- United States

- /

- Aerospace & Defense

- /

- NYSE:PKE

Exploring 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

As major U.S. stock indexes experience volatility, with recent Nvidia-led gains evaporating and economic indicators presenting a mixed picture, investors are increasingly seeking opportunities beyond the usual market giants. In such an environment, identifying undiscovered gems in the small-cap sector can offer potential for growth, as these companies often thrive on innovation and niche market strategies that may be less affected by broader market swings.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Agora (API)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service across the United States, the People's Republic of China, and internationally, with a market cap of $327.52 million.

Operations: Agora generates revenue primarily through its real-time engagement platform-as-a-service, catering to various international markets. The company incurs costs related to service delivery, which impact its profitability.

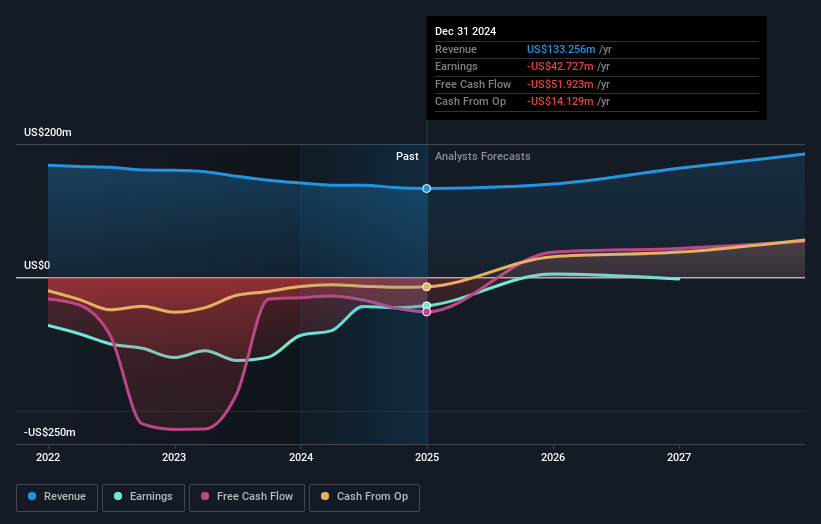

Agora is making waves in the tech sector with its real-time engagement platform, which benefits from increased digital engagement and remote work trends. The company reported a turnaround with a net income of US$2.74 million for Q3 2025, compared to a net loss of US$24.18 million the previous year, while revenue rose to US$35.37 million from US$31.57 million. Agora's partnership with OpenAI enhances its Conversational AI Engine, offering advanced features like automated greetings and mixed-modality interaction, positioning it well for future growth despite challenges such as leadership turnover and customer concentration risks.

Liquidity Services (LQDT)

Simply Wall St Value Rating: ★★★★★★

Overview: Liquidity Services, Inc. operates e-commerce marketplaces and offers auction tools and value-added services both in the United States and internationally, with a market cap of approximately $708.45 million.

Operations: The company's revenue primarily comes from its Retail Supply Chain Group (RSCG) segment, which generated $325.62 million, followed by GovDeals at $83.90 million and Capital Assets Group (CAG) at $37.51 million.

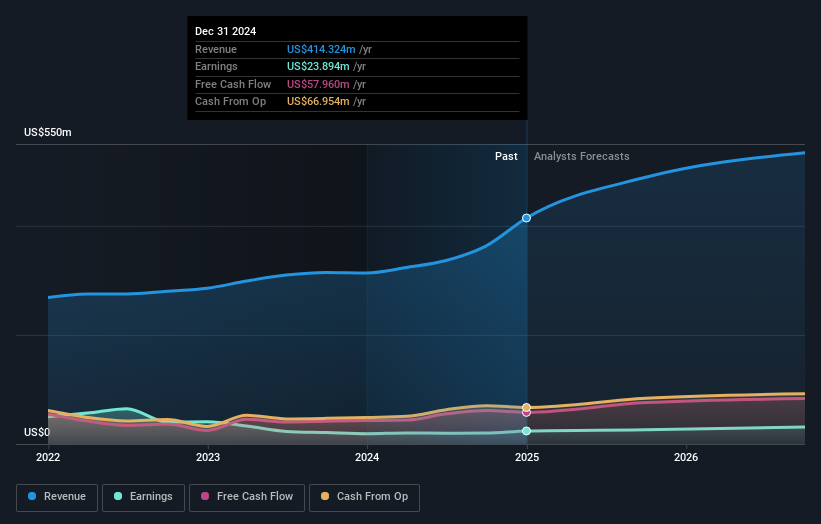

Liquidity Services, a nimble player in the commercial services sector, has shown impressive growth with earnings soaring 33.9% over the past year, outpacing the industry average of 2.4%. The company remains debt-free for five years and trades at a discount of 27.6% below its estimated fair value. Recent financials highlight robust revenue growth from $363 million to $477 million and net income climbing to $28 million from $20 million. A new share repurchase program worth US$15 million reflects confidence in future prospects, though market shifts and competition pose potential challenges to sustaining this momentum.

Park Aerospace (PKE)

Simply Wall St Value Rating: ★★★★★★

Overview: Park Aerospace Corp. is an aerospace company specializing in the development and manufacturing of advanced composite materials for composite structures in the aerospace market across North America, Asia, and Europe, with a market cap of $373.63 million.

Operations: Park Aerospace generates revenue primarily from its Aerospace & Defense segment, which accounted for $63.13 million. The company's market cap stands at $373.63 million.

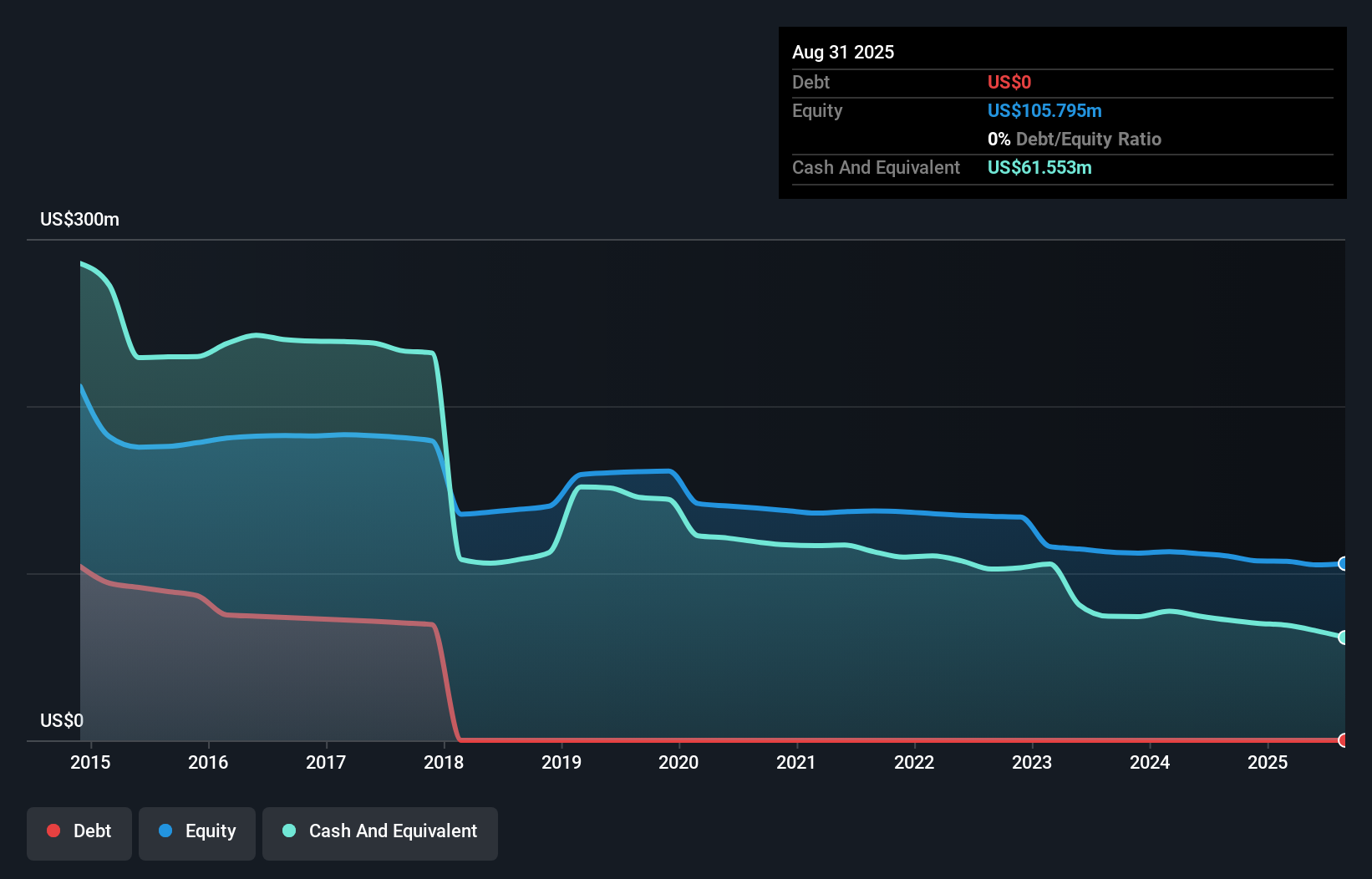

Park Aerospace, a nimble player in the aerospace sector, showcases robust financial health with no debt and consistent free cash flow. Over the past five years, its earnings have increased at a modest 0.7% annually, reflecting high-quality earnings despite not outpacing industry growth. Recent figures reveal net income of US$2.4 million for Q2 2025, up from US$2.07 million the previous year, alongside sales of US$16.38 million compared to last year's US$16.71 million for the same period. The company completed a share buyback program worth US$9.29 million in August 2025, indicating confidence in its valuation and future prospects.

- Click to explore a detailed breakdown of our findings in Park Aerospace's health report.

Gain insights into Park Aerospace's past trends and performance with our Past report.

Turning Ideas Into Actions

- Discover the full array of 294 US Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PKE

Park Aerospace

An aerospace company, develops and manufactures solution and hot-melt advanced composite materials used to produce composite structures for the aerospace market in North America, Asia, and Europe.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives