- United States

- /

- Construction

- /

- NYSE:MTZ

Analyst Upgrades and Record Backlog Might Change The Case For Investing In MasTec (MTZ)

Reviewed by Sasha Jovanovic

- In the past week, MasTec has received a series of analyst upgrades with several firms maintaining positive ratings and raising their expectations for the company's future performance, citing confidence in its growth outlook amid a record backlog across key infrastructure segments.

- This show of widespread analyst support highlights a collective belief that MasTec's investments and market positioning could accelerate its momentum in energy, communications, and renewables projects.

- We'll explore how the wave of analyst upgrades, driven by MasTec's record backlog, could influence the company's investment outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

MasTec Investment Narrative Recap

To be a shareholder in MasTec, you need confidence in the sustained demand for North American infrastructure, especially in clean energy, telecom, and power delivery projects. The recent surge of analyst upgrades underlines strong optimism for MasTec’s multi-year growth, but it does not materially change the primary short-term catalyst: effective backlog conversion amid record orders. The biggest immediate risk remains margin pressure from higher costs tied to aggressive workforce and equipment expansion if project execution falters or demand slows.

MasTec’s record $16.5 billion backlog, reported in Q2 2025, is the most relevant development to these upgrades. This milestone confirms robust growth across key segments like Communications and Clean Energy, giving management confidence to raise full-year revenue and earnings guidance. Record order books have solidified near-term growth drivers, even as competition and operational challenges persist.

However, despite management’s confidence, investors should watch for signs that higher fixed costs could weigh on long-term earnings if project timing or demand disappoints...

Read the full narrative on MasTec (it's free!)

MasTec's narrative projects $17.2 billion revenue and $730.8 million earnings by 2028. This requires 9.6% yearly revenue growth and an increase of $465.2 million in earnings from $265.6 million today.

Uncover how MasTec's forecasts yield a $221.58 fair value, a 3% upside to its current price.

Exploring Other Perspectives

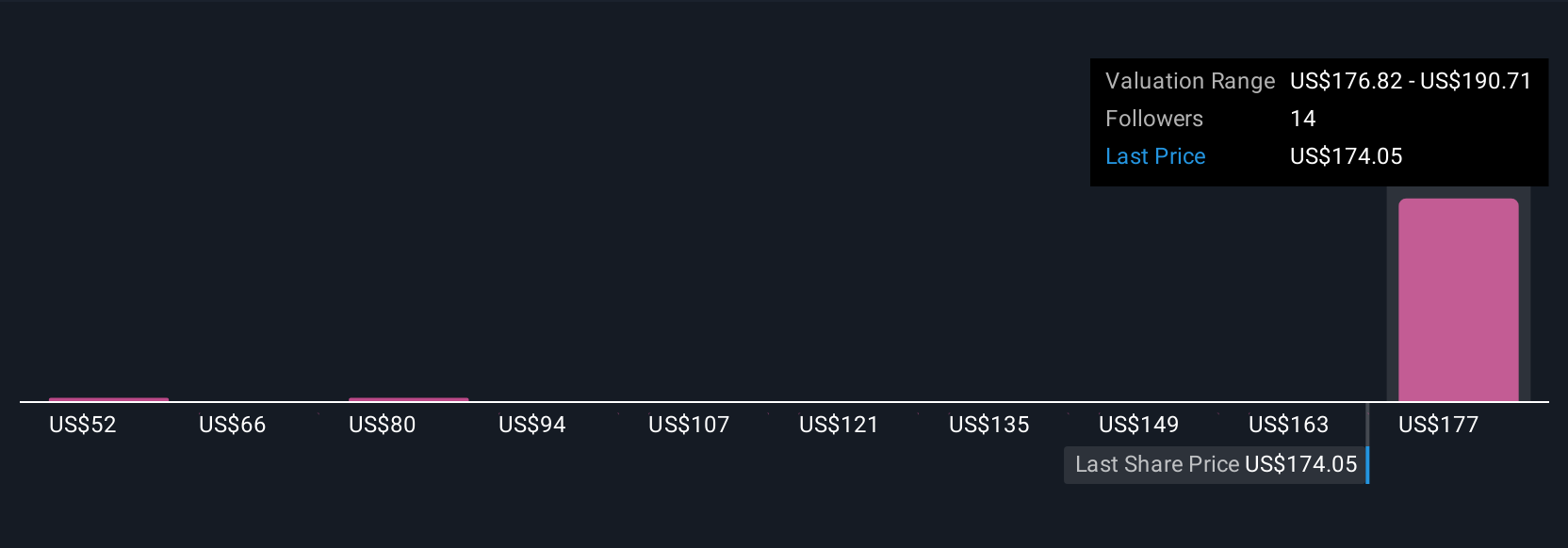

Four fair value estimates from the Simply Wall St Community range from US$51.88 to US$226.46 per share. While bullish momentum is evident among analysts, some participants remain focused on margin pressures that could affect future returns, highlighting the value of reviewing many viewpoints.

Explore 4 other fair value estimates on MasTec - why the stock might be worth as much as $226.46!

Build Your Own MasTec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MasTec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MasTec's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives