- United States

- /

- Construction

- /

- NYSE:PWR

Quanta Services (NYSE:PWR) Wins Part Of US$1.7 Billion Contract For HVDC Line Project

Reviewed by Simply Wall St

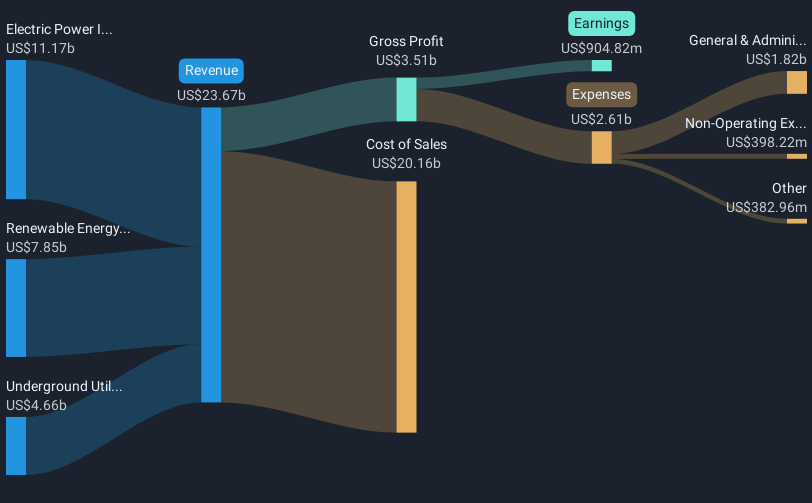

Quanta Services (NYSE:PWR) saw a 33% upward price movement over the past month, largely reflecting the boost from securing nearly $1.7 billion in awards for the Grain Belt Express project. The announcement highlighting enhanced U.S. grid security and job creation added weight to this surge. The company's strong Q1 earnings report, with a significant rise in sales, and increased year-end guidance further fueled optimism, even as broader markets remained mixed amid pending Fed interest rate decisions and trade negotiations. These elements collectively supported the company's price movement compared to the market's flat performance.

You should learn about the 1 risk we've spotted with Quanta Services.

The recent 33% surge in Quanta Services' share price, spurred by the effective communication of a US$1.7 billion win from the Grain Belt Express project, underscores the positive investor sentiment around its growth initiatives. This move is anticipated to reinforce Quanta's narrative of revenue and margin expansion driven by increased grid security efforts and job creation. However, it's pertinent to consider how this will translate into sustained financial performance. The anticipated boost in revenue and earnings forecasts aligns with Quanta's strategic expansion and acquisition efforts, particularly in Australia and through the Cupertino acquisition, which broaden service lines and enhance revenue consistency.

Over the past five years, Quanta has achieved a very large total return of 906.67%, highlighting its capacity for long-term growth. Over the past year, Quanta has outperformed the US market's 7.2% return and the US Construction industry's 17% return, reflecting positively on its resilience and growth potential. The company's recent news may potentially drive revenue to US$33.5 billion by 2028, with earnings expected to grow towards US$1.5 billion, bolstering analyst confidence, as reflected in a consensus price target of US$319.60. Currently, Quanta's share price stands at US$292.38, indicating an 8.5% potential upside relative to the target. This proximity to the target suggests a market view that the stock is appropriately valued, aligning with analyst projections.

Gain insights into Quanta Services' historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Quanta Services, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PWR

Quanta Services

Offers infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline, and energy industries in the United States, Canada, Australia, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives