- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Is Lockheed Martin’s Valuation Attractive After Latest Defense Contract Wins?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Lockheed Martin is truly trading at a bargain or perhaps already priced for perfection, you are in the right place. Let us dig into what the numbers are really saying.

- Despite a 1.6% gain in the past week, Lockheed Martin's stock remains down 6.7% over the last month and is still off by 3.4% so far this year, hinting at shifting investor sentiment and possible opportunities.

- Recently, Lockheed Martin grabbed headlines with its new contract wins in defense technology and renewed international partnerships, fueling speculation that the company could be set for a turnaround after recent volatility. These strategic developments add important context to the ebbs and flows of its stock price in recent months.

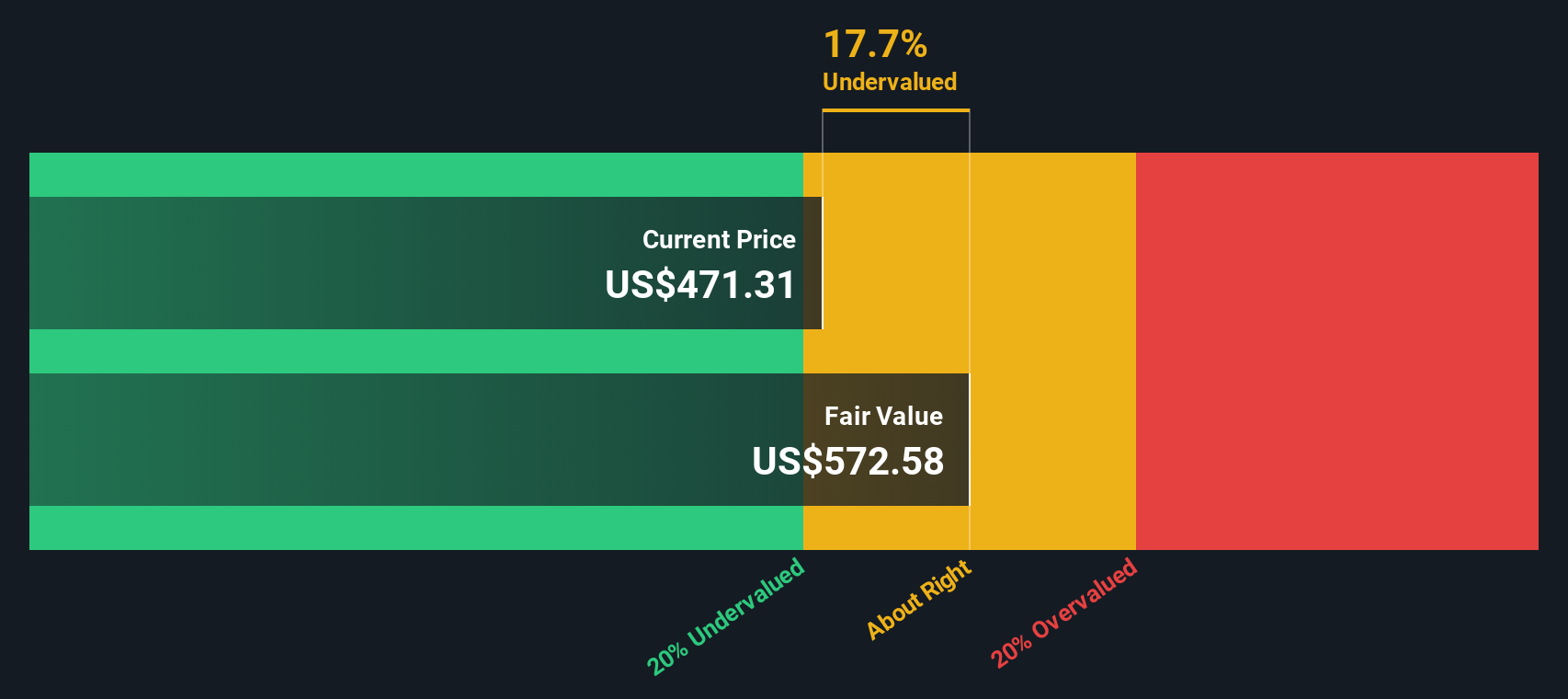

- On our valuation checks, Lockheed Martin scores a solid 5 out of 6, indicating it looks undervalued by many measures. We will walk through these methods next, and then share the smarter way savvy investors are sizing up shares today.

Find out why Lockheed Martin's -10.5% return over the last year is lagging behind its peers.

Approach 1: Lockheed Martin Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to their present value, reflecting today’s worth of expected future earnings. For Lockheed Martin, analysts estimate the company’s free cash flow currently stands at $4.5 Billion, with expectations of steady growth over the next decade.

Forecasts suggest that Lockheed Martin’s free cash flow could climb to $7.5 Billion by 2029. Although analyst projections extend for about five years, further cash flow growth is extrapolated using market-standard assumptions. This two-stage approach helps provide a comprehensive picture of potential long-term value.

Based on these projections and the current discount rate, the estimated intrinsic value of Lockheed Martin’s shares is $639.26. This is 27.1% higher than current market prices, indicating the stock is trading at a significant discount to its intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lockheed Martin is undervalued by 27.1%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Lockheed Martin Price vs Earnings

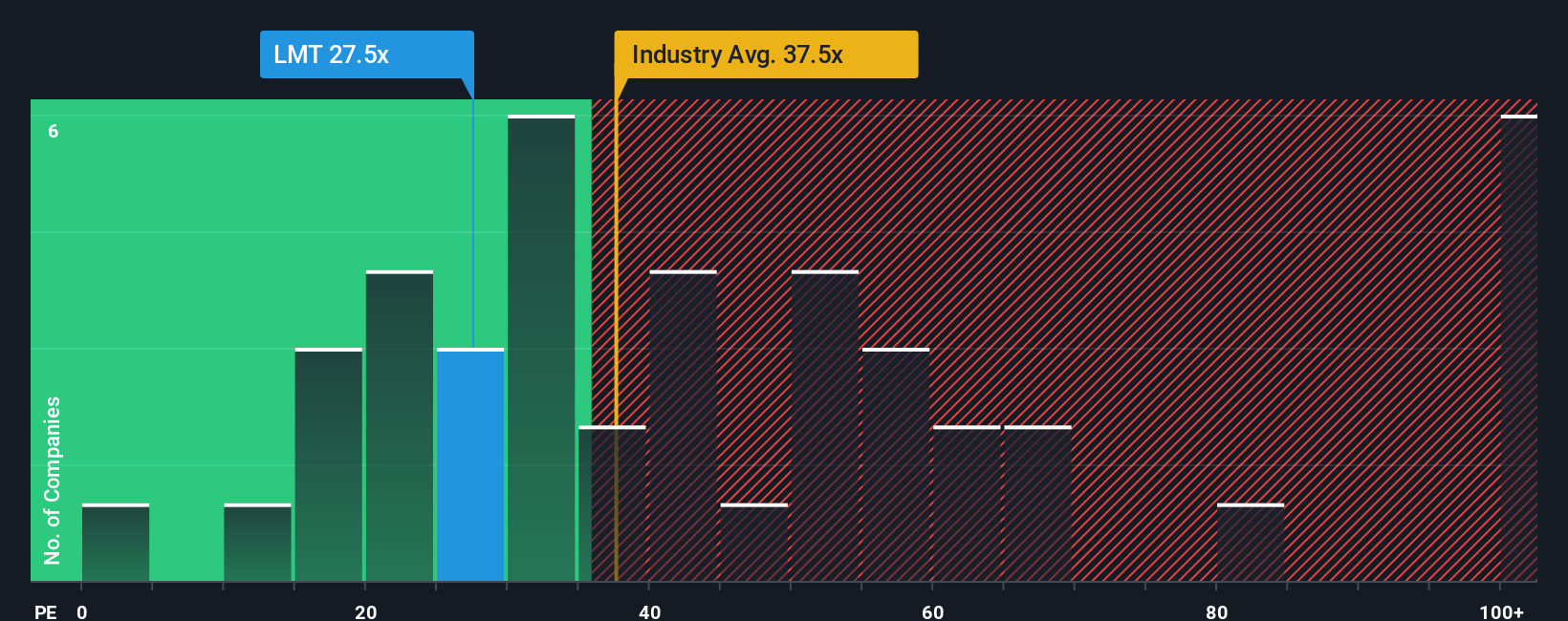

The Price-to-Earnings (PE) ratio is a widely respected valuation tool for profitable companies like Lockheed Martin, as it directly relates a company's share price to its earnings power. Investors often gravitate toward the PE ratio because it offers a quick, apples-to-apples way to compare how much they are paying for each dollar of earnings, a crucial consideration for established, profit-making businesses.

However, choosing what is “normal” or “fair” for a PE ratio is not one-size-fits-all. Growth outlook, company risk profile, and broader industry trends all play a big role. Higher growth rates or lower perceived risks typically justify higher PE ratios, while lower growth or added uncertainties tend to push the fair multiple down.

Currently, Lockheed Martin trades at a PE ratio of 25.7x. This sits well below the Aerospace & Defense industry average of 38.5x and also beneath the peer group average of 34.7x. But benchmarks like these only go so far. That is why Simply Wall St calculates a “Fair Ratio” in this case, 33.4x which weighs not just industry norms and peer comparisons, but also accounts for Lockheed Martin’s specific growth rates, profit margins, risk profile, and its market capitalization. This makes the Fair Ratio a more tailored and insightful gauge of where the stock’s valuation should actually sit.

When comparing Lockheed Martin’s current PE of 25.7x to its Fair Ratio of 33.4x, the shares appear to be meaningfully undervalued based on this comprehensive metric, suggesting there could be upside if the market moves to recognize the company's strengths.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lockheed Martin Narrative

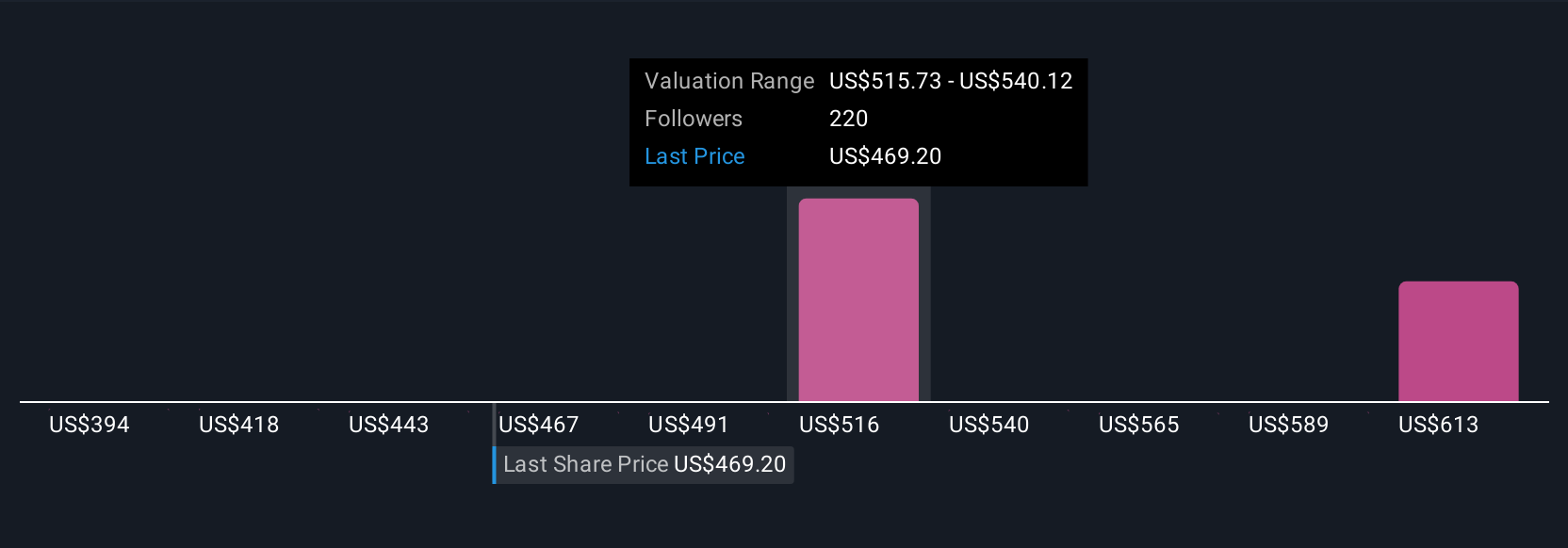

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story about a company, connecting the numbers with your unique perspective on Lockheed Martin’s future by making your own assumptions about its fair value, expected revenue, earnings, and profit margins.

Narratives are powerful because they bridge the gap between what a business does and what the numbers project, linking your understanding of Lockheed Martin’s story directly to a financial forecast and a calculated fair value. This tool is easy to use and accessible right on Simply Wall St’s Community page, where millions of investors share their Narratives.

By comparing the Fair Value you believe in with the current share price, a Narrative helps make smarter, more timely decisions about when to buy or sell. Narratives update automatically whenever new information arrives, such as news and earnings, so your view always stays relevant.

For example, some investors see the analyst consensus Narrative that Lockheed Martin should be worth around $476 per share if growth remains steady. Others, based on the most bullish or bearish estimates, believe Fair Value could be as high as $544 or as low as $398, depending on how confident they are in sustained order momentum, margin recovery, and future risks.

Do you think there's more to the story for Lockheed Martin? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives