- United States

- /

- Construction

- /

- NYSE:PRIM

How Investors Are Reacting To Primoris Services (PRIM) Analyst Upgrade After Solar Symposium Presentations

Reviewed by Simply Wall St

- Primoris Services Corporation recently participated in the 12th Annual ROTH Solar & Storage Symposium in Las Vegas, with key executives including CEO David L. King and President of Renewable Energy Anthony Vorderbruggen presenting updates to investors and stakeholders.

- Shortly after the event, the company received an analyst upgrade driven by rising earnings estimates, highlighting increased confidence in its underlying business fundamentals and growth outlook among market observers.

- We’ll explore how the analyst upgrade, grounded in improved earnings prospects, could influence Primoris Services’ broader investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Primoris Services Investment Narrative Recap

To be a Primoris Services shareholder, you need to have conviction in the company’s ability to capitalize on ongoing infrastructure spending in renewables and utilities, while managing execution risks and project mix to preserve margins. The recent analyst upgrade, triggered by improved earnings outlook, sharpens near-term focus on margin traction and backlog quality, but doesn't meaningfully diminish the key short-term risk, namely, margin volatility in highly competitive sectors like renewables, which could quickly resurface if execution stumbles or project awards slow.

Among recent announcements, Primoris’s raised earnings guidance stands out as most relevant, reinforcing the upgraded outlook by pointing to increased contract wins and potential margin improvement. This momentum aligns with the current short-term catalyst of robust renewables and power delivery activity, though pressure on segment profitability remains a central concern.

On the other hand, investors should be aware just how quickly project timing or weather-related issues could affect...

Read the full narrative on Primoris Services (it's free!)

Primoris Services' outlook projects $8.7 billion in revenue and $358.2 million in earnings by 2028. This is based on a 7.7% annual revenue growth rate and a $117.2 million increase in earnings from the current $241.0 million level.

Uncover how Primoris Services' forecasts yield a $124.67 fair value, in line with its current price.

Exploring Other Perspectives

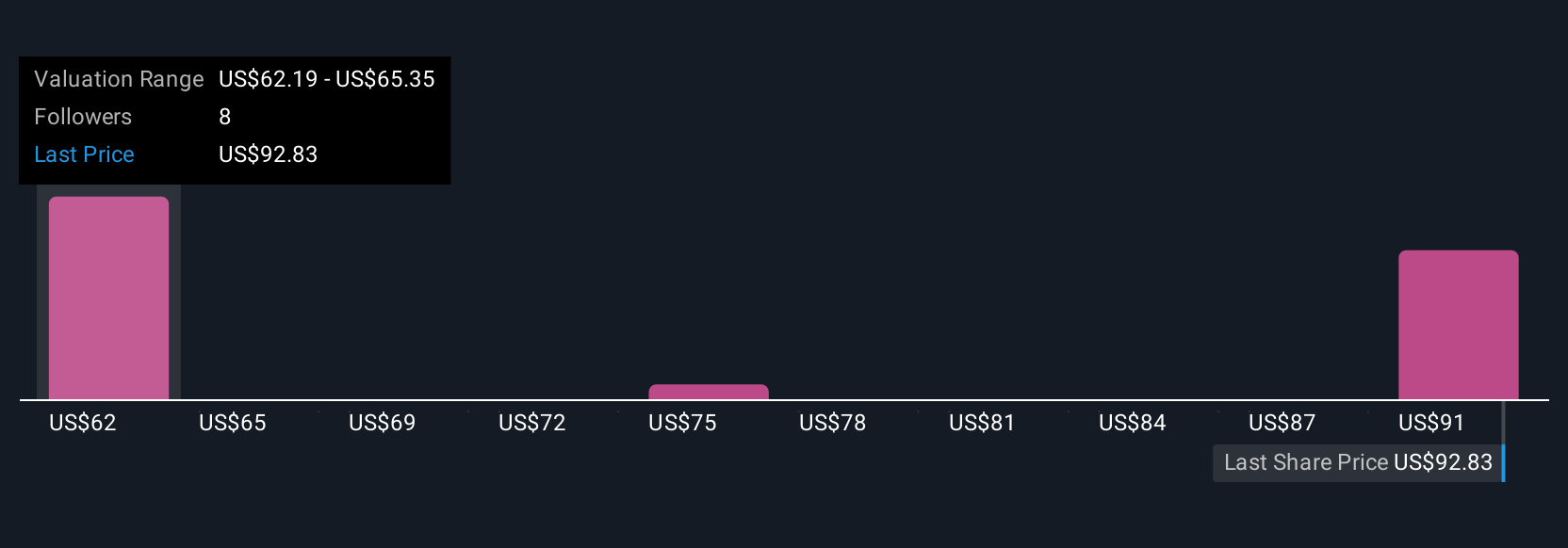

Three fair value estimates from the Simply Wall St Community range from US$77.76 to US$124.67, highlighting substantial variation in expectations. While recent analyst upgrades are tied to stronger earnings momentum, it is clear market participants view the risks and long-term opportunity for Primoris Services in different ways, consider reviewing several viewpoints to broaden your analysis.

Explore 3 other fair value estimates on Primoris Services - why the stock might be worth 36% less than the current price!

Build Your Own Primoris Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primoris Services research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Primoris Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primoris Services' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives