- United States

- /

- Construction

- /

- NYSE:PRIM

Primoris Services (PRIM): Weighing Valuation After Analyst Upgrades and Contract Win Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Primoris Services.

Backing up that upbeat outlook, Primoris Services' momentum stands out as part of a broader construction sector rally. The latest share price rose to $136.86, building on increased contract wins and improving sector sentiment. Over the last year, its total shareholder return reached 1.3%, a modest but positive step. The company’s steady backlog growth also hints at further long-term potential.

If you’re interested in finding more standout names in construction and infrastructure, take the next step and discover fast growing stocks with high insider ownership

With shares climbing alongside rising earnings estimates and contract wins, the question is whether Primoris Services is undervalued at current levels or if the market has already priced in its strong growth prospects. Could now be the right time to buy?

Most Popular Narrative: 5% Overvalued

Primoris Services' widely followed analyst narrative places its fair value at $130.11, which is below the latest closing price of $136.86. This signals that the stock is currently trading at a premium compared to what analysts consider justified by fundamentals.

Expanding power delivery and grid modernization activity, supported by population growth in the Sun Belt and ongoing utility infrastructure upgrades, are fueling robust bookings and margin expansion in the Utilities segment. This is translating to higher net margins and more resilient cash flows.

Want to know what’s fueling this bullish price? The forecast incorporates accelerating revenue streams, margin gains, and a future profit multiple not usually seen in this sector. Intrigued by the analyst projections that build up this fair value? Dive in to uncover the numbers driving the valuation story.

Result: Fair Value of $130.11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in data center awards or margin pressure in the Renewables segment could quickly challenge these bullish assumptions and reshape expectations.

Find out about the key risks to this Primoris Services narrative.

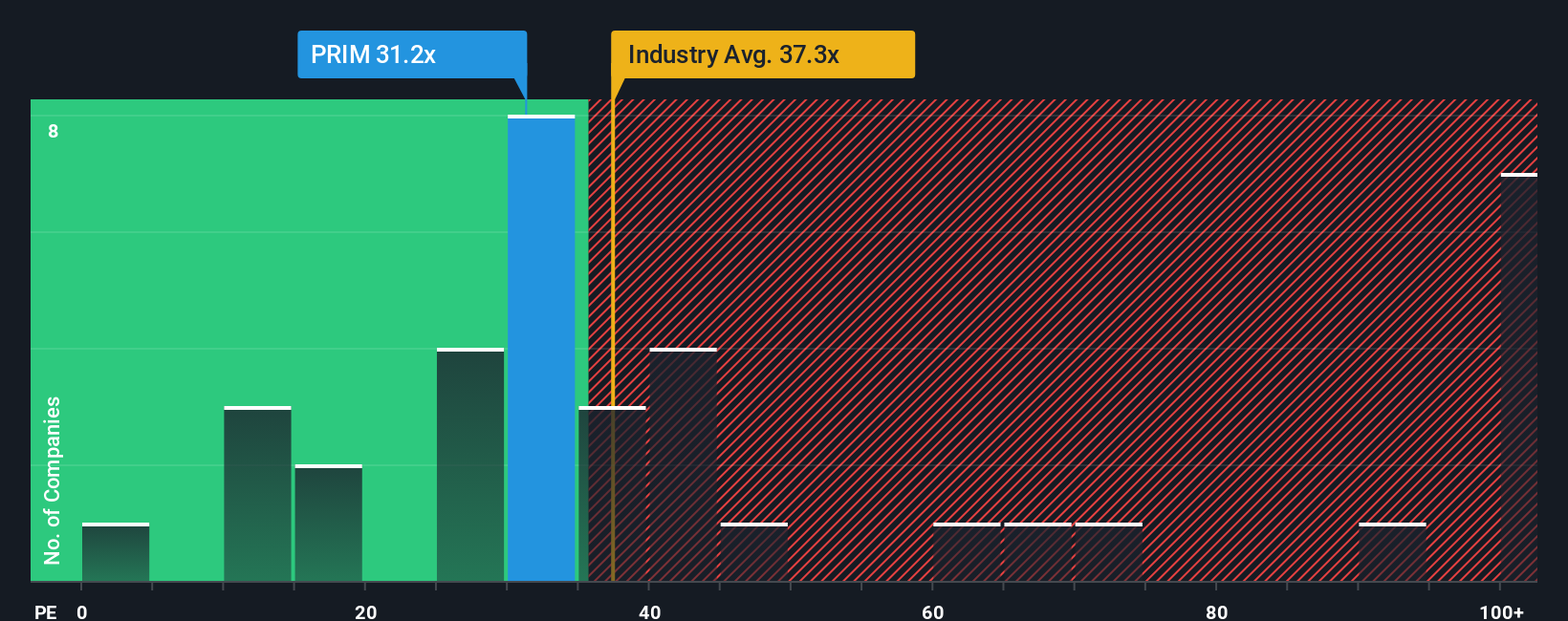

Another View: Market Multiples Tell a Different Story

While the analyst fair value puts Primoris Services at a slight premium, market comparisons using the price-to-earnings ratio suggest a more favorable position. With a 30.7x ratio, which is lower than both the peer average (39.2x) and the industry (35.6x), shares appear less expensive than competitors. However, compared to a fair ratio of 30.4x, there is little margin for error if sentiment shifts. Is this attractive gap an overlooked opportunity, or a signal to tread carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Primoris Services Narrative

If you see things differently or want a hands-on approach, you can explore the key figures and build your own perspective in just a few minutes, and Do it your way.

A great starting point for your Primoris Services research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t let today’s momentum pass you by. Unlock even more winning ideas tailored to unique growth themes. The right stock could be just a click away, so seize an edge on your next big move.

- Tap into high-yield potential by checking out these 19 dividend stocks with yields > 3% offering impressive returns above 3%.

- Spot emerging tech leaders by exploring these 24 AI penny stocks built for tomorrow’s breakthroughs in artificial intelligence.

- Catch value before the market does and find these 896 undervalued stocks based on cash flows quietly trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives