- United States

- /

- Trade Distributors

- /

- NYSE:NPKI

Is Now The Time To Put NPK International (NYSE:NPKI) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like NPK International (NYSE:NPKI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

NPK International's Improving Profits

NPK International has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, NPK International's EPS catapulted from US$0.24 to US$0.50, over the last year. Year on year growth of 107% is certainly a sight to behold.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note NPK International achieved similar EBIT margins to last year, revenue grew by a solid 7.0% to US$235m. That's a real positive.

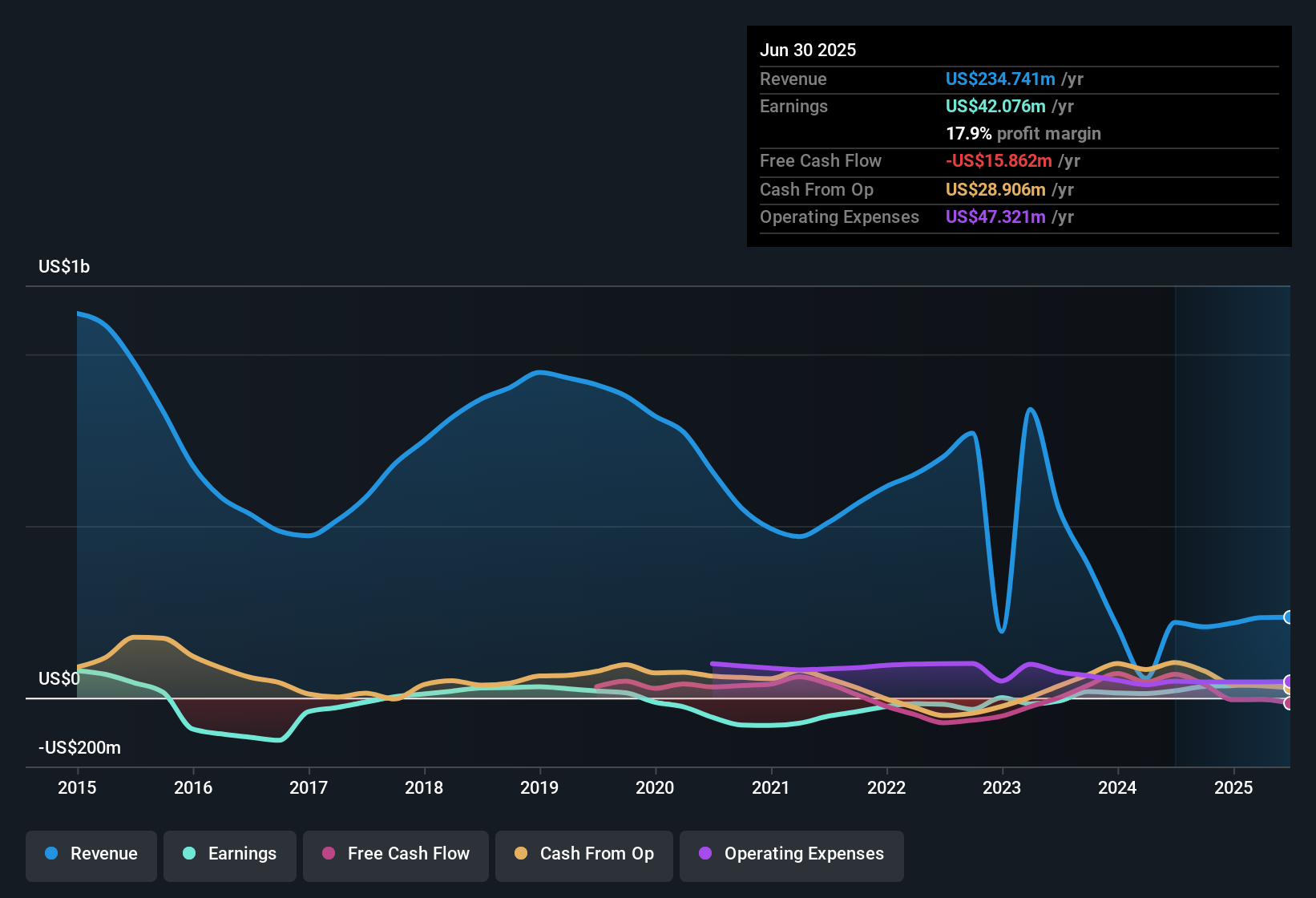

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Check out our latest analysis for NPK International

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for NPK International's future EPS 100% free.

Are NPK International Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that NPK International insiders spent US$185k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by Independent Director Joseph Cutillo for US$100k worth of shares, at about US$8.00 per share.

Along with the insider buying, another encouraging sign for NPK International is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$47m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 4.8% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is NPK International Worth Keeping An Eye On?

NPK International's earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe NPK International deserves timely attention. Of course, just because NPK International is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Keen growth investors love to see insider activity. Thankfully, NPK International isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if NPK International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NPKI

NPK International

A temporary worksite access solutions company, manufactures, sells, and rents recyclable composite matting products.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives