- United States

- /

- Construction

- /

- NYSE:MTZ

MasTec (MTZ): Evaluating the Infrastructure Leader’s Valuation After a Strong Run

Reviewed by Simply Wall St

See our latest analysis for MasTec.

Momentum has been building for MasTec, with its share price climbing 18.2% over the last 90 days and surging more than 51% year-to-date. The three-year total shareholder return stands at an impressive 145%, reflecting sustained optimism around the company's infrastructure growth story despite occasional pullbacks.

If MasTec’s steady run has you thinking about what else is on the rise, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With MasTec’s shares not far from analyst price targets and strong fundamentals fueling its rally, the question is clear: does this infrastructure leader still offer room for upside, or is future growth already reflected in the price?

Most Popular Narrative: 14% Undervalued

The narrative consensus points to MasTec’s fair value at $246.67, well above its last close of $212.14. This sets investor expectations for future growth and profitability to potentially unlock further upside if the projections hold true.

Rapid acceleration in utility grid modernization, data center build-outs, and renewable energy investment is fueling double-digit revenue growth and record backlog in MasTec's Power Delivery and Clean Energy & Infrastructure divisions. The company's leading position and customer relationships indicate continued outsized top-line expansion over the next multi-year cycle.

What is driving this value? The narrative relies on ambitious growth from infrastructure modernization and aggressive profit expansion targets. Want to see which bold assumptions could spark a major re-rating? Click through to uncover the numbers behind this valuation.

Result: Fair Value of $246.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising execution risk and reliance on large project backlogs mean that unexpected delays or softer demand could quickly challenge MasTec's bullish growth outlook.

Find out about the key risks to this MasTec narrative.

Another View: Caution from Price Ratios

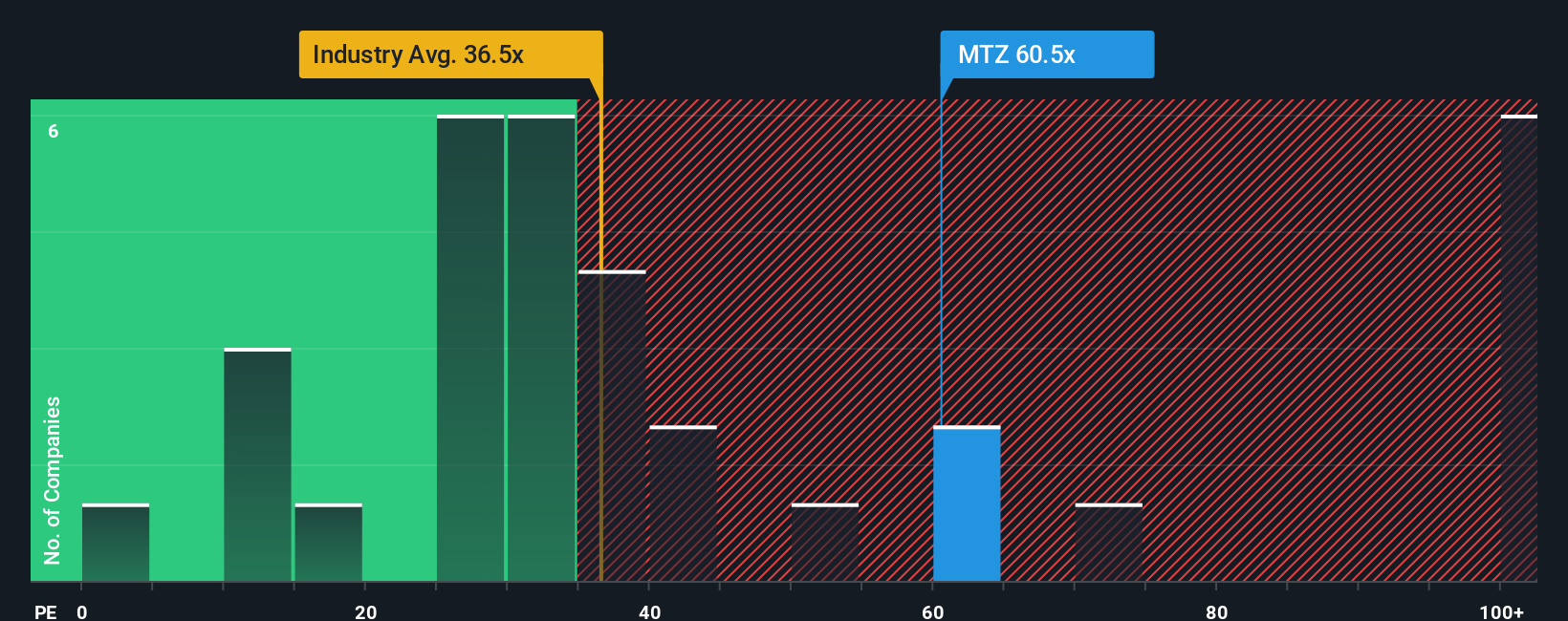

Looking at MasTec through price-to-earnings, investors may notice a red flag. The company's ratio sits at 49.8x, which is higher than both the US Construction industry average of 33x and the peer average of 47.5x. It is also above our fair ratio of 39.6x. This wide gap suggests the market is pricing in a lot of future growth and leaves little room for error if results disappoint. Is the optimism justified or will expectations run ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MasTec Narrative

If these perspectives do not fit your view, you can always dive into the numbers yourself and craft a personal take. Get started in just minutes with Do it your way.

A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Strengthen your portfolio and stay ahead by taking action now. The market is changing quickly, so consider your next move before potential opportunities are missed.

- Identify undervalued potential by screening these 923 undervalued stocks based on cash flows based on robust cash flow metrics to position yourself for future growth.

- Begin your search for high-yield opportunities with these 14 dividend stocks with yields > 3% offering income and consistent returns above 3%.

- Explore advancements in medicine by using these 30 healthcare AI stocks to discover leading innovators at the intersection of healthcare and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026