- United States

- /

- Electrical

- /

- NYSE:NVT

A Fresh Look at nVent Electric's Valuation Following Second Data Center Manufacturing Expansion Announcement

Reviewed by Simply Wall St

Most Popular Narrative: 4.6% Undervalued

According to the most widely followed narrative, nVent Electric is seen as slightly undervalued, with the stock trading below its estimated fair value based on anticipated earnings and revenue growth.

Significant investments in capacity, new product launches (notably in liquid cooling and modular data center solutions), and digital sales channels position nVent to capitalize on recurring upgrade cycles and rising demand for turnkey, advanced electrical solutions. This is likely to support future increases in both revenues and net margins.

Curious how nVent's next phase of growth is being valued? The heart of this narrative lies in bold estimates for future sales, expanding profit margins, and a financial multiple usually reserved for high-flyers. Want to see the real numbers behind that price target? Dig deeper and you might be surprised by what is driving this calculation.

Result: Fair Value of $97.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain if AI data center spending slows or if recent acquisitions do not deliver the expected operational and margin benefits.

Find out about the key risks to this nVent Electric narrative.Another View: Challenging the Story from a Different Angle

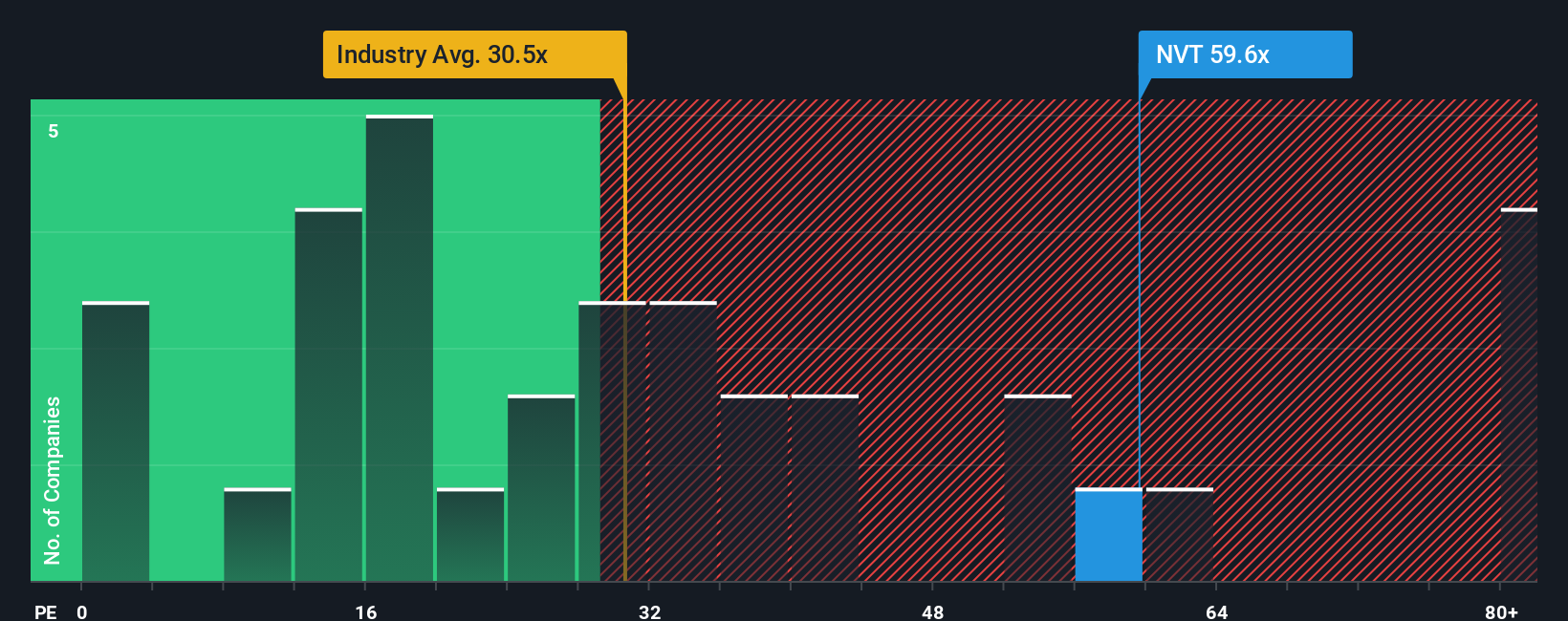

While some see nVent Electric as undervalued by future earnings, a look through the lens of its earnings multiple compared to the industry suggests the shares may actually be expensive. Can both views be right?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding nVent Electric to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own nVent Electric Narrative

If you see things differently or want to dig into the numbers yourself, you can assemble your own take in just a few minutes. Do it your way

A great starting point for your nVent Electric research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Compelling Investment Opportunities?

Seize your next big move by filtering for stocks that match your strategy. The best ideas rarely wait. Make sure you do not miss them by checking out these hand-picked starting points:

- Spot tomorrow’s leaders in automation and machine learning when you track AI-focused growth stories using our AI penny stocks.

- Unlock exceptional value by targeting companies priced well below their cash flow potential through our exclusive undervalued stocks based on cash flows.

- Boost your income strategy with companies offering robust, consistent returns via our curated list of dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:NVT

nVent Electric

Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives