- United States

- /

- Trade Distributors

- /

- NYSE:MRC

Assessing MRC Global (MRC) Valuation: Is There Still Upside After Recent Gains?

Reviewed by Simply Wall St

MRC Global (MRC) has recently drawn attention as investors look for value plays in the industrial sector. The stock’s performance over the past year has shown a positive trend, and participants are closely watching for shifts in market sentiment.

See our latest analysis for MRC Global.

The momentum around MRC Global is building as the stock’s share price has climbed steadily so far in 2024, with a notable 10.3% year-to-date share price return. Over the past year, total shareholder return sits at an impressive 13.8%, suggesting that optimism about its growth potential is outweighing any near-term concerns.

If you’re interested in finding more companies with a similar growth story, broaden your search and discover fast growing stocks with high insider ownership

With the stock’s strong gains and a promising growth story, investors are left to consider whether MRC Global is truly undervalued at current levels or if the market has already factored in the expected upside.

Most Popular Narrative: 10.6% Undervalued

MRC Global’s most followed valuation perspective suggests the stock is currently trading below what growth and profitability trends indicate it could be worth. The last close was $14.00, compared to a fair value estimate of $15.67 using a 9.17% discount rate.

*The simplification of MRC Global's capital structure by repurchasing convertible preferred shares is expected to be accretive to both cash generation and earnings in 2025 and beyond. This should positively impact net margins and EPS. The sale of the Canada business and reinvestment of proceeds to reduce debt is anticipated to improve profitability and margins, enhancing the company's overall financial health and net earnings.*

Want to know the numbers that make this valuation stand out? This narrative is based on bold assumptions about future revenue, margin improvements, and a rerating in the company’s profit multiple. Curious how these factors combine to support a higher value? Explore the details to see which financial levers are driving these expectations.

Result: Fair Value of $15.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as persistent internal control weaknesses or a sustained downturn in sales could quickly undermine the optimistic outlook for MRC Global.

Find out about the key risks to this MRC Global narrative.

Another View: Is the Market Price Telling a Different Story?

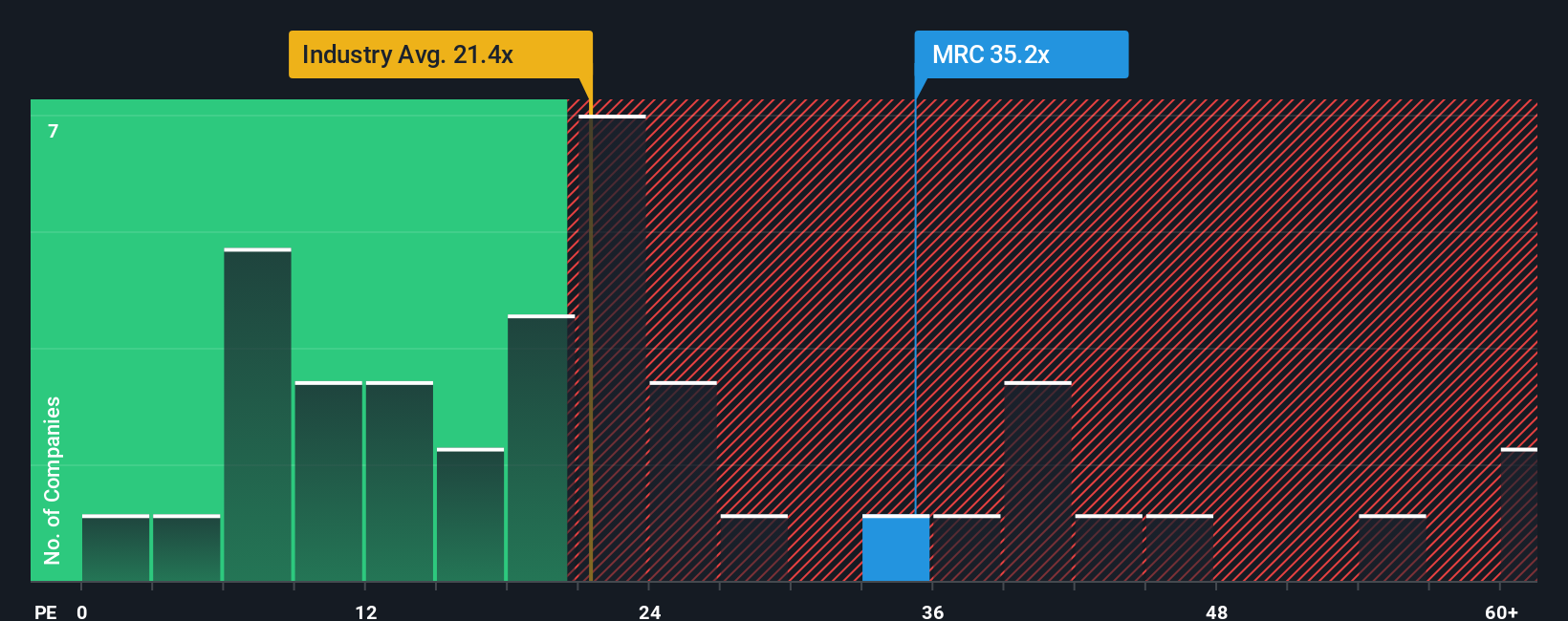

Looking through the lens of price-to-earnings, MRC Global currently trades at a ratio of 37.2x. This is much higher than both the US Trade Distributors industry average of 21.6x and the peer average of 28x. It is also above the fair ratio of 29.4x, suggesting the market has priced in a lot of good news already. Could this premium mean investors are overestimating future performance, or is something else at play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MRC Global Narrative

If you’d like to dig deeper or take a different approach, the data is all available for you to build your own perspective on MRC Global’s future in just a few minutes. Do it your way

A great starting point for your MRC Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next winning stock could be just a click away. Don’t let opportunity pass you by. The market’s smartest strategies are at your fingertips. Start building your advantage today by checking out these hand-picked investment avenues:

- Kickstart your search for reliable income by tapping into these 17 dividend stocks with yields > 3% offering attractive yields and steady performance beyond the typical market movers.

- Unleash growth potential by tapping into trends with these 26 AI penny stocks poised to transform entire industries using artificial intelligence innovations.

- Maximize value by acting on these 878 undervalued stocks based on cash flows where strong fundamentals could signal tomorrow’s top performers trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRC

MRC Global

Through its subsidiaries, distributes pipes, valves, fittings, and other infrastructure products and services in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives