- United States

- /

- Machinery

- /

- NYSE:OSK

Is Barclays' Bullish Stance on Segment Backlogs Shifting the Investment Case for Oshkosh (OSK)?

Reviewed by Sasha Jovanovic

- In the past week, Barclays initiated coverage of Oshkosh Corporation with an Overweight rating, citing expectations of a multiyear expansion in earnings and highlighting segment strengths and challenges.

- Barclays' analysis underlined the strong backlog and profit potential in Oshkosh's vocational segment, even as demand softens in the Access segment.

- We'll explore how Barclays' endorsement of long-term earnings momentum and robust vocational segment backlogs affects Oshkosh's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Oshkosh Investment Narrative Recap

To be comfortable holding Oshkosh stock, an investor needs to believe in the company’s ability to drive long-term earnings growth, particularly through its resilient vocational segment and sustained contract backlogs. Barclays’ recent initiation of coverage acknowledges these strengths but does not materially change the short-term picture, where softer Access segment demand remains the key near-term catalyst to monitor and ongoing sensitivity to government contract cycles is the primary risk.

The lowered earnings guidance issued in October is especially relevant, as it reflects reduced near-term expectations for the Access and Transport segments. This aligns with concerns highlighted in Barclays’ analysis and places even greater importance on the performance and order flow within the vocational segment as Oshkosh’s potential stabilizer for both earnings and sentiment ahead.

In contrast, investors should be aware that increased reliance on large government contracts could mean exposure to swings in funding or delays...

Read the full narrative on Oshkosh (it's free!)

Oshkosh's outlook anticipates $12.0 billion in revenue and $940.2 million in earnings by 2028. This reflects a 5.1% annual revenue growth and a $289.8 million increase in earnings from the current $650.4 million.

Uncover how Oshkosh's forecasts yield a $153.08 fair value, a 20% upside to its current price.

Exploring Other Perspectives

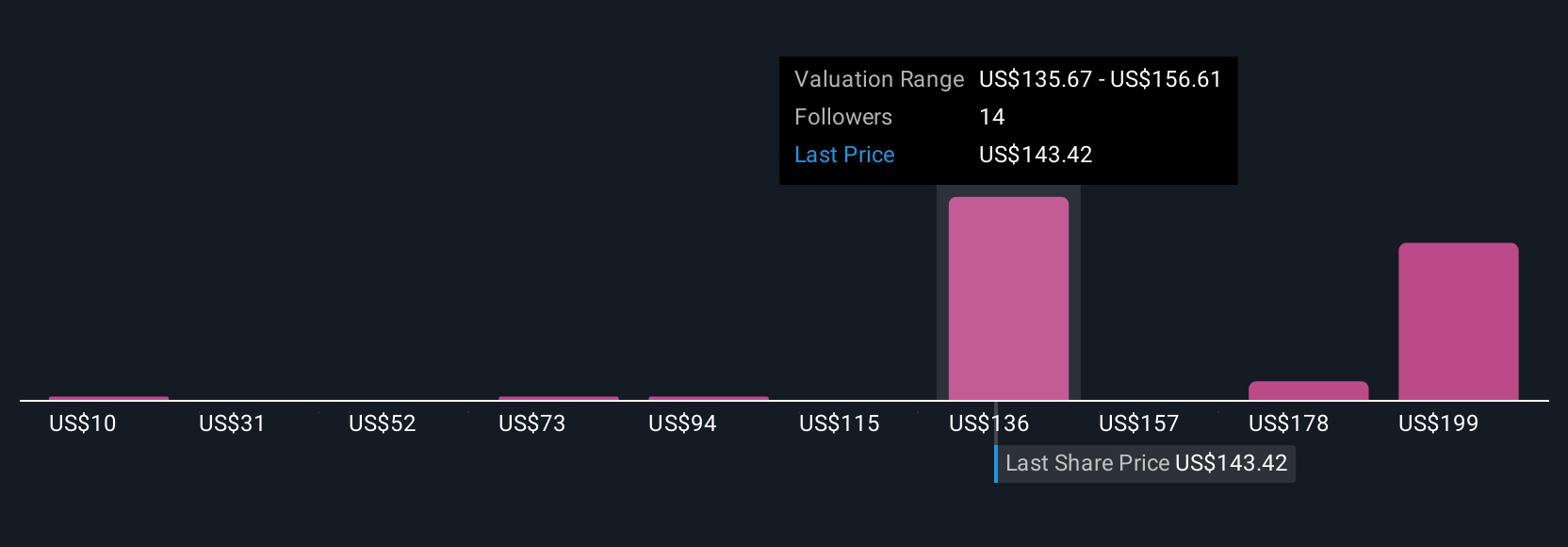

Seven members of the Simply Wall St Community see fair value estimates for Oshkosh ranging from as low as US$10 to as high as US$237.83 per share. Given this wide span, your view on the company’s heavy government contract exposure could significantly influence how you interpret its future potential and risk profile.

Explore 7 other fair value estimates on Oshkosh - why the stock might be worth less than half the current price!

Build Your Own Oshkosh Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oshkosh research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Oshkosh research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oshkosh's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSK

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success