- United States

- /

- Construction

- /

- NYSE:MTZ

MasTec (MTZ): Examining Valuation After Producer Price Index Drop Spurs Rate Cut Optimism

Reviewed by Simply Wall St

MasTec (MTZ) is suddenly in the spotlight after a sharp drop in the Producer Price Index for August ignited a rally across the industrial sector. With inflation easing, investors are betting on a Federal Reserve interest rate cut as soon as the next meeting. For MasTec, which already signaled openness to new acquisitions in recent comments from CFO Paul DiMarco, lower borrowing costs could provide more flexibility for strategic investment and expansion.

This latest wave of optimism comes on the heels of MasTec’s participation in two industry conferences, where leadership emphasized selective growth and value-driven opportunities. The stock has been quietly gathering momentum, rising 7% in the past month and gaining nearly 17% over the past three months. Over the past year, MasTec has delivered a total return of 67%, signaling that market enthusiasm is well above the broader sector average.

After such a run, the big question is whether MasTec’s share price reflects all the good news already or if this shift in the macro environment is setting the stage for another leg up.

Most Popular Narrative: 7.6% Undervalued

According to the most widely followed narrative, MasTec is currently considered undervalued by nearly 8% compared to its fair value, based on analyst consensus and future growth expectations. The narrative assesses future earnings, profit margins, and sector trends to determine a target price above the current market level.

Rapid acceleration in utility grid modernization, data center build-outs, and renewable energy investment is fueling double-digit revenue growth and record backlog in MasTec's Power Delivery and Clean Energy & Infrastructure divisions. The company's leading position and customer relationships indicate continued outsized top-line expansion over the next multi-year cycle.

Curious what could be fueling this rally? The most talked-about narrative is built on forecasts of massive growth ahead, including surging revenues, rising margins, and sector-defining infrastructure upgrades. But what are the crucial assumptions behind this bullish outlook, and just how bold are the analyst projections baked into that price target? The numbers might surprise you, so keep reading to discover the secret sauce behind this valuation call.

Result: Fair Value of $205.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, MasTec's rapid expansion and heavy client concentration mean that execution missteps or project delays could quickly sour the current bullish narrative.

Find out about the key risks to this MasTec narrative.Another View: High Market Price Signals Caution

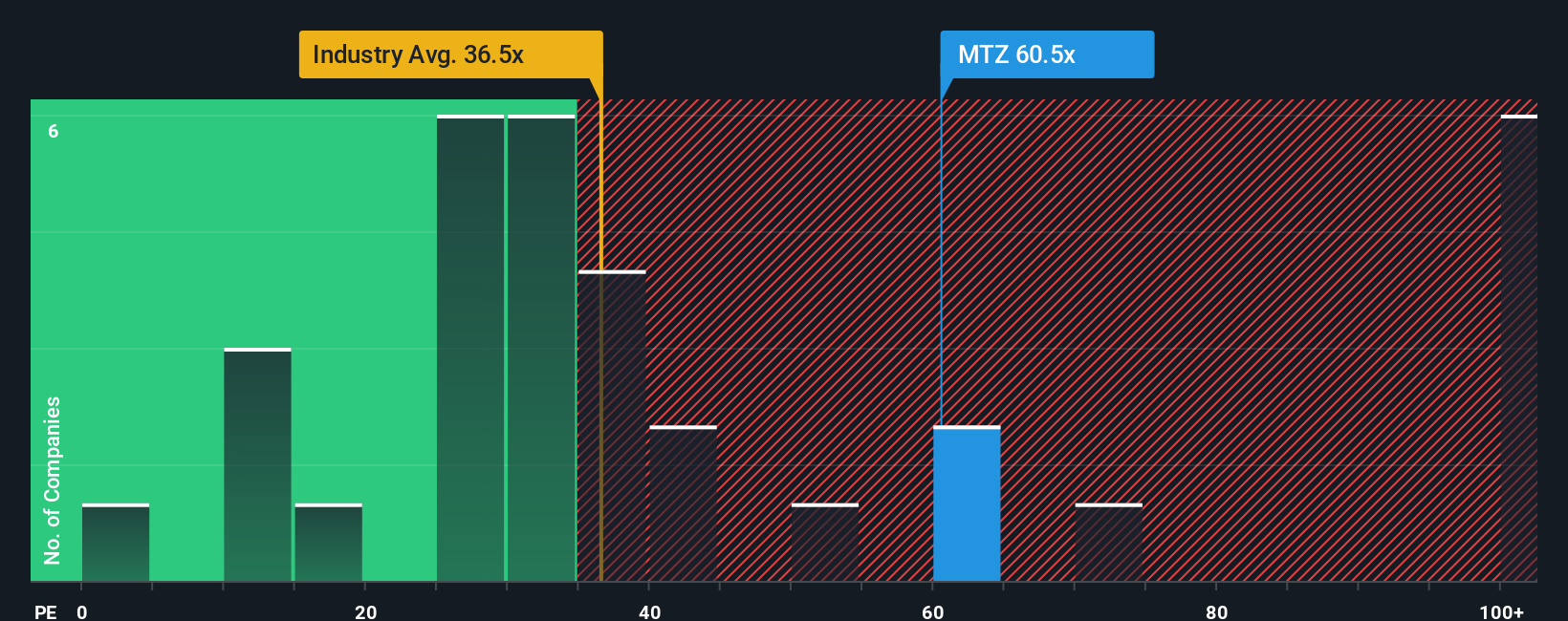

Taking a look through a different lens, the market price looks steep compared to industry norms based on the usual earnings yardstick. Could MasTec’s rapid momentum have pushed optimism too far, too fast?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MasTec Narrative

If you think the story could unfold differently or want to dig into the numbers yourself, you can easily shape your own view in just a few minutes. Do it your way.

A great starting point for your MasTec research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your portfolio to just one story? Spark your next smart play with some of the market’s most compelling opportunities. These unique themes can power up your investing approach.

- Target stable income streams and enhance your yield by checking out dividend stocks with yields > 3% offering payouts above 3%.

- Ride the future of artificial intelligence with AI penny stocks poised for growth in this revolutionary sector.

- Catch early-stage potential by scouting penny stocks with strong financials that combine innovation with sound financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives