- United States

- /

- Machinery

- /

- NYSE:LNN

Does Lindsay’s (LNN) Tech Upgrade and CFO Transition Signal a New Phase in Strategic Leadership?

Reviewed by Simply Wall St

- Lindsay Corporation recently announced the launch of TowerWatch™, a premier tower alignment monitor available on new and existing Zimmatic™ pivots, alongside the upcoming retirement of longtime CFO Brian Ketcham at the end of 2025.

- This move highlights Lindsay’s dual focus on technological improvement in agricultural irrigation and proactive succession planning for executive leadership roles.

- We'll explore how the introduction of TowerWatch™ innovation may reinforce Lindsay's position in smart irrigation solutions and future growth prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Lindsay Investment Narrative Recap

To be a Lindsay shareholder, you must believe in the company’s ability to drive growth through smart irrigation solutions, international expansion, and innovative technology, while managing risks like volatile infrastructure project timing and North American market stagnation. The launch of TowerWatch™ reinforces Lindsay’s commitment to efficiency in agricultural irrigation, but in the short term, this product rollout does not substantially shift the biggest catalysts, such as the completion of large infrastructure projects, or address the primary risks, including exposure to tariff uncertainties and fluctuating steel prices.

Among the company’s recent events, the announcement of a quarterly dividend increase to US$0.37 per share highlights Lindsay’s continued focus on shareholder returns, even as the company invests in new agtech products. Dividend growth provides some stability for shareholders, particularly when the timing of international and infrastructure project revenues can be unpredictable.

However, while these financial actions may comfort some investors, the ongoing uncertainty tied to tariff-related input costs is something every shareholder should consider before making decisions...

Read the full narrative on Lindsay (it's free!)

Lindsay's outlook forecasts $751.5 million in revenue and $86.5 million in earnings by 2028. This is based on a projected 3.5% annual revenue growth rate and a $10.5 million increase in earnings from the current $76.0 million level.

Uncover how Lindsay's forecasts yield a $143.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

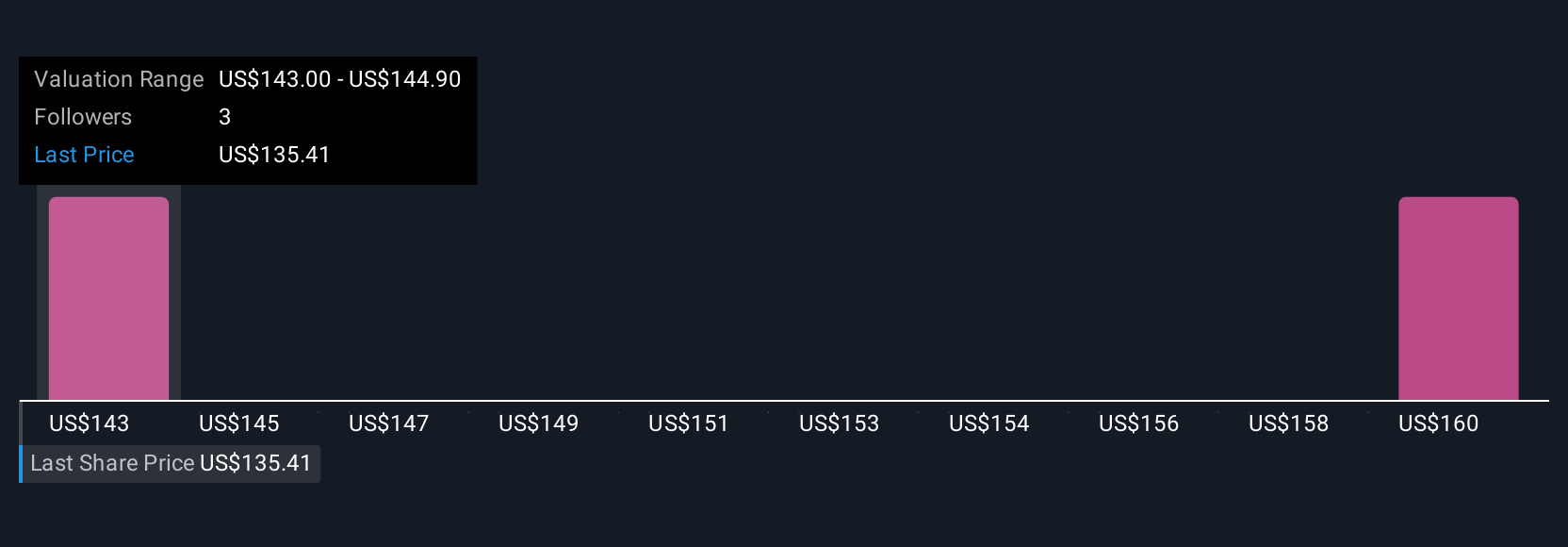

Simply Wall St Community members have set Lindsay’s fair value between US$143 and US$162, based on two individual projections. With tariff uncertainties persisting, a wide range remains for how future cost pressures could impact earnings and valuation, so explore several perspectives before taking action.

Explore 2 other fair value estimates on Lindsay - why the stock might be worth as much as 19% more than the current price!

Build Your Own Lindsay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lindsay research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Lindsay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lindsay's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNN

Lindsay

Provides water management and road infrastructure products and services in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives