- United States

- /

- Machinery

- /

- NYSE:NPO

Enpro (NPO): Neutral Look at Valuation Following Recent Share Momentum

Reviewed by Kshitija Bhandaru

Enpro (NPO) shares have experienced a slight move this week, drawing the attention of investors curious about the factors behind recent price action. With positive year-to-date gains, the stock’s performance stands out compared to the wider sector.

See our latest analysis for Enpro.

Enpro’s momentum has been hard to miss lately, with a 35.2% year-to-date share price return and total shareholder returns of 47.2% over the past twelve months. While there has been no major headline driving the latest shift, steady gains in recent months suggest investors are increasingly confident about the company’s growth story and long-term outlook.

If Enpro's strong run has you rethinking what’s possible, now could be a good time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares not far below analyst targets after strong gains, investors may wonder if Enpro is still undervalued or if all future growth has already been priced into the stock. This creates a tough decision for buyers.

Most Popular Narrative: 5.1% Undervalued

Enpro’s recent closing price sits just below the fair value proposed by the most followed narrative, suggesting a modest discount remains. This sets the stage for an optimistic outlook closely connected to the company’s strategic moves and sector positioning.

Increased investments in capacity expansion, technology differentiation, and market reach, especially in areas like aerospace, sustainable power generation, and compositional analysis, are positioning Enpro to capitalize on the rising demand for automation, digitalization, and advanced engineered solutions, supporting sustained revenue growth.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is bold, multi-year expansion moves in fast-evolving industries. Hint: there is a heavy bet on both recurring sales and margin leaps. Which levers are driving those future profits? Dive in to find out the big assumptions behind Enpro’s valuation story.

Result: Fair Value of $241 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including exposure to volatile cyclical markets and the challenge of scaling expansion investments in a way that does not impact profitability and cash flow.

Find out about the key risks to this Enpro narrative.

Another View: Is the Market Too Optimistic?

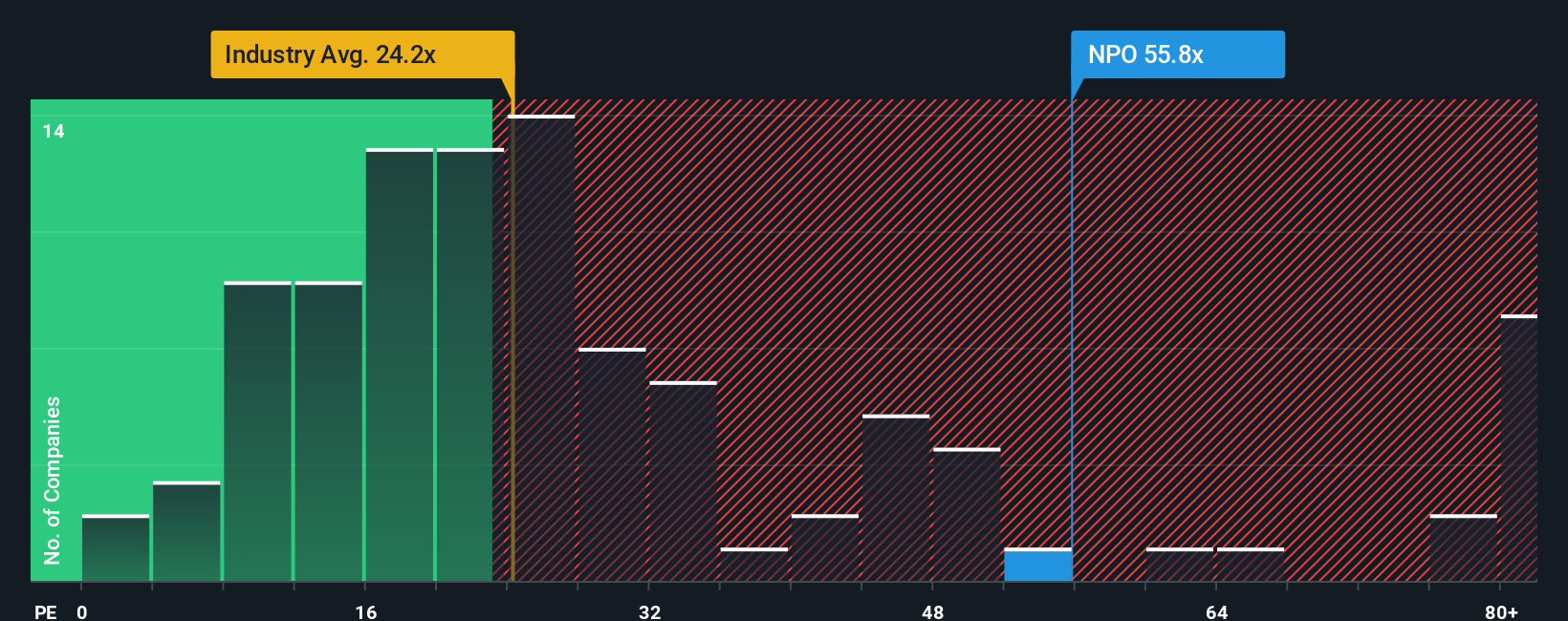

While the most popular narrative points to Enpro trading at a discount, our review of price-to-earnings multiples tells a different story. Enpro’s ratio of 56.9x is well above both its industry average of 24.2x and the peer average of 32.2x, and higher than its fair ratio of 31.8x. This suggests the market is pricing in exceptional growth. Is this optimism sustainable, or could it signal increased valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enpro Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own argument in just a few minutes. Do it your way

A great starting point for your Enpro research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on new opportunities. Level up your watchlist by tapping into stocks with breakout potential that may not be on your radar yet.

- Unlock high-yield potential by checking out these 18 dividend stocks with yields > 3%, which offers strong returns and stability for your income portfolio.

- Position yourself at the forefront of innovation by reviewing these 24 AI penny stocks, a selection of companies powering the AI revolution and changing how industries operate.

- Catch early-stage momentum by scanning these 3596 penny stocks with strong financials, featuring robust financials that could deliver outsized growth in the coming months.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enpro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPO

Enpro

An industrial technology company, design, develops, manufactures, and markets proprietary, value-added products and solutions to safeguard critical environments in the United States, Europe, Asia Pacific, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives