- United States

- /

- Machinery

- /

- NYSE:PRLB

Proto Labs (PRLB): Is the Recent Momentum Reflected in the Stock’s Current Valuation?

Reviewed by Kshitija Bhandaru

Proto Labs (PRLB) shares have caught some attention lately, especially given their solid 21% gain over the past three months. Investors seem to be taking a closer look at recent performance and growth trends in this digital manufacturing company.

See our latest analysis for Proto Labs.

Zooming out, Proto Labs has delivered a modest 1-year total shareholder return of 0.7%, a positive, if not spectacular backdrop to its recent momentum. While the stock’s climb over the past quarter hints at improving sentiment, long-term results have been muted. However, a fresh upswing could be on the cards if optimism keeps building.

If you’re interested in what else is gaining traction, this is the perfect opportunity to broaden your strategy and discover fast growing stocks with high insider ownership

With recent gains and improving earnings growth, is Proto Labs currently undervalued by the market, or has the latest momentum already been factored into its next phase of expansion? Is there still a buying opportunity here?

Most Popular Narrative: Fairly Valued

Proto Labs closed at $49.65, landing almost precisely on the narrative consensus fair value of $50. This alignment signals that market expectations may already factor in most near-term catalysts and risks.

Expansion in advanced manufacturing for aerospace, defense, and medical sectors is fueling sustained revenue growth and positioning the company favorably in digitalized, regulated industries. Digital infrastructure, resilient supply chains, and strong financial health enable investments in automation and global expansion, supporting margin improvement and long-term earnings growth.

What secret sparks this ultra-precise fair value call? Analysts are betting on a transformation driven by deeper market reach and big margin moves. The true drivers are ambitious financial upgrades, bold revenue gains, and an earnings surge that could flip the growth narrative. Wondering just how those bullish projections stack up? Dive into the full story to see which forecasts hold the key.

Result: Fair Value of $50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as ongoing weakness in European manufacturing and increased reliance on large aerospace clients could quickly shift Proto Labs’ growth outlook.

Find out about the key risks to this Proto Labs narrative.

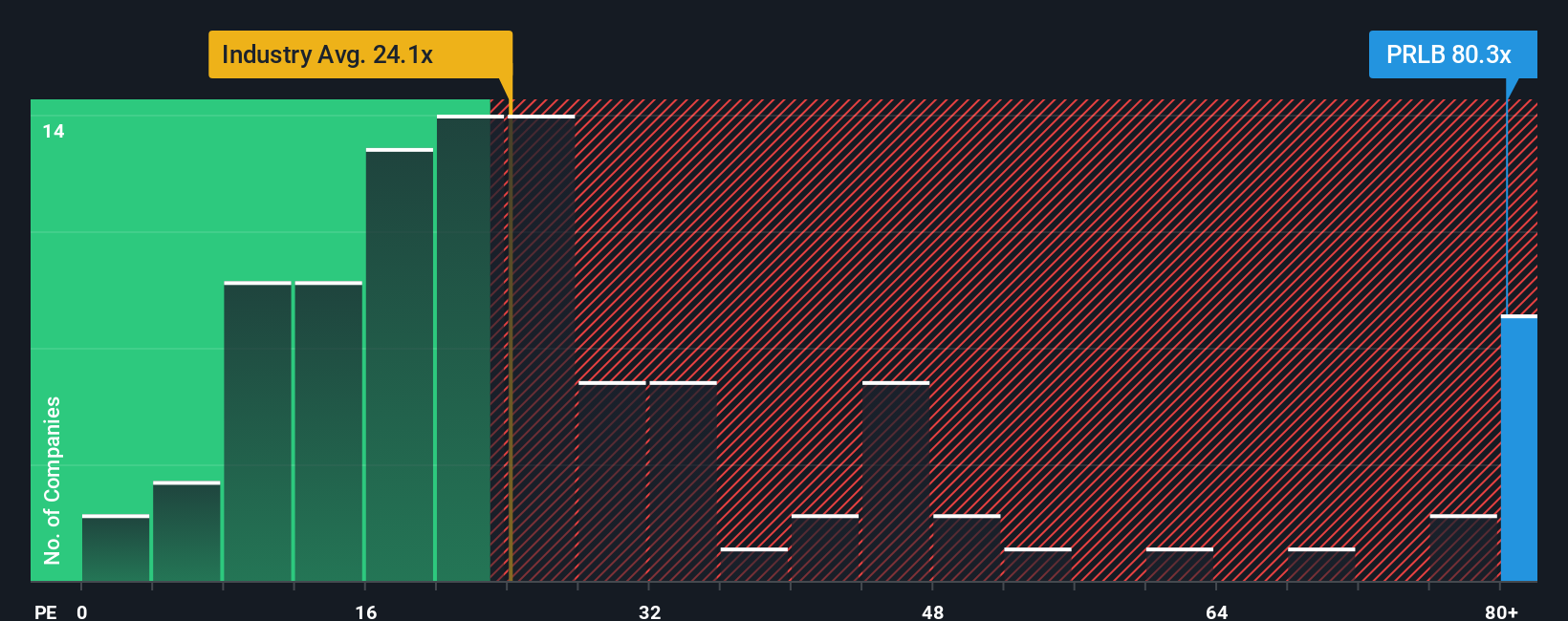

Another View: Multiples Signal Elevated Valuation Risk

Taking a different angle, Proto Labs is currently trading at around 80 times its earnings. This figure is much higher than both the US Machinery industry average of 24.3x and its peer group average of 37.7x. In addition, this multiple sits well above the fair ratio of 36.8x that regression analysis suggests the market could revert to. Such a premium price reflects high expectations for future growth, but it also introduces the risk that any disappointing results could spark a sharp correction. Will investors continue to justify paying such a lofty price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Proto Labs Narrative

Of course, if you have a different perspective or want to dig into the numbers yourself, you can craft and share your own take in just a few minutes. Do it your way

A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Supercharge your strategy and secure your advantage with these hand-picked stock ideas and market trends, ready for you right now.

- Unlock the potential of digital healthcare by tapping into these 31 healthcare AI stocks, making waves with next-level medical innovation and AI-driven breakthroughs.

- Power up your portfolio with reliable income by targeting these 19 dividend stocks with yields > 3%, offering attractive yields above 3% from proven dividend payers.

- Seize early-stage growth with confidence by targeting these 3561 penny stocks with strong financials that combine solid balance sheets with massive upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives