- United States

- /

- Aerospace & Defense

- /

- NYSE:LOAR

Loar Holdings (LOAR): Valuation in Focus After Strong Q3 and Nine-Month Earnings Growth

Reviewed by Simply Wall St

Loar Holdings (LOAR) released its third quarter and nine-month earnings, revealing a clear jump in both sales and net income compared to a year ago. Investors are likely weighing what this means for the road ahead.

See our latest analysis for Loar Holdings.

After Loar Holdings' strong earnings results, the share price rallied 3.2% in the last day. However, investors are still contending with a year-to-date share price return of -8.8% and a total shareholder return over one year of -24.4%. While the recent earnings boost has sparked some positive momentum, the longer-term performance highlights that many are still cautious about the company's valuation and underlying risks.

If this kind of post-earnings turnaround interests you, why not expand your search and discover fast growing stocks with high insider ownership

With double-digit growth in both sales and net income, and the stock still trading well below analyst targets, is this the moment bargain hunters have been waiting for? Or is the market already anticipating future gains?

Most Popular Narrative: 29.3% Undervalued

The most widely followed valuation narrative places Loar Holdings' fair value notably above yesterday’s $67.45 close, setting up a debate on whether the market is missing future upside.

Ongoing productivity initiatives, adoption of advanced value-based pricing, and continuous improvement in manufacturing processes, including the integration of advanced digital technologies, are facilitating annual margin expansion. This trend should enhance both operating leverage and net margins as topline scales.

Want to know the secret sauce behind this bold valuation? Hint: The narrative is anchored by aggressive forecasts for profit margins and revenue growth not typically seen in this sector. Intrigued by the numbers that could justify such a premium? The full breakdown reveals the quantitative bets driving this call.

Result: Fair Value of $95.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integration risks from ongoing acquisitions or disruptions in major customer production could quickly undermine this optimistic outlook for Loar Holdings.

Find out about the key risks to this Loar Holdings narrative.

Another View: Multiples Raise Red Flags

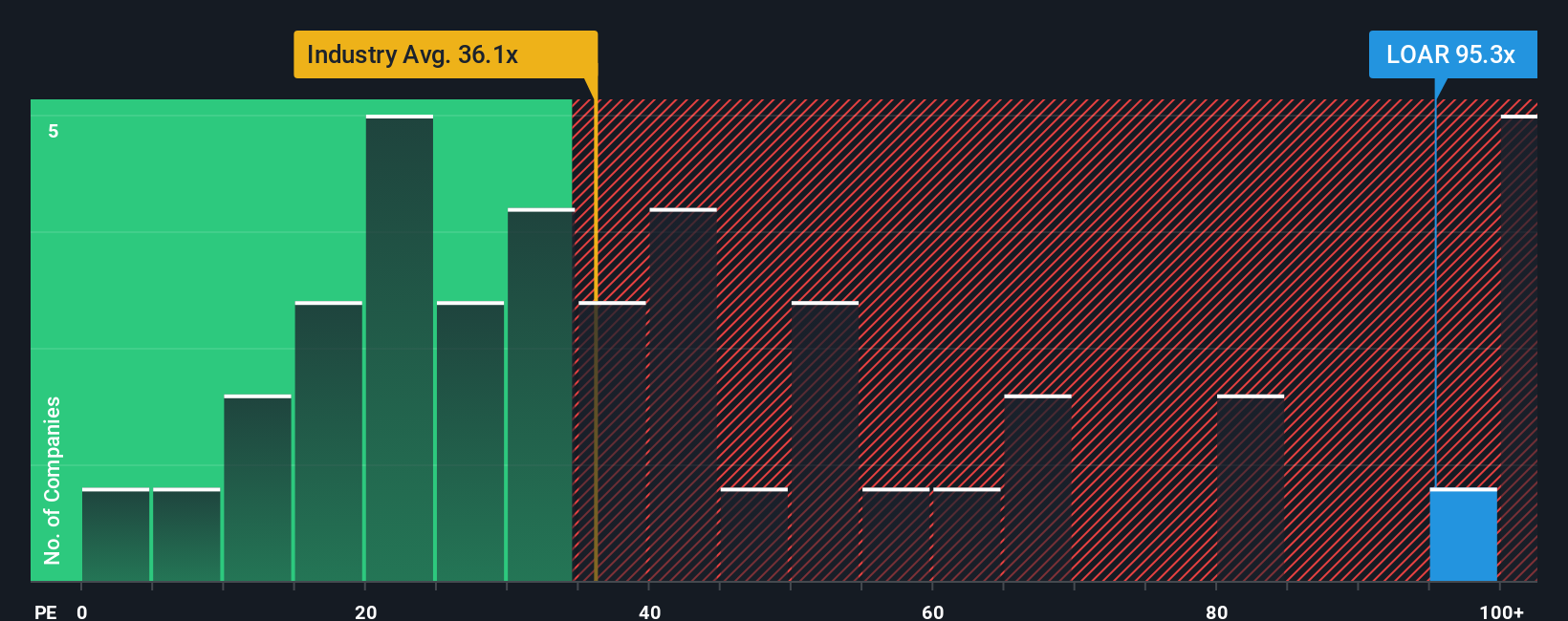

While the prevailing narrative calls Loar Holdings undervalued, a closer look at its price-to-earnings ratio paints a different picture. At 99.7 times earnings, the stock is far more expensive than both its peers (58.8x) and the Aerospace & Defense industry average (36.6x). Even compared to the fair ratio of 30.8x, Loar trades at a pronounced premium, which signals significant valuation risk if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Loar Holdings Narrative

If you see things differently, or want to analyze the story from your own angle, you can build a personal take in just a few minutes with Do it your way

A great starting point for your Loar Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for better investing outcomes by checking out uniquely promising companies before everyone else. The right insights might be just one click away.

- Maximize your returns by screening for reliable income with these 14 dividend stocks with yields > 3%, which offers yields above 3% and strong dividend histories.

- Tap into the momentum of technology with these 26 AI penny stocks, featuring innovative businesses at the forefront of artificial intelligence.

- Uncover real value plays by searching through these 930 undervalued stocks based on cash flows, identified by robust cash flows and attractive price points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOAR

Loar Holdings

Through its subsidiaries, designs, manufactures, and markets aerospace and defense components for aircraft, and aerospace and defense systems in the United States and internationally.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026