- United States

- /

- Aerospace & Defense

- /

- NYSE:NPK

The CEO Of National Presto Industries, Inc. (NYSE:NPK) Might See A Pay Rise On The Horizon

Shareholders will be pleased by the robust performance of National Presto Industries, Inc. (NYSE:NPK) recently and this will be kept in mind in the upcoming AGM on 18 May 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

View our latest analysis for National Presto Industries

Comparing National Presto Industries, Inc.'s CEO Compensation With the industry

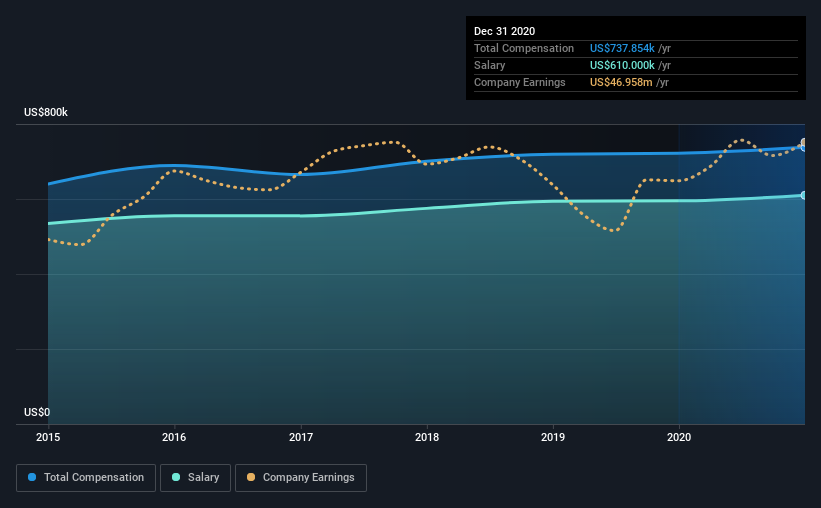

At the time of writing, our data shows that National Presto Industries, Inc. has a market capitalization of US$741m, and reported total annual CEO compensation of US$738k for the year to December 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of US$610.0k, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$2.3m. That is to say, Maryjo Cohen is paid under the industry median. Furthermore, Maryjo Cohen directly owns US$177m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$610k | US$595k | 83% |

| Other | US$128k | US$127k | 17% |

| Total Compensation | US$738k | US$722k | 100% |

Talking in terms of the industry, salary represented approximately 17% of total compensation out of all the companies we analyzed, while other remuneration made up 83% of the pie. According to our research, National Presto Industries has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at National Presto Industries, Inc.'s Growth Numbers

National Presto Industries, Inc. has seen its earnings per share (EPS) increase by 2.5% a year over the past three years. It achieved revenue growth of 14% over the last year.

This revenue growth could really point to a brighter future. And the improvement in EPSis modest but respectable. So while performance isn't amazing, we think it really does seem quite respectable. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has National Presto Industries, Inc. Been A Good Investment?

National Presto Industries, Inc. has served shareholders reasonably well, with a total return of 22% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it manages to keep up the current streak, CEO remuneration could well be one of shareholders' least concerns. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for National Presto Industries that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade National Presto Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if National Presto Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:NPK

National Presto Industries

Provides housewares and small appliance, defense, and safety products in North America.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives