- United States

- /

- Construction

- /

- NYSE:PRIM

Primoris Services (PRIM): Valuation Check as Strong Zacks Rank Highlights Above-Industry EPS Growth Potential

Reviewed by Simply Wall St

Primoris Services (PRIM) just landed on the radar as a top growth stock pick after earning a strong Zacks Rank and Growth Score, thanks to upbeat earnings revisions and expectations for above industry EPS growth.

See our latest analysis for Primoris Services.

That optimism is showing up in the chart too, with the share price now at $125.86 and a strong year to date share price return of 63.69 percent. This echoes the powerful multi year total shareholder returns that suggest momentum is still building rather than fading.

If Primoris’s run has you thinking about where else growth might be hiding, it could be a good moment to explore fast growing stocks with high insider ownership for more potential standouts.

But after such a powerful run and a premium to fair value estimates, does Primoris still offer upside for patient investors, or is the market already fully pricing in its future growth potential?

Most Popular Narrative: 15.6% Undervalued

With Primoris Services last closing at $125.86 against a narrative fair value of $149.08, the story leans toward upside that still is not fully reflected.

Analysts expect earnings to reach $358.2 million (and earnings per share of $6.2) by about September 2028, up from $241.0 million today. The analysts are largely in agreement about this estimate.

Want to see what kind of revenue climb, margin lift, and future earnings multiple are baked into that fair value target? The full narrative unpacks the specific growth runway, profitability reset, and valuation re rating assumptions that underpin this 15 percent plus upside case, and reveals which long term demand trends are doing the heavy lifting.

Result: Fair Value of $149.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin pressure in the Energy segment, or weaker than expected data center and renewables awards, could quickly challenge this upbeat valuation story.

Find out about the key risks to this Primoris Services narrative.

Another Lens on Value

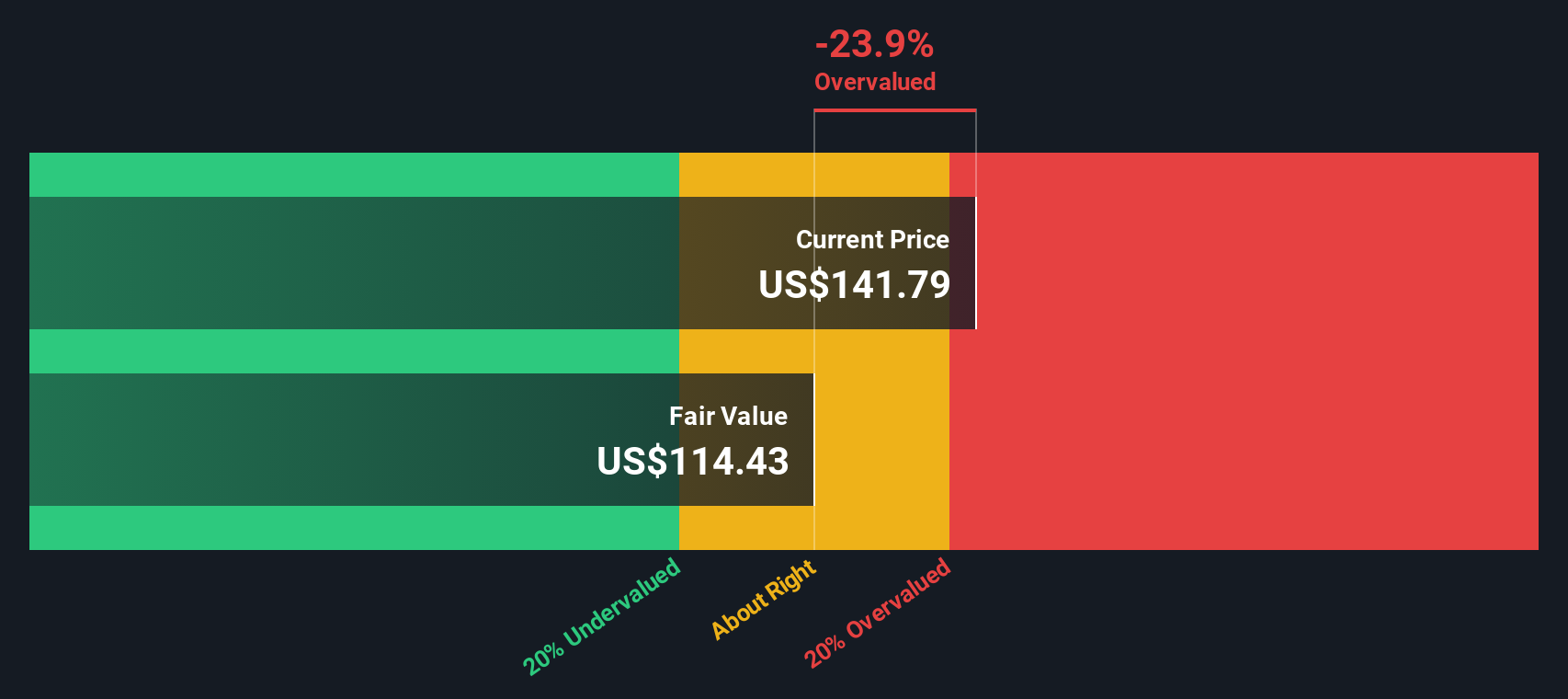

While the narrative fair value points to upside, our DCF model paints a cooler picture, with an estimated fair value of $110.34, below today’s $125.86. If future cash flows do not ramp as expected, is the stock already pricing in too much of the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Primoris Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Primoris Services Narrative

If you want to stress test these assumptions or build a thesis that better reflects your own view of Primoris, you can craft a custom narrative in just a few minutes: Do it your way.

A great starting point for your Primoris Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more high conviction opportunities?

Before you move on, put Simply Wall Street’s powerful Screener to work so you do not miss quality ideas that match your strategy and risk appetite.

- Capitalize on mispriced winners by scanning these 908 undervalued stocks based on cash flows that may offer strong upside based on robust cash flow potential.

- Ride structural growth trends by targeting these 30 healthcare AI stocks at the intersection of innovation and long term healthcare demand.

- Seize speculative upside by filtering these 81 cryptocurrency and blockchain stocks aiming to benefit from the expanding digital asset and blockchain ecosystem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026