- United States

- /

- Trade Distributors

- /

- NYSE:MRC

These 4 Measures Indicate That MRC Global (NYSE:MRC) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that MRC Global Inc. (NYSE:MRC) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for MRC Global

What Is MRC Global's Debt?

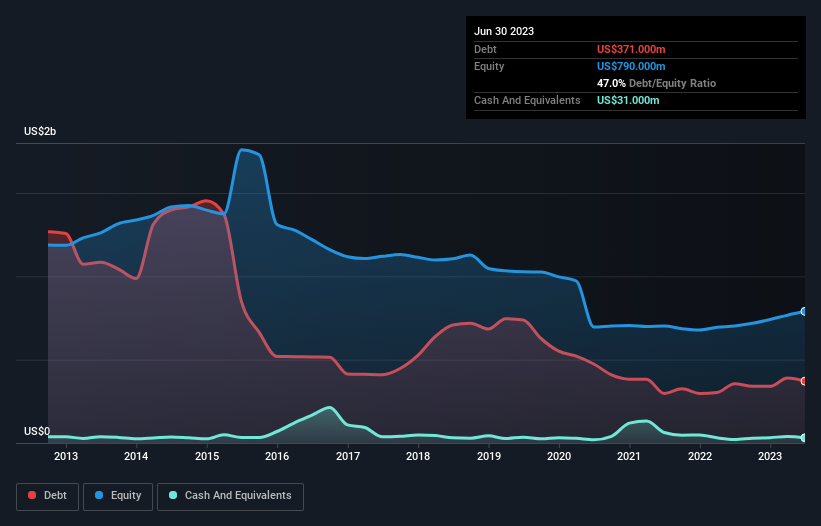

The image below, which you can click on for greater detail, shows that at June 2023 MRC Global had debt of US$371.0m, up from US$356.0m in one year. However, because it has a cash reserve of US$31.0m, its net debt is less, at about US$340.0m.

How Healthy Is MRC Global's Balance Sheet?

According to the last reported balance sheet, MRC Global had liabilities of US$585.0m due within 12 months, and liabilities of US$625.0m due beyond 12 months. Offsetting these obligations, it had cash of US$31.0m as well as receivables valued at US$519.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$660.0m.

This deficit is considerable relative to its market capitalization of US$783.8m, so it does suggest shareholders should keep an eye on MRC Global's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

MRC Global's net debt is sitting at a very reasonable 1.5 times its EBITDA, while its EBIT covered its interest expense just 6.1 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Even more impressive was the fact that MRC Global grew its EBIT by 235% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if MRC Global can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, MRC Global recorded free cash flow worth 64% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

When it comes to the balance sheet, the standout positive for MRC Global was the fact that it seems able to grow its EBIT confidently. But the other factors we noted above weren't so encouraging. For example, its level of total liabilities makes us a little nervous about its debt. When we consider all the elements mentioned above, it seems to us that MRC Global is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that MRC Global is showing 1 warning sign in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MRC

MRC Global

Through its subsidiaries, distributes pipes, valves, fittings, and other infrastructure products and services in the United States and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026