- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

Northrop Grumman (NOC): Evaluating Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

Northrop Grumman (NOC) has seen shares trade flat in recent sessions, prompting investor interest in how the defense contractor’s fundamentals are currently stacking up. With revenue and net income growth just above 5% over the past year, the stock’s performance invites a closer look at the underlying value drivers.

See our latest analysis for Northrop Grumman.

After a strong run earlier this year, Northrop Grumman’s share price has pulled back 8.36% over the past month but remains up more than 19% year-to-date, which points to solid momentum in 2024. Long-term holders have also benefited, with a 14.94% total shareholder return over the last twelve months. This suggests that recent volatility could reflect evolving views on defense spending and the company’s underlying growth prospects rather than a significant shift in fundamentals.

If defense stocks are on your radar, now is a great moment to discover opportunities in the sector with our curated See the full list for free..

With shares still below analyst targets and recent growth figures in focus, the key question for investors is clear: is Northrop Grumman trading at a compelling discount, or has the market already factored in its future gains?

Most Popular Narrative: 16.1% Undervalued

Northrop Grumman’s most widely followed narrative sees the stock trading meaningfully below its estimated fair value of $664.83, based on the latest closing price of $558. This creates a clear gap that investors will want to investigate.

Accelerating U.S. and allied defense spending, supported by substantial increases in procurement and RDT&E budgets (for example, a 22% increase in U.S. spending for FY26) and significant new funding for key Northrop Grumman programs (B-21, Sentinel, and E-2D), is expected to drive sustained revenue growth and provide multi-year order visibility.

Want to know what powers this narrative’s bullish outlook? The explanation lies in bold profit projections, future buybacks, and a valuation usually reserved for top-tier growth stocks. Curious about how these strong expectations could reshape perceptions of Northrop Grumman’s value? Find out what’s behind the fair value calculation today.

Result: Fair Value of $664.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on large U.S. defense contracts and shifting global priorities could disrupt Northrop Grumman’s projected growth trajectory and margin expectations.

Find out about the key risks to this Northrop Grumman narrative.

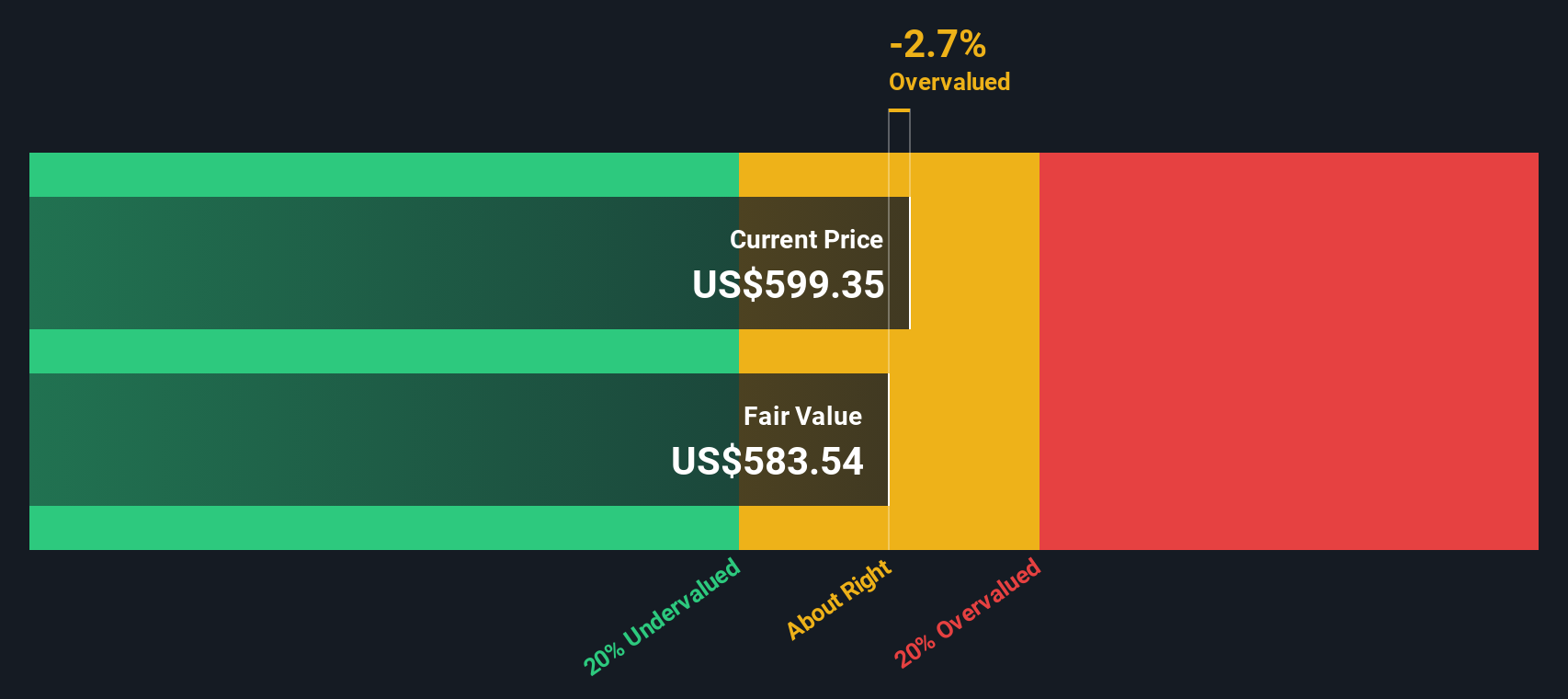

Another View: Our DCF Model Offers Perspective

While analysts see Northrop Grumman as undervalued relative to its fair price, our SWS DCF model suggests a more cautious stance. The model values the stock at $532.87, below its current price of $558.00. This suggests that recent optimism might be running a little ahead of fundamentals. Which scenario will play out as the year unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northrop Grumman for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northrop Grumman Narrative

If you have your own perspective or want a hands-on approach to the numbers, it takes just a few minutes to build and test your own view of Northrop Grumman’s story. Do it your way.

A great starting point for your Northrop Grumman research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself—new leaders are emerging in every corner of the market. Make your next smart move and check out these powerful stock opportunities today:

- Unlock high yields by scanning these 16 dividend stocks with yields > 3% poised to reward shareholders with attractive income in any market climate.

- Capitalize on innovation and track these 25 AI penny stocks, which are setting the pace in artificial intelligence breakthroughs you don’t want to miss.

- Position yourself ahead of the curve by evaluating these 879 undervalued stocks based on cash flows, which have yet to be fully recognized by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives