- United States

- /

- Building

- /

- NYSE:LII

Lennox International (LII): Evaluating Valuation After Revenue Decline and Lowered Guidance in Challenging HVAC Market

Reviewed by Simply Wall St

Lennox International (NYSE:LII) caught investor attention this week after reporting a drop in third quarter revenue, citing continued weakness in both residential and commercial HVAC markets. Management highlighted larger inventory reductions and persistent demand challenges.

See our latest analysis for Lennox International.

After hinting at a choppier road ahead with its downward revision to annual revenue guidance, Lennox International's share price momentum has clearly faded, down almost 20% year-to-date and 6% over the past month as investors weigh weak near-term industry demand and an extended inventory correction cycle. Despite this, Lennox’s long-term total shareholder returns still stack up impressively, with a 118% gain over three years, a testament to resilient margins and disciplined capital allocation even as short-term sentiment remains cautious.

If you’re scanning the market for areas with strong long-term potential and want to look beyond short-term market jitters, it could be the perfect time to discover fast growing stocks with high insider ownership

With the stock now trading well below recent highs and analysts split on its outlook, is the market too pessimistic about Lennox’s prospects, or is future growth uncertainty already reflected in the price?

Most Popular Narrative: 15% Undervalued

Lennox International’s most followed narrative puts fair value at $575, a solid step up from the latest close of $488. That premium reflects aggressive expectations about shifts unfolding inside the business and broader HVAC sector.

Strategic partnerships with Samsung (mini splits/VRF with smart tech integration) and Ariston (heat pump water heaters) will expand Lennox's advanced, energy-efficient product offerings. This will enhance its access to segments benefiting from regulatory and consumer demand for sustainability, with significant revenue growth expected from 2026 and 2027 onward.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is future-shaping product launches and margin expansion moves that could rewire the company's earnings potential. What bold financial targets are fueling that fair value upgrade? Dive in to uncover the specific projections driving this outlier price tag.

Result: Fair Value of $575 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain uncertainties and persistent softness in residential construction could test Lennox's ability to deliver on these optimistic growth projections.

Find out about the key risks to this Lennox International narrative.

Another View: Discounted Cash Flow Model Offers Caution

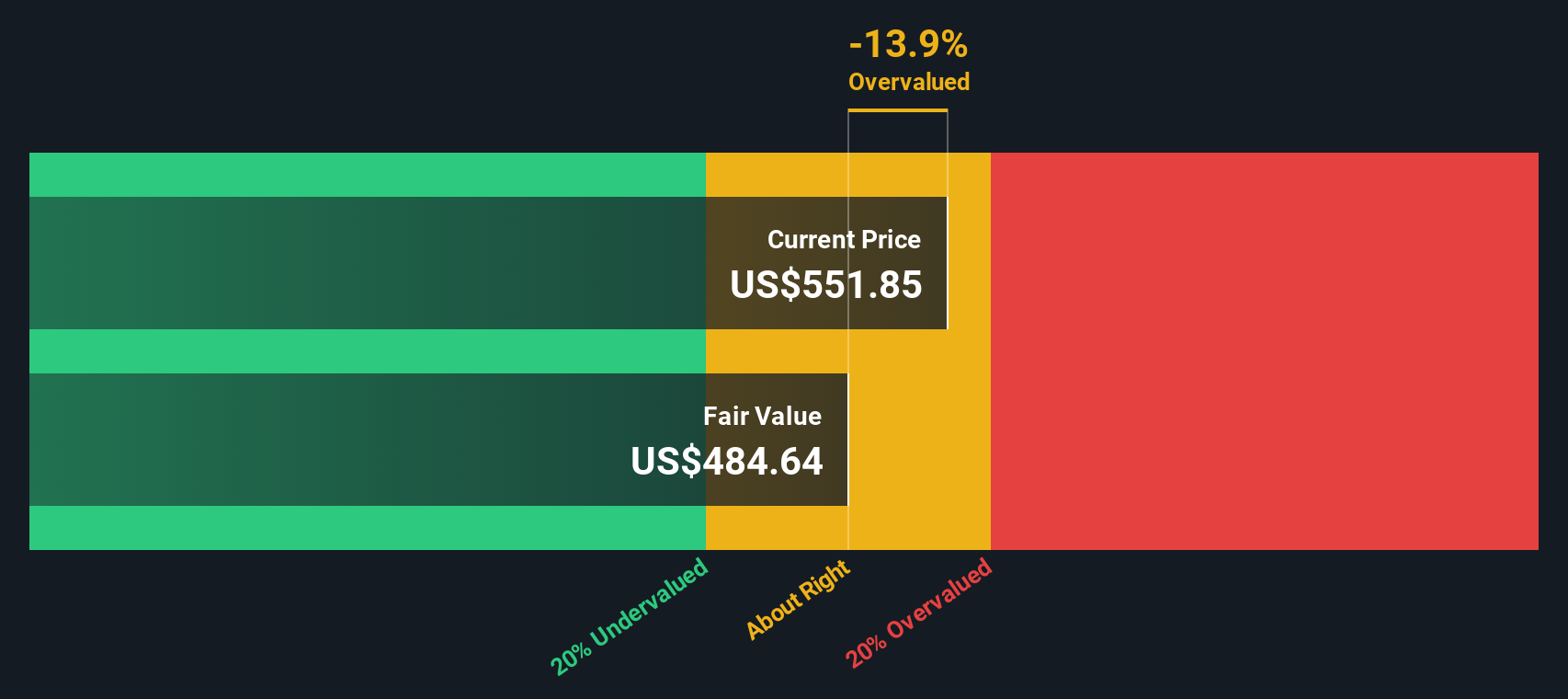

While analysts see Lennox International as undervalued using forward earnings estimates, the SWS DCF model reaches a different conclusion. Based on cash flow projections, Lennox trades above its fair value of $439.82. This suggests some optimism may already be priced in. Could this foreshadow near-term volatility ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lennox International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lennox International Narrative

If you prefer your own analysis over consensus or want to test a different set of assumptions, crafting your own Lennox outlook is quick and simple. Do it your way

A great starting point for your Lennox International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your strategy to just one company. Put yourself ahead of the market by exploring new trends and sectors driving tomorrow’s winners. Get inspired by these handpicked investment angles:

- Boost your income strategy and cut through low yield noise by tapping into these 21 dividend stocks with yields > 3% with attractive yields above 3%.

- Supercharge your portfolio’s exposure to tech by jumping on these 26 AI penny stocks at the forefront of artificial intelligence transformation.

- Seize the upside in rapidly evolving industries with these 28 quantum computing stocks powering breakthroughs in computing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LII

Lennox International

Designs, manufactures, and markets products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives