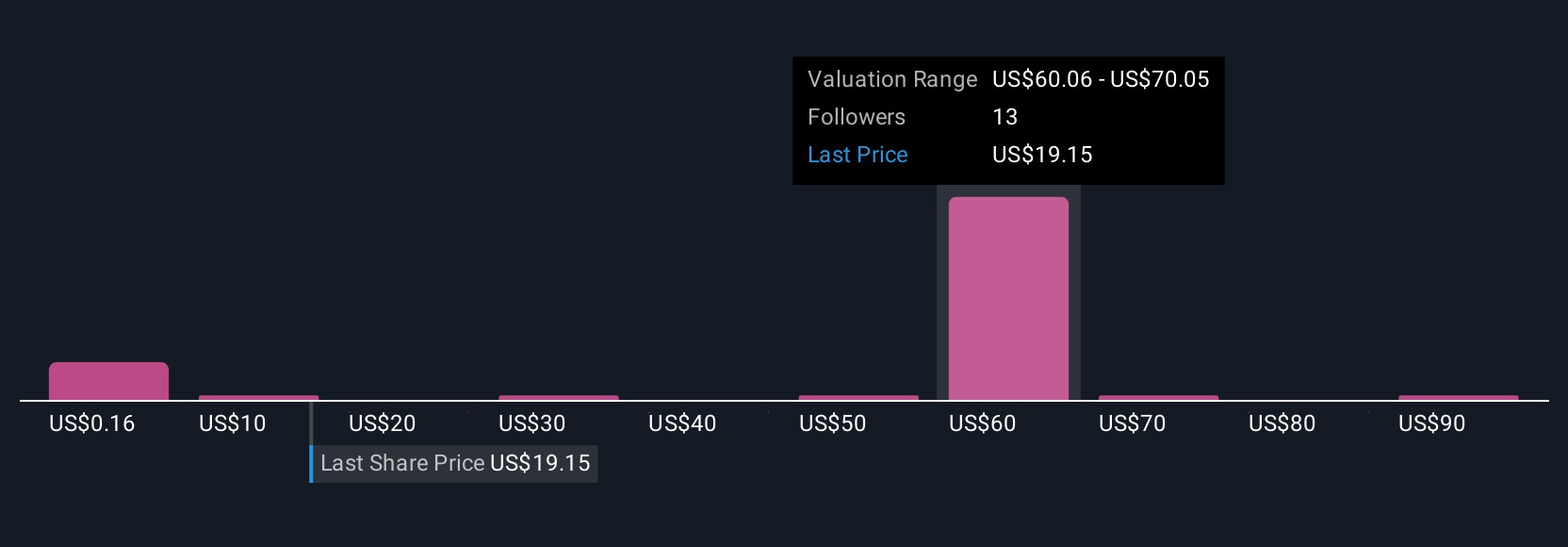

But before becoming too comfortable, consider how board and management inexperience could cut both ways. QXO's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 13 other fair value estimates on QXO - why the stock might be worth over 5x more than the current price!

Build Your Own QXO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QXO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QXO's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QXO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QXO

QXO

Distributes roofing, waterproofing, and other building products in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives