- United States

- /

- Industrials

- /

- NYSE:MMM

3M (MMM) Margin Compression Reinforces Valuation Concerns Raised by Investors

Reviewed by Simply Wall St

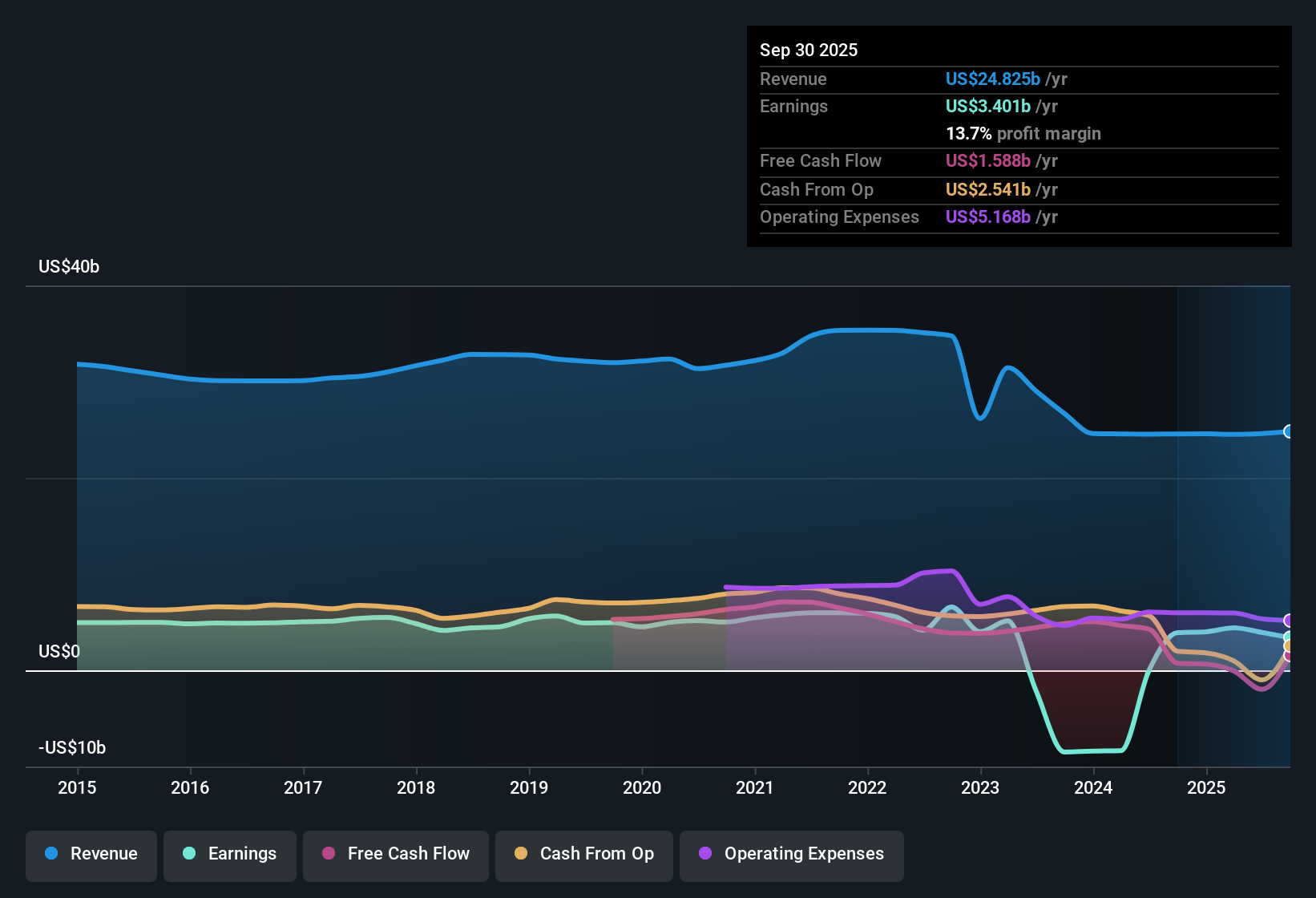

3M (MMM) reported a net profit margin of 13.7%, down from 15.9% a year ago, pointing to recent margin compression. Earnings have declined by an average of 23.1% per year over the past five years. Forecasts suggest 11.8% annual earnings growth going forward, which trails both the broader US market and sector revenue growth outlooks. With these numbers on the table, investors are weighing ongoing profit growth and perceived value against concerns such as financial health and dividend sustainability.

See our full analysis for 3M.Next up, we will compare these headline numbers with the most widely followed narratives from the Simply Wall St community. This will explore which investor expectations are reinforced and which are put to the test.

See what the community is saying about 3M

Innovation Pipeline Drives Optimism

- 3M plans to launch 215 new products this year, up 70% from last year. Five-year innovation sales are expected to exceed 15% annual growth, suggesting new products could become a key margin driver.

- Analysts' consensus view emphasizes strategic investment in R&D, especially in advanced materials and eco-friendly filtration, as catalysts for future growth, but

- While new launches and innovation investment are set to propel top-line gains, current annual revenue growth forecasts of 2.1% are still well behind the broader market estimate of 10.1%.

- Consensus expects innovation-driven gains to help expand profit margins from 16.0% to 18.1% in three years, underscoring faith in the company's ability to monetize new products despite recent margin pressure.

What’s reinforcing or challenging the analysts’ balanced view? Dive deeper into how the innovation push could reshape the long-term story. 📊 Read the full 3M Consensus Narrative.

Legal Liabilities Threaten Stability

- Over 30 state attorney general PFAS litigation cases remain unresolved, posing significant risk of large, unpredictable cash outflows that could pressure net margins for years to come.

- Bears highlight the ongoing legal overhang and exposure to regulatory risk, arguing these could weigh heavily on future earnings:

- Consensus notes that despite recent risk management successes, further settlements and compliance costs related to PFAS and environmental liabilities may undermine future profitability and slow progress in key growth areas.

- Prolonged or escalating cases could also spark extra costs or reputational issues not yet fully reflected in current forecasts.

Valuation Signals Mixed Messages

- Shares trade at a price-to-earnings ratio of 26.2x, a modest premium to peers (25.4x) and more than double the broader industrials sector (12.9x). Analyst price targets ($172.38) are only slightly above the $167.23 share price, pointing to limited near-term upside.

- According to the analysts' consensus, the fair value looks reasonable if you believe revenue will reach $26.1 billion and earnings $4.7 billion by 2028. However,

- Moderate future earnings growth (11.8% forecast annually) and ongoing margin compression may make the premium valuation hard to justify relative to faster-growing peers and broader sector benchmarks.

- A small gap between current price and target price suggests analysts see 3M as roughly fairly valued given today’s risk/reward profile.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for 3M on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your outlook and shape the story in just a few minutes. Do it your way

A great starting point for your 3M research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

3M’s premium valuation and slow earnings growth compared to sector leaders raise questions about its ability to keep pace with stronger performers.

If you want to focus on opportunities with more attractive pricing versus growth outlook, check out these 872 undervalued stocks based on cash flows that could outperform from here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMM

3M

Provides diversified technology services in the Americas, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives