- United States

- /

- Construction

- /

- NYSE:PRIM

How Primoris Services' (PRIM) New CEO Appointment May Reshape Its Investment Story

Reviewed by Sasha Jovanovic

- On October 6, 2025, Primoris Services Corporation announced that Koti Vadlamudi was appointed as President and CEO effective November 10, 2025, succeeding Interim CEO David King, who will remain Chairman of the Board.

- Vadlamudi brings over 30 years of global leadership experience in engineering and construction, most recently overseeing multi-billion-dollar operations at Jacobs Solutions Inc., with deep expertise in data centers, energy, and infrastructure sectors.

- We'll examine how Vadlamudi’s appointment, coupled with analysts’ focus on growth sectors, could influence Primoris Services’ investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Primoris Services Investment Narrative Recap

To be a Primoris Services shareholder today, you generally need confidence in the sustained demand for North American renewables, grid expansion, and data center infrastructure. The transition to Koti Vadlamudi as CEO may not influence the imminent catalyst, winning high-margin data center contracts, or affect the main risk, which is the challenge of maintaining a strong project backlog amid heightened competition and persistent margin pressure in renewables and pipeline segments.

Among the latest developments, Primoris recently reported robust Q2 2025 results with year-over-year growth in both revenue and earnings, while also raising its full-year guidance. This signals operational execution remains a core strength and continues to support the company’s catalyst of expanding renewables and utility-scale project revenues. However, while these results offer some momentum, the near-term outlook will likely hinge on continued success in securing large-scale new awards.

But unlike last quarter’s revenue jump, it’s the unpredictability in data center and renewables project wins that investors should stay alert to...

Read the full narrative on Primoris Services (it's free!)

Primoris Services' narrative projects $8.7 billion revenue and $358.2 million earnings by 2028. This requires 7.7% yearly revenue growth and a $117.2 million earnings increase from $241.0 million today.

Uncover how Primoris Services' forecasts yield a $130.11 fair value, a 6% downside to its current price.

Exploring Other Perspectives

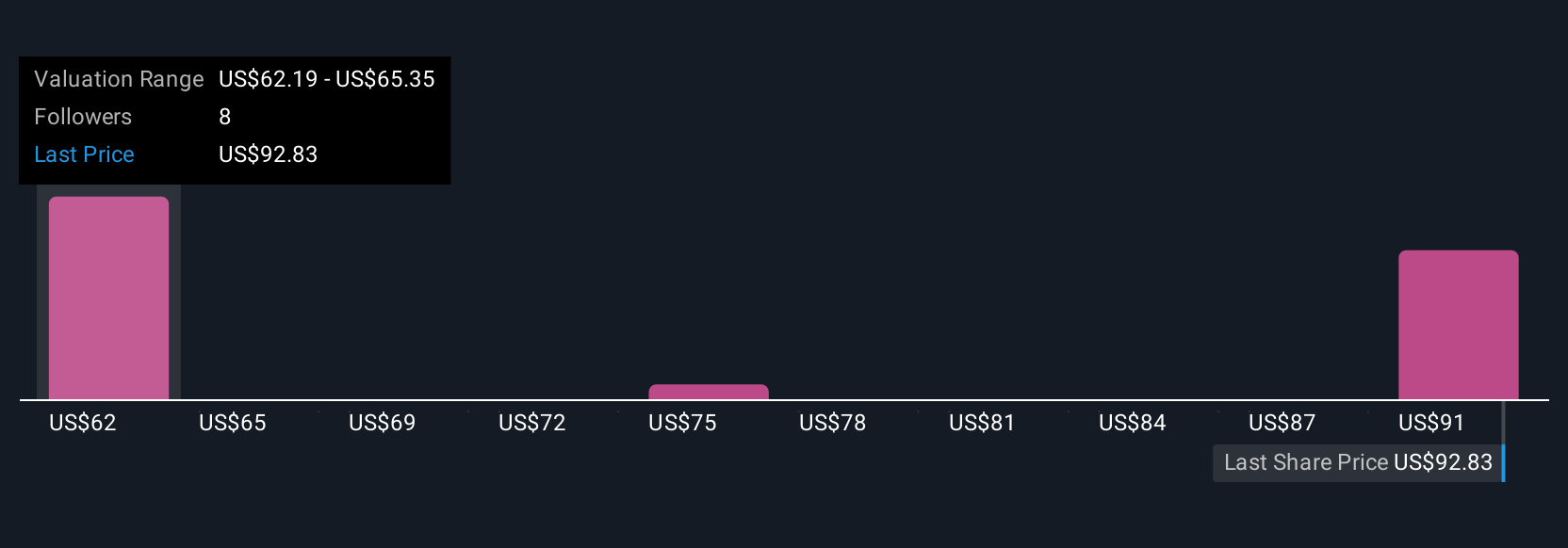

Four Simply Wall St Community members peg Primoris’s fair value estimates between US$77.76 and US$130.11. Investor sentiment varies widely, while access to high-margin data center contracts remains a defining factor for performance.

Explore 4 other fair value estimates on Primoris Services - why the stock might be worth 44% less than the current price!

Build Your Own Primoris Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primoris Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Primoris Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primoris Services' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives