- United States

- /

- Machinery

- /

- NYSE:LNN

A Fresh Look at Lindsay (LNN) Valuation Following Recent Share Price Drop

Reviewed by Simply Wall St

See our latest analysis for Lindsay.

While Lindsay’s 1-day and 7-day share price returns show only mild movement, the real story is the sharp 18.1% drop in the past month. This has added to a year-to-date decline and brought the total shareholder return for the past year down to -9.7%. Although recent momentum is fading, these shifts may be reflecting changing expectations about growth or risk perceptions more than fundamental business changes.

If recent volatility has you considering new opportunities, this could be the perfect moment to broaden your sights and discover fast growing stocks with high insider ownership

With shares trading below both analyst price targets and some intrinsic value estimates, the question remains: is Lindsay’s recent slump an opportunity to buy at a discount, or is the market already factoring in future growth?

Most Popular Narrative: 13.3% Undervalued

Lindsay’s last closing price of $110.07 stands well below the narrative’s estimated fair value of $127 per share, hinting at a sizable gap. This sets up an intriguing context: with shares trading at a discount, what are the forces shaping that view?

Strategic supply chain initiatives and potential tariff-related pricing actions indicate an ability to manage cost pressures, helping to maintain or improve net margins despite global economic uncertainties.

Want to discover what’s really driving this premium in value? The math behind this forecast depends on bold upward revisions for both revenue and earnings. It assumes Lindsay will soon achieve the kind of profit margins and valuation multiples usually reserved for the top names in its industry. What assumptions set these projections apart from the market’s view? Read the full breakdown to see the specific targets behind this fair value call.

Result: Fair Value of $127 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising interest rates and slower domestic irrigation demand could limit Lindsay’s earnings growth if market conditions remain challenging in key segments.

Find out about the key risks to this Lindsay narrative.

Another View: What Do Valuation Ratios Reveal?

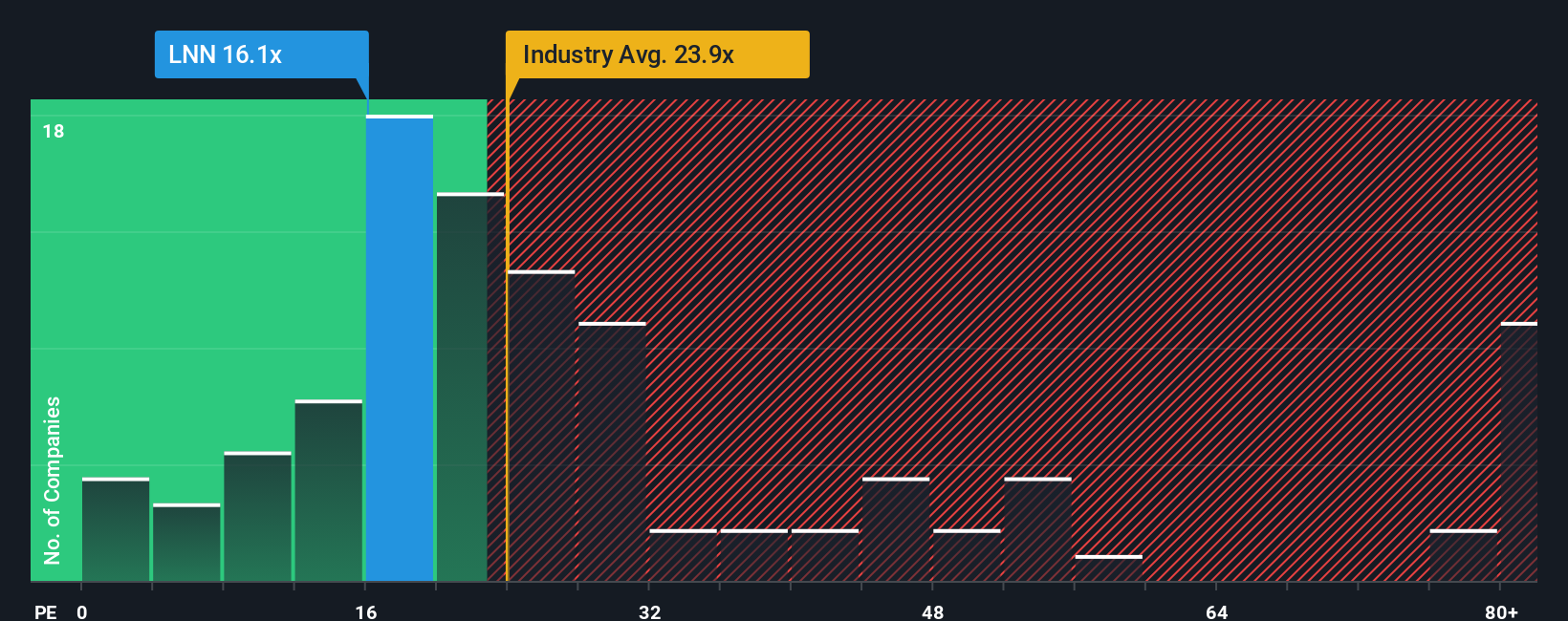

Lindsay’s current price-to-earnings ratio sits at 16.1x. That is below the peer average of 19.8x and well under the US Machinery industry average of 24.1x. However, it is just above the fair ratio of 15.8x, suggesting there may not be a major valuation advantage unless the market trend shifts further. Could this make Lindsay a value trap, or is the market being too cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lindsay Narrative

If you see the story differently, or want to dig deeper into the numbers, you can quickly develop your own Lindsay outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lindsay.

Looking for More Investment Ideas?

Smart investors never wait for opportunities to come to them. Widen your search now to uncover stocks with the potential to reset your portfolio’s growth trajectory.

- Boost your potential income by targeting stable companies offering attractive yields with these 16 dividend stocks with yields > 3%.

- Step into the fast lane of innovation and growth by checking out these 25 AI penny stocks, which are shaking up industries with AI-driven solutions.

- Seize the chance to spot overlooked gems that analysts think are priced below their true worth through these 879 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNN

Lindsay

Provides water management and road infrastructure products and services in the United States and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives