- United States

- /

- Electrical

- /

- NYSE:NVT

Is nVent Electric’s Rally Sustainable After 47% Jump and Record Data Center Demand?

Reviewed by Bailey Pemberton

If you’ve been keeping an eye on nVent Electric, you’re probably wondering whether this stock’s sizzling run can keep up. Over the past five years, nVent has wowed investors with a remarkable gain of 454.3%, turning heads with its consistent upward momentum. Even just this year, the stock is up an impressive 46.9%, far outpacing the broader market and securing a spot on many watchlists. The latest 30-day return clocks in at 4.5%, with a 2.9% pop in just the last week. This shows that sentiment around nVent has been anything but stagnant. All this movement is happening as investors assess broader market trends in electrical infrastructure and growth around smart, sustainable technology, where nVent continues to attract attention.

But with this much momentum, it’s natural to pause and wonder if nVent is getting ahead of itself, or if there’s still more to capture. A look at its valuation score might give you a moment’s pause: nVent is currently undervalued in 0 out of the 6 standard checks, giving it a value score of 0. That means by most conventional yardsticks, it isn’t cheap. Still, does that tell the whole story?

We’re about to dive into the specific valuation approaches one by one. At the end, a more insightful way to think about nVent’s true worth in the market will be explored.

nVent Electric scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: nVent Electric Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting all future expected cash flows and then discounting them back to their value today. This approach helps investors judge whether a stock is overpriced, underpriced, or fairly valued based on its actual capacity to generate cash over time.

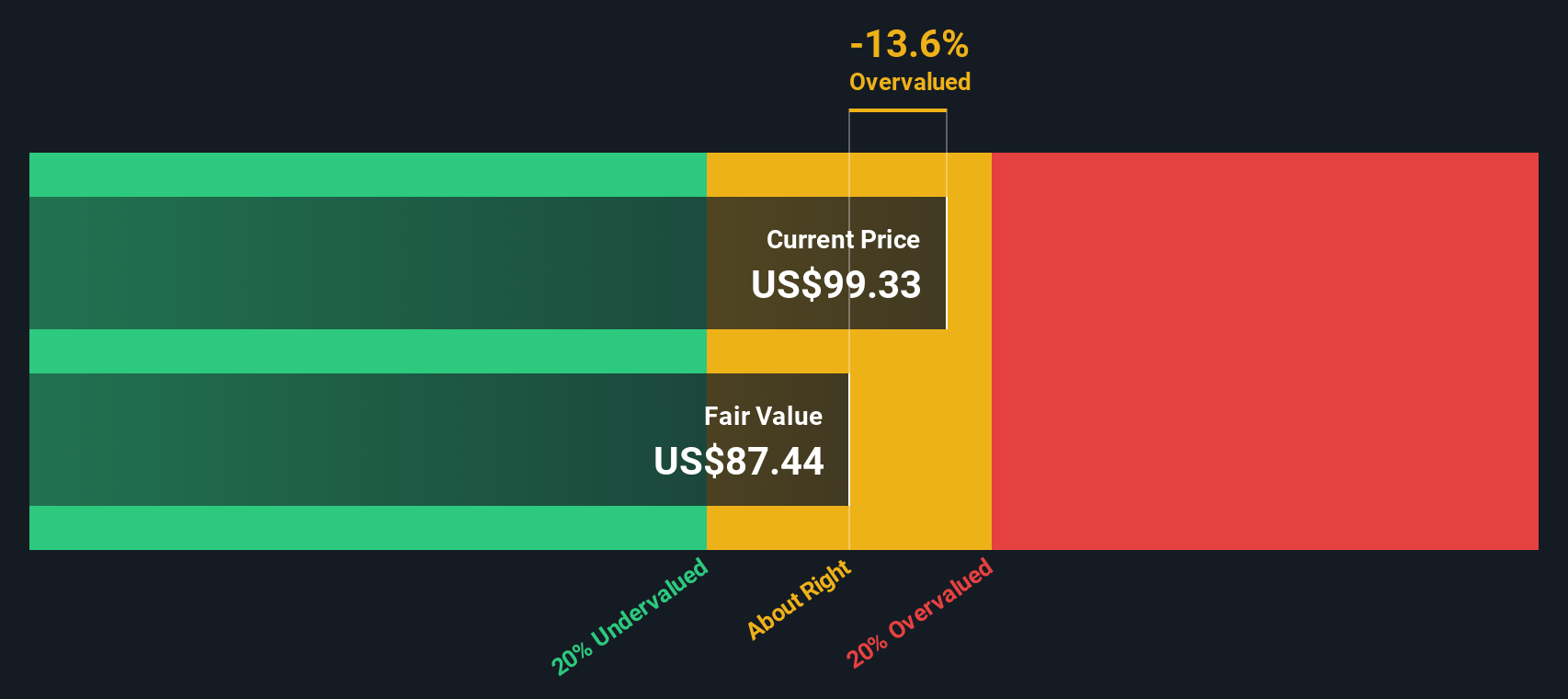

For nVent Electric, the most recent Free Cash Flow (FCF) stands at $390.6 million. Analysts have provided detailed forecasts for the next five years, and beyond that, estimates are extrapolated. Looking further out, nVent’s Free Cash Flow is projected to reach $933 million by 2029, with continued increases expected into the next decade, driven by both market demand and internal growth initiatives.

Using the 2 Stage Free Cash Flow to Equity model, the estimated fair value per share comes to $87.50. However, this calculation indicates the stock is currently trading at a 14.9% premium to its intrinsic value. In other words, it is considered overvalued according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests nVent Electric may be overvalued by 14.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: nVent Electric Price vs Earnings

The Price-to-Earnings (PE) ratio is the preferred multiple for valuing profitable companies like nVent Electric because it directly relates a company’s share price to its per-share earnings. This makes it especially insightful for investors who want to know how much they are paying for each dollar of earnings the business generates.

What counts as a "fair" PE ratio is influenced by factors like expected growth and risk. Companies poised for strong earnings expansion generally deserve a higher PE, while those with lower growth or more risk are assigned lower multiples. Benchmarking against certain standards helps investors understand if a company is overstretched or potentially a bargain.

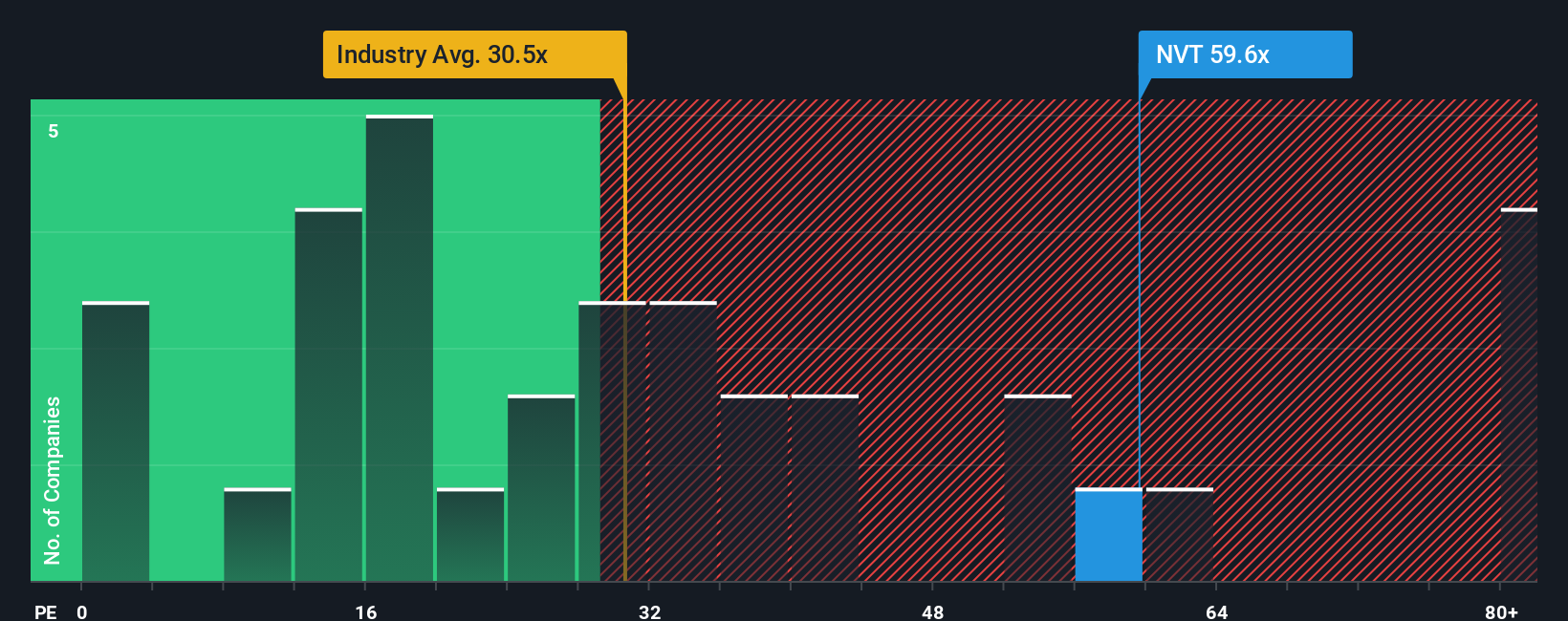

nVent Electric currently trades at a PE of 63.2x, which is notably higher than both the electrical industry average of 30.5x and the peer group average at 29.3x. At first glance, this premium might suggest overvaluation. However, Simply Wall St introduces the “Fair Ratio,” a tailored benchmark that estimates the appropriate PE for nVent based on factors like its earnings growth, market cap, profit margin, and sector risks. For nVent, the Fair Ratio is calculated to be 34.3x.

While traditional comparisons imply nVent is priced significantly above its sector and peer averages, the Fair Ratio gives better context by accounting for the company’s unique circumstances. Comparing nVent's current PE to its Fair Ratio, there is a substantial gap. This means the stock appears overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your nVent Electric Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your own story and outlook for a company, grounded in what you believe about its future revenues, profits, and margins. These assumptions are directly connected to an estimated fair value.

Unlike rigid models, Narratives link a company’s big-picture business story with dynamic financial forecasts, making it easier for investors to see how projections and recent news translate into actionable buy or sell decisions.

With Narratives, available to everyone in the Community page on Simply Wall St’s platform, you can quickly build or adjust your view on nVent Electric by updating growth assumptions or incorporating the latest earnings releases or market news. Millions already use these interactive tools to test their thinking as facts change.

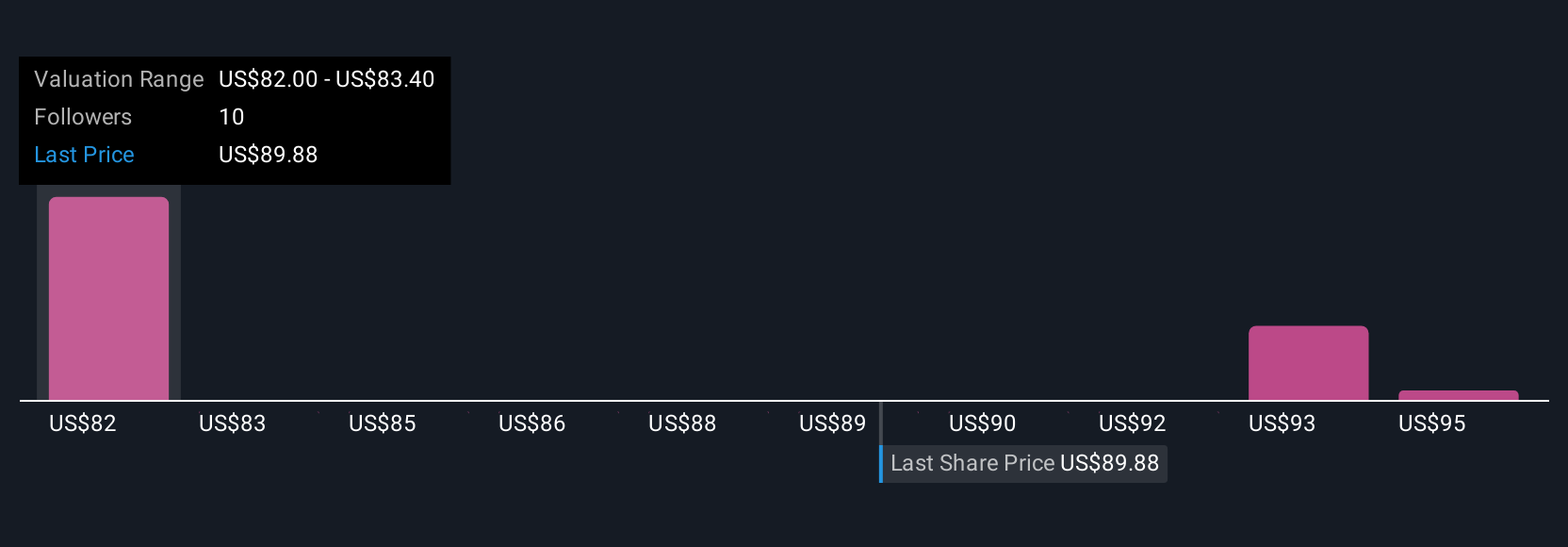

For example, recent analyst Narratives for nVent place its fair value as high as $105 if you believe in continued rapid AI-fueled growth and successful integration of new acquisitions, or as low as $68 if you are concerned about risks such as overexposure to data center trends or execution challenges in margin expansion. Narratives put you in control, letting you compare your story and resulting fair value to the current share price to decide when to act.

Do you think there's more to the story for nVent Electric? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVT

nVent Electric

Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives