- United States

- /

- Machinery

- /

- NYSE:LNN

Can Lindsay (LNN) Balance Diverging Regional Trends and Cautious Outlook in Fiscal 2025?

Reviewed by Sasha Jovanovic

- Lindsay Corporation recently reported mixed full-year results for fiscal 2025, with sales rising to US$676.37 million and net income reaching US$74.05 million, while the Board also declared a quarterly cash dividend of US$0.37 per share to be paid on November 28, 2025.

- The company highlighted contrasting regional trends, with strong international irrigation growth offset by ongoing North American weakness and ongoing uncertainty for domestic demand.

- We will explore how Lindsay's regional performance divergence and management's cautious outlook may influence its investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Lindsay Investment Narrative Recap

To be a shareholder in Lindsay Corporation, you need to believe in its ability to grow international irrigation and infrastructure sales while managing ongoing challenges in the North American market. The recent mix of improved earnings and steady dividends provides incremental support, but does not fundamentally change the short-term catalyst, which remains the recovery of domestic demand, or the ongoing risk from weak North American conditions.

The most relevant recent announcement is the Board’s decision to maintain its quarterly dividend at US$0.37 per share, signaling confidence in the company’s cash flow stability despite regional headwinds. While this move supports sentiment among income-focused investors, the company’s future trajectory still hinges on shifts in North American demand, which management notes are difficult to predict in the current environment.

In contrast to the international momentum Lindsay is seeing, investors should be aware of the ongoing uncertainty regarding the timing of large infrastructure projects…

Read the full narrative on Lindsay (it's free!)

Lindsay's outlook anticipates $751.5 million in revenue and $86.5 million in earnings by 2028. This reflects an annual revenue growth rate of 3.5% and a $10.5 million increase in earnings from the current $76.0 million.

Uncover how Lindsay's forecasts yield a $143.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

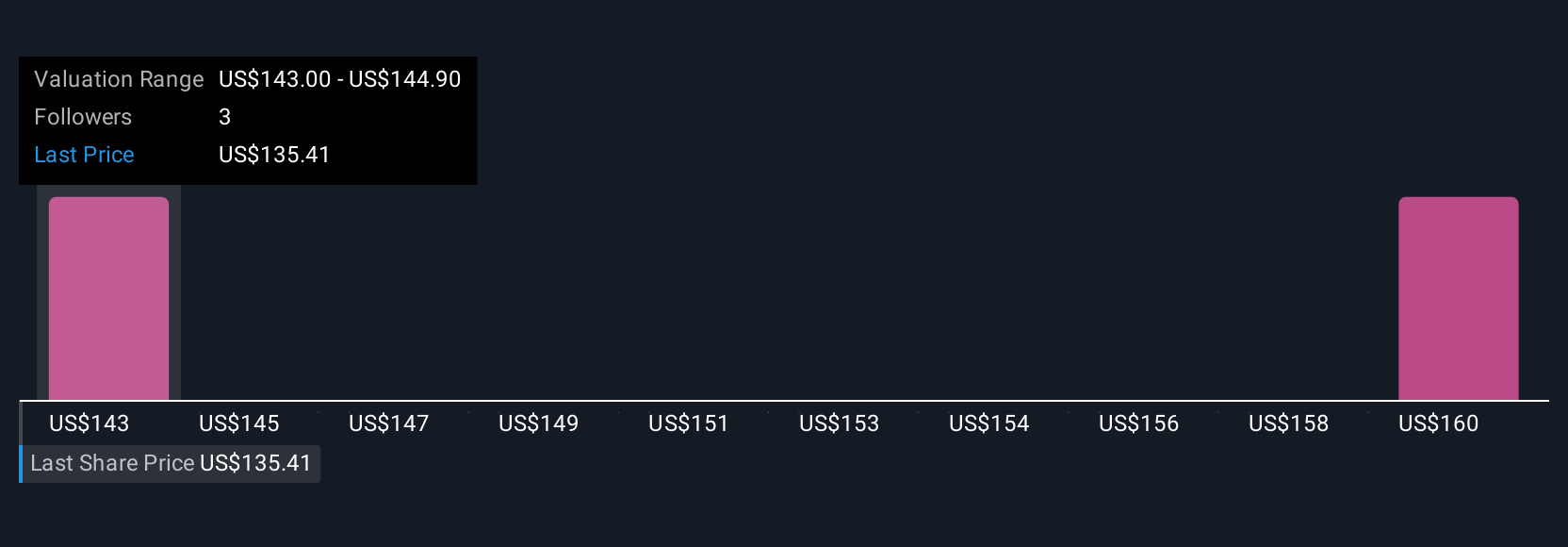

Retail investors within the Simply Wall St Community place Lindsay's fair value between US$143 and US$163.69, across 2 different outlooks. While this broad valuation band reflects differing opinions, ongoing volatility in North American demand remains a focal point for forward-looking performance, suggesting readers consider several perspectives before forming their view.

Explore 2 other fair value estimates on Lindsay - why the stock might be worth as much as 47% more than the current price!

Build Your Own Lindsay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lindsay research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lindsay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lindsay's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNN

Lindsay

Provides water management and road infrastructure products and services in the United States and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives