- United States

- /

- Machinery

- /

- NYSE:PRLB

AI-Focused Leadership Change Could Be a Game Changer for Proto Labs (PRLB)

Reviewed by Sasha Jovanovic

- Proto Labs announced in early October that Marc Kermisch will join as Chief Technology and AI Officer, succeeding Oleg Ryaboy after his departure from the company.

- Kermisch’s appointment brings over 25 years of leadership experience in technology, AI, and manufacturing to Proto Labs, reinforcing its intent to accelerate innovation across global operations.

- We'll explore how Proto Labs' emphasis on AI and digital transformation with Kermisch’s arrival could shift its investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Proto Labs Investment Narrative Recap

For investors considering Proto Labs, the core belief rests on the company’s ability to lead in digital manufacturing through innovation in CNC machining, sheet metal, and 3D printing, while securing growth from regulated and agile market segments. The appointment of Marc Kermisch as Chief Technology and AI Officer signals intent to advance digital transformation, but the short-term catalyst, expanding production-focused offerings for Aerospace and Defense, remains unchanged; the bigger near-term risk continues to be revenue concentration among a few large clients, which could magnify volatility if contracts shift suddenly.

Relevant to this leadership transition, Proto Labs recently achieved ISO 13485 certification for metal 3D printing, strengthening its positioning in the digitizing medical device sector. This underscores the company’s push to align investments in automation and high-requirement verticals with efforts to sharpen its competitive edge and unlock durable growth drivers.

On the other hand, investors should be alert to the risk that concentrated exposure to a handful of large aerospace clients could leave results exposed if ...

Read the full narrative on Proto Labs (it's free!)

Proto Labs' outlook anticipates $592.3 million in revenue and $33.7 million in earnings by 2028. This implies a 5.2% annual revenue growth rate and an earnings increase of $18.9 million from current earnings of $14.8 million.

Uncover how Proto Labs' forecasts yield a $50.00 fair value, in line with its current price.

Exploring Other Perspectives

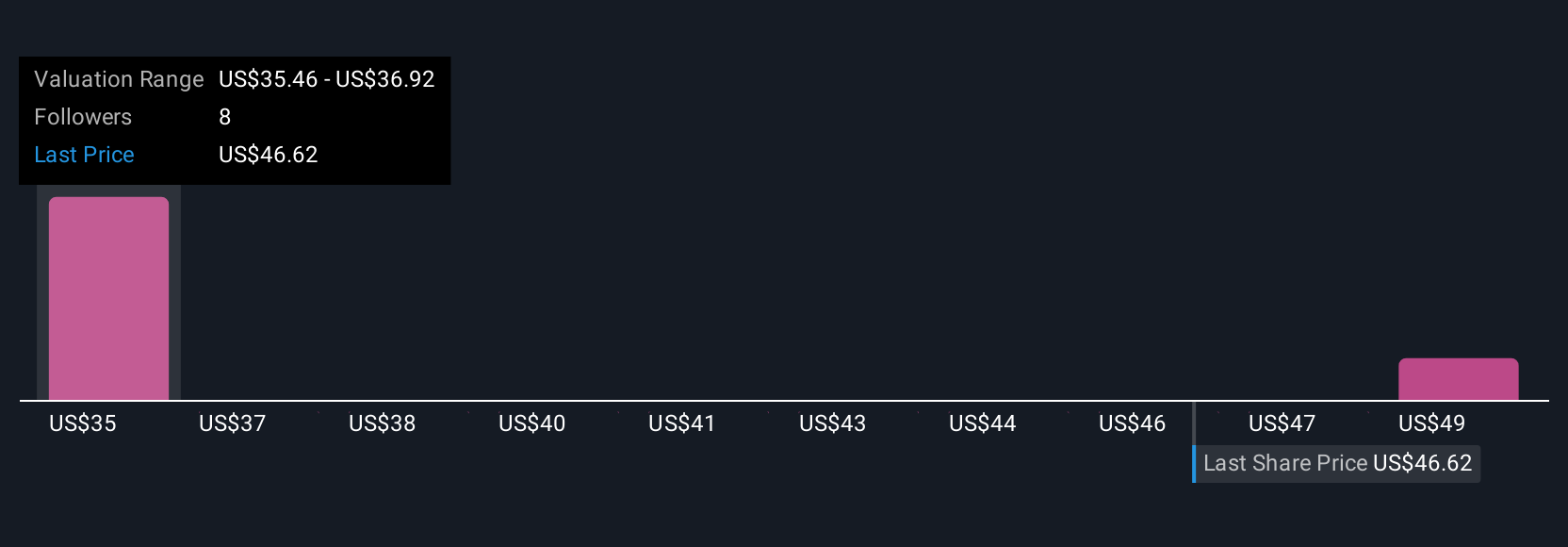

Two fair value estimates from the Simply Wall St Community range from US$34.76 to US$50. Customer concentration risk looms large, adding another dimension to how you evaluate Proto Labs’ future drivers. See how your view compares and explore more investor takes.

Explore 2 other fair value estimates on Proto Labs - why the stock might be worth as much as $50.00!

Build Your Own Proto Labs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Proto Labs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Proto Labs' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives