- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Does Lockheed Martin’s Stock Price Reflect Its True Value After Recent Decline?

Reviewed by Bailey Pemberton

If you’re weighing what to do with your Lockheed Martin shares, you’re definitely not alone right now. The last several months have kept investors on their toes, with the stock price closing recently at $485.41. For a company that has delivered a solid 59.0% return over the past five years, the recent short-term moves might feel a little concerning. Lockheed is down 2.0% over the last week and has slipped 0.2% in the past month. Even the year-to-date performance is just barely positive, up 0.7%, while the one-year return stands at -11.2%. It’s a mixed picture, and it’s left investors asking whether the current price truly reflects Lockheed’s value or if there’s growth potential being overlooked.

Much of this uncertainty has cropped up alongside changing global defense priorities and ongoing geopolitical developments, which have put the spotlight back on companies like Lockheed Martin. As world events and government defense budgets shift, so does the market’s perception of risk and reward for major defense contractors.

To cut through the noise, I like to run Lockheed Martin through a set of six key valuation checks. Out of these, it’s currently undervalued in four, giving it a valuation score of 4. That’s a strong signal, but the real question is, what do these checks actually mean, and are they the best way to judge the company’s value? Let’s break down the different approaches to valuing Lockheed, and I’ll share an even more insightful way to tie it all together at the end.

Why Lockheed Martin is lagging behind its peers

Approach 1: Lockheed Martin Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors understand what the business could be worth, based on its ability to generate cash in the coming years.

For Lockheed Martin, the latest reported Free Cash Flow (FCF) stands at $4.5 Billion. Analyst forecasts indicate that FCF will continue to grow over the next several years, with projections reaching approximately $7.5 Billion by 2029. After this period, Simply Wall St extrapolates further increases, culminating in just over $9.3 Billion by 2035. It is important to note that analyst forecasts are only available for the next five years, so these later values rely on modeled estimates.

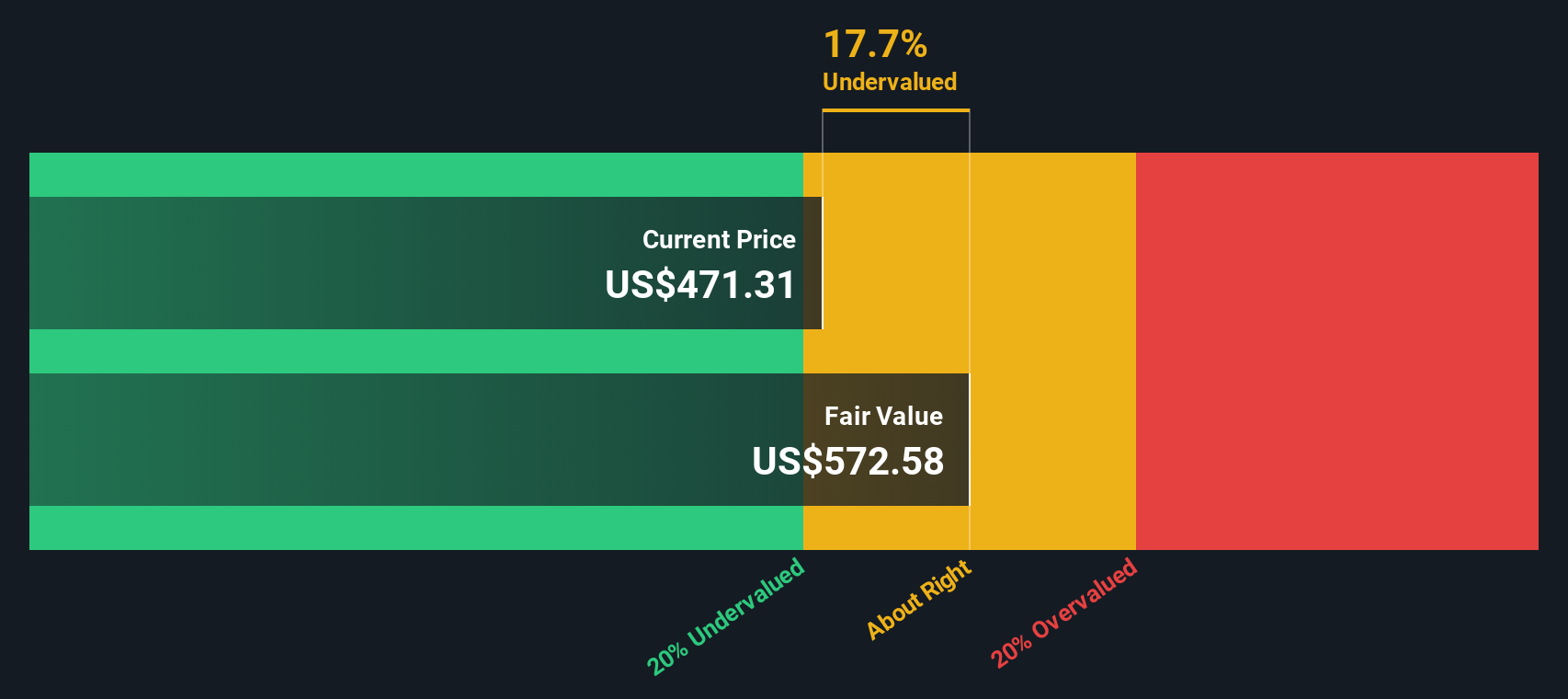

Based on these projections, the DCF model estimates Lockheed Martin’s intrinsic value at $597.96 per share. This is 18.8% higher than the recent share price of $485.41, signaling that the stock appears significantly undervalued according to the cash flow analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lockheed Martin is undervalued by 18.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Lockheed Martin Price vs Earnings (PE)

For profitable companies like Lockheed Martin, the Price-to-Earnings (PE) ratio is often a go-to valuation metric. The PE ratio shows how much investors are willing to pay for each dollar of the company’s earnings, making it especially relevant when steady profits are part of the story.

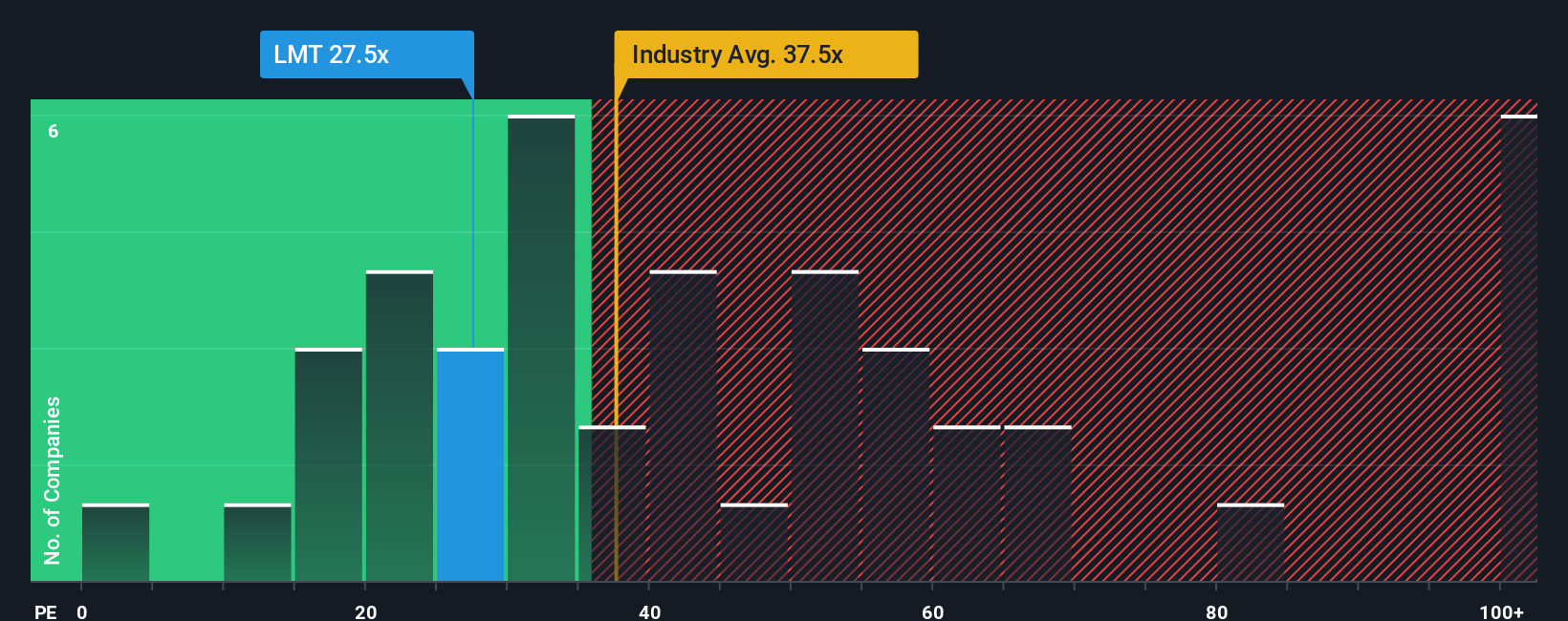

Determining what makes for a “normal” or “fair” PE ratio depends on factors like growth expectations and risk. High-growth companies and those with stronger balance sheets often trade at higher multiples, while greater risk can lower a ratio. With Lockheed Martin, the current PE ratio sits at 26.7x. For context, the average for its peers is 34.6x, while the broader Aerospace and Defense industry has a higher average of 40x.

Simply Wall St’s “Fair Ratio” goes a step beyond these benchmarks. It calculates the PE multiple you would expect for Lockheed Martin given its growth outlook, profit margins, industry dynamics, market cap, and company-specific risks. This means the Fair Ratio, currently 32.9x, is tailored to Lockheed’s unique profile rather than relying solely on broad comparisons.

Looking at the numbers, Lockheed’s current PE ratio of 26.7x is below both the peer average and its Fair Ratio. This suggests that the market may be undervaluing the company based on its earnings power, adjusted for its strengths and risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lockheed Martin Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simply the stories or perspectives that investors have about a company, combining their expectations around its future revenues, margins, risks, and opportunities into a single, concrete vision. With Narratives, you link Lockheed Martin’s business story and news flow to your own financial forecast, translating it into a personal fair value.

Used by millions on Simply Wall St’s Community page, Narratives make valuation more accessible and actionable than ever. They allow you to set your own assumptions, compare your estimated fair value to the current price, and quickly decide if Lockheed Martin is a buy, hold, or sell. Every Narrative is dynamic and updates automatically as new earnings, news, or forecasts come in, so you’re always acting with the latest information.

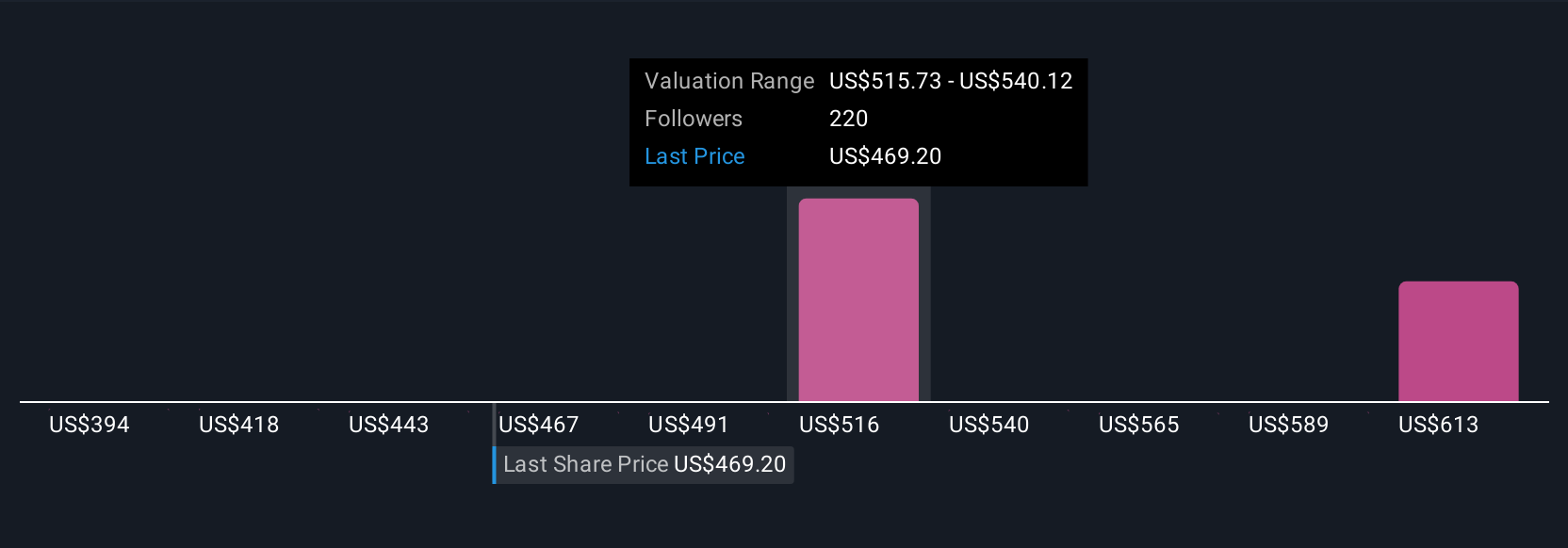

For example, some investors see order growth and technological leadership as positioning Lockheed for strong long-term gains, resulting in bullish fair values as high as $544 per share. Others focus on legacy program risks and uncertainty in defense budgets, setting more cautious targets of $398. Narratives put you in control, helping you visualize how your unique view stacks up so you can upgrade your decision making with confidence.

Do you think there's more to the story for Lockheed Martin? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives