- United States

- /

- Machinery

- /

- NYSE:PRLB

Proto Labs (PRLB): Assessing Valuation After Third-Quarter Earnings Beat Expectations

Reviewed by Simply Wall St

Proto Labs (PRLB) shares drew attention after the company reported its third-quarter earnings for 2025, with both earnings per share and revenue coming in ahead of Wall Street expectations. Investors responded positively to these solid results.

See our latest analysis for Proto Labs.

Proto Labs’ robust quarterly results fueled a surge in market optimism, helping the share price recover by 31.25% year-to-date and contributing to a 23.48% total shareholder return over the past twelve months. While momentum is building compared to recent months, long-term holders have still faced a challenging five-year stretch.

If you’re watching success stories like this unfold, it could be the perfect moment to discover fast growing stocks with high insider ownership

With the stock rebounding sharply and recent earnings beating expectations, the critical question becomes whether Proto Labs is still trading at a discount or if all the optimism for future growth is already priced in. Could there still be a buying opportunity here?

Most Popular Narrative: 10% Undervalued

With Proto Labs' most widely followed narrative assigning a fair value of $56.67, the stock’s recent close at $50.86 sits meaningfully below that target. This puts the spotlight on the projections driving this valuation.

Ongoing investments in sales enablement, marketing, and optimization of fulfillment channels are improving customer experience and wallet share, as evidenced by higher revenue per customer (+11% y/y) and increased cross-platform adoption (+44% y/y). This points to future top-line growth and improved earnings quality.

Curious what’s powering this valuation gap? The most persuasive factor is aggressive revenue and margin growth embedded in the calculation, supported by new operational efficiencies. Is a major leap in profitability truly within reach? Discover what numbers make this narrative so compelling, and whether you might agree.

Result: Fair Value of $56.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in European manufacturing or a sharp loss of major accounts could threaten Proto Labs' growth trajectory and valuation outlook.

Find out about the key risks to this Proto Labs narrative.

Another View: Market Multiples Suggest Caution

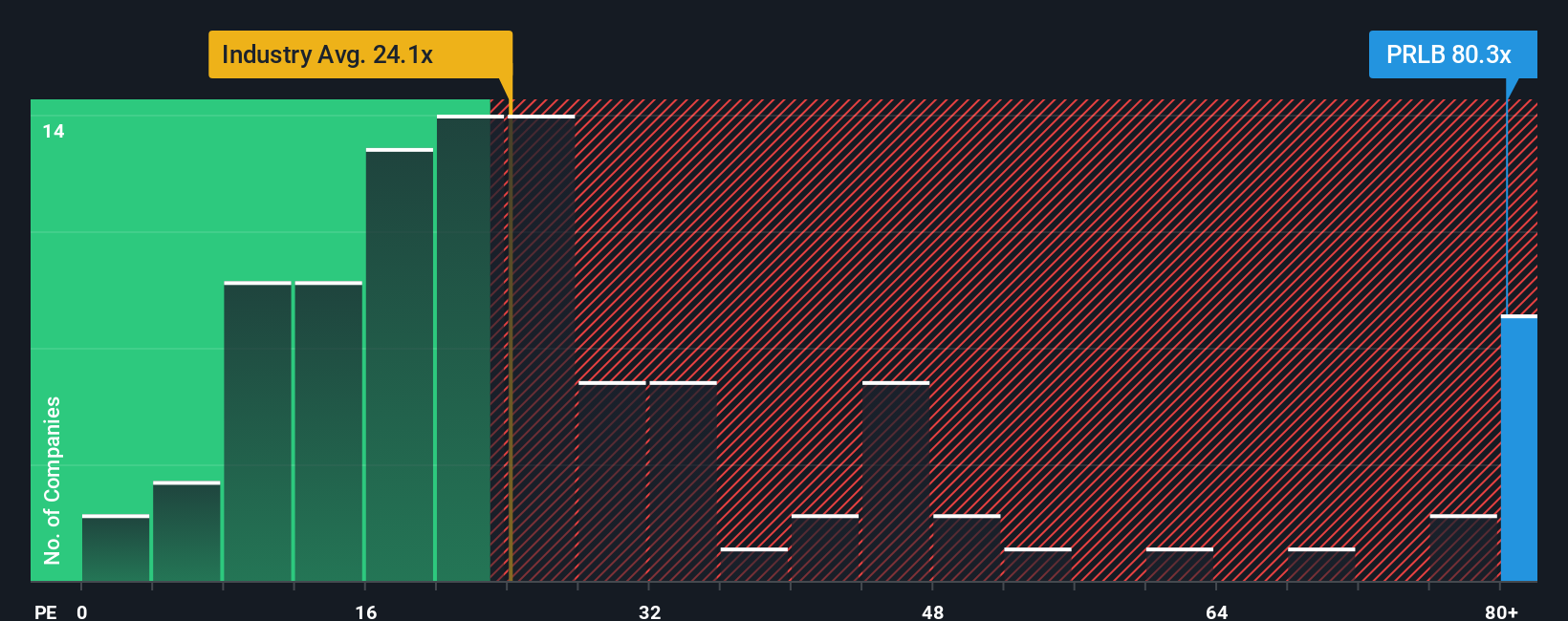

Looking at valuation through market ratios paints a different picture. Proto Labs currently trades at a price-to-earnings ratio of 81.2x, which is significantly higher than both the US Machinery industry average of 24.8x and its peer average of 37.1x. The fair ratio the market could move towards is 32.9x. This large gap signals a valuation premium that adds risk if growth stumbles. Does this price for future potential leave enough room for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Proto Labs Narrative

Not convinced by the current outlook or prefer to reach your own conclusions? With just a few minutes, you can dive into the numbers and craft your own perspective. Do it your way.

A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by when there’s a world of powerful stocks just waiting to be uncovered. Let Simply Wall Street’s screeners guide your next move.

- Supercharge your portfolio with the momentum of these 25 AI penny stocks fueling breakthroughs in artificial intelligence and reshaping industries worldwide.

- Kickstart your hunt for tomorrow’s hidden gems with these 922 undervalued stocks based on cash flows that could offer outsized upside based on real cash flow strength.

- Capture long-term income with these 15 dividend stocks with yields > 3% delivering attractive yields and stable returns even when markets get rocky.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.