- United States

- /

- Trade Distributors

- /

- NYSE:MRC

Assessing MRC Global (MRC) Valuation After Recent Share Price Decline and 2024 Performance

Reviewed by Kshitija Bhandaru

MRC Global (MRC) shares have dipped around 5% today, continuing a negative trend that has persisted over the past week. Despite the recent pullback, the stock is up slightly so far this year, keeping investors watchful.

See our latest analysis for MRC Global.

Zooming out, MRC Global's 1-day share price return of -5.23% and a 7-day loss of -11.38% reflect some recent volatility. However, the stock has still managed a 4.33% share price return year-to-date. While momentum has cooled in the last month, long-term holders are up significantly. A five-year total shareholder return of over 187% underscores the company’s ability to create value over time.

If you’re interested in what other stocks are gaining traction right now, it could be a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading about 18% below the average analyst price target and an even steeper discount to some valuation metrics, is MRC Global an undervalued opportunity? Or is the market accurately pricing in its prospects for growth?

Most Popular Narrative: 15.5% Undervalued

With MRC Global closing at $13.24 and the most widely followed narrative suggesting a fair value of $15.67, there is a notable gap between the current price and where consensus expects shares could go. This sets the stage for a valuation thesis tied closely to internal strategy and future sector growth bets.

*The simplification of MRC Global's capital structure by repurchasing convertible preferred shares is expected to be accretive to both cash generation and earnings in 2025 and beyond. This move could positively impact net margins and EPS. The sale of the Canada business and reinvestment of proceeds to reduce debt may improve profitability and margins, enhancing the company's overall financial health and net earnings.*

Earnings power, cash returns, and bold sector moves underpin this narrative’s valuation. Want to unravel which aggressive financial targets must be hit for this price? Open the full story to see what really drives these expectations.

Result: Fair Value of $15.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing internal control weaknesses and a recent decline in sales could challenge the upbeat forecasts and place pressure on the company’s future performance.

Find out about the key risks to this MRC Global narrative.

Another View: What Do Market Multiples Say?

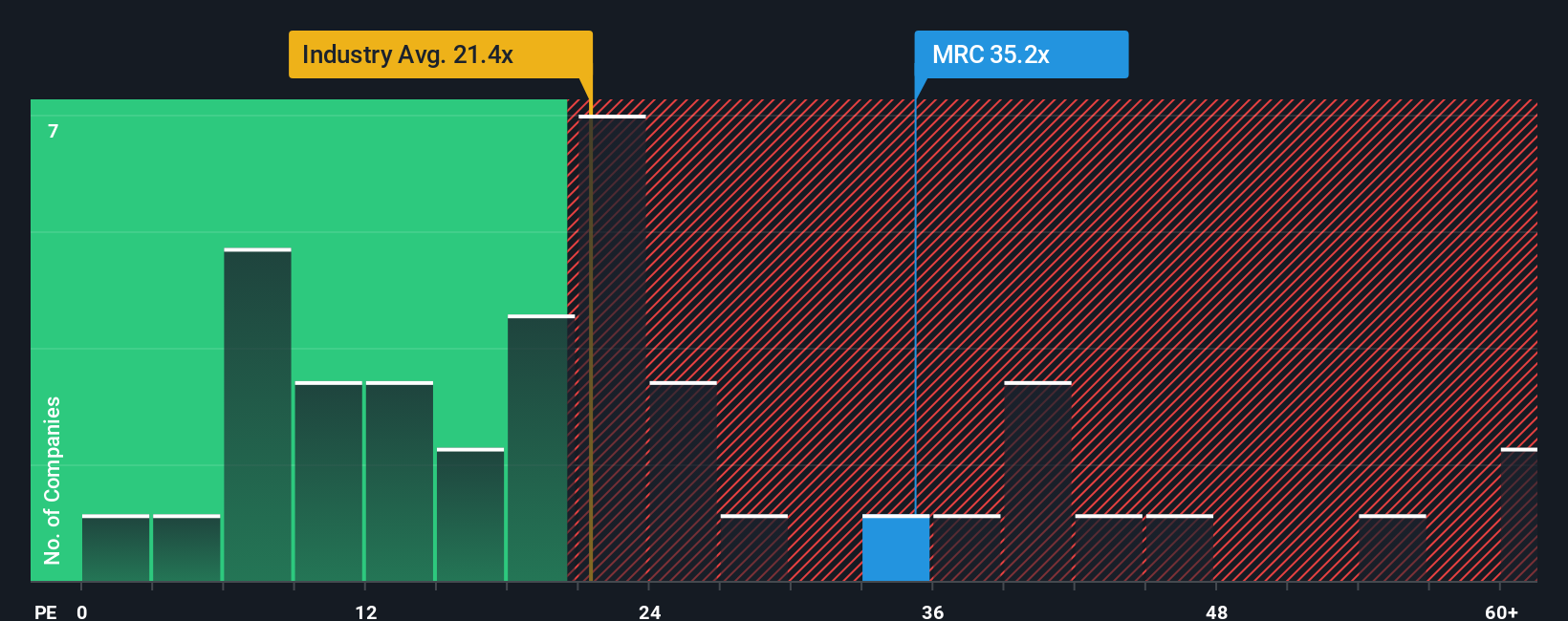

While some believe MRC Global is undervalued, market ratios tell a different story. The company's price-to-earnings ratio stands at 35.2 times, higher than both the industry average of 21.4 and its own fair ratio of 29.2. This suggests that based on earnings, shares may be priced more optimistically than peers. Does this raise red flags, or does the growth case justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MRC Global Narrative

If you see things differently or want to dig deeper into the data yourself, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your MRC Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open for the next winning opportunity. Don’t let great stocks pass you by. Expand your research with these powerful tools:

- Capture consistent cash flow potential by checking out these 19 dividend stocks with yields > 3% and see which companies deliver yields that stand out this year.

- Seize the edge in AI innovation by tapping into these 24 AI penny stocks, where artificial intelligence is reshaping entire industries.

- Position yourself ahead of the curve with these 892 undervalued stocks based on cash flows and uncover stocks the market may be overlooking right now based on core financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRC

MRC Global

Through its subsidiaries, distributes pipes, valves, fittings, and other infrastructure products and services in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives