- United States

- /

- Building

- /

- NYSE:LII

How Lennox International's Lowered Outlook and Legal Probe Could Shift Margin Expectations for LII Investors

Reviewed by Sasha Jovanovic

- In recent weeks, Lennox International experienced sustained declines after posting mixed third-quarter results and lowering its full-year outlook, attributing challenges to softening HVAC demand, regulatory obstacles, and news of a legal investigation.

- Amid these pressures, the company’s Feel The Love initiative in October provided over 400 donated HVAC units to nonprofits and homeowners in need, underscoring ongoing community engagement despite market headwinds.

- We’ll explore how the revised outlook and legal investigation may affect Lennox’s investment narrative, particularly regarding future margin assumptions.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Lennox International Investment Narrative Recap

Owning Lennox International today hinges on confidence in the company’s ability to sustain margin growth and capitalize on HVAC replacement demand, even as the business faces near-term pressure from softer end markets and regulatory disruptions. The recent legal investigation and downward revision of the 2025 outlook call into question the short-term reliability of margin assumptions, adding weight to the risk that weaker replacement volumes or elevated costs could pressure financial results more than previously expected.

Among recent announcements, the third-quarter results stand out: while net income and diluted EPS rose year over year, revenue slipped and guidance for full-year revenue was revised downward by 1%, reflecting direct impact from industry headwinds. This backdrop puts renewed focus on Lennox’s margin strategy, as near-term uncertainty around HVAC demand and regulatory compliance is likely to be a central catalyst, or headwind, for both earnings growth and investor sentiment.

But while some investors may be focused on earnings trends, there are further details around the legal investigation that every stakeholder should keep in mind...

Read the full narrative on Lennox International (it's free!)

Lennox International is projected to reach $6.2 billion in revenue and $1.1 billion in earnings by 2028. Achieving this outlook requires a 4.7% annual revenue growth rate and an earnings increase of $265 million from the current $834.6 million.

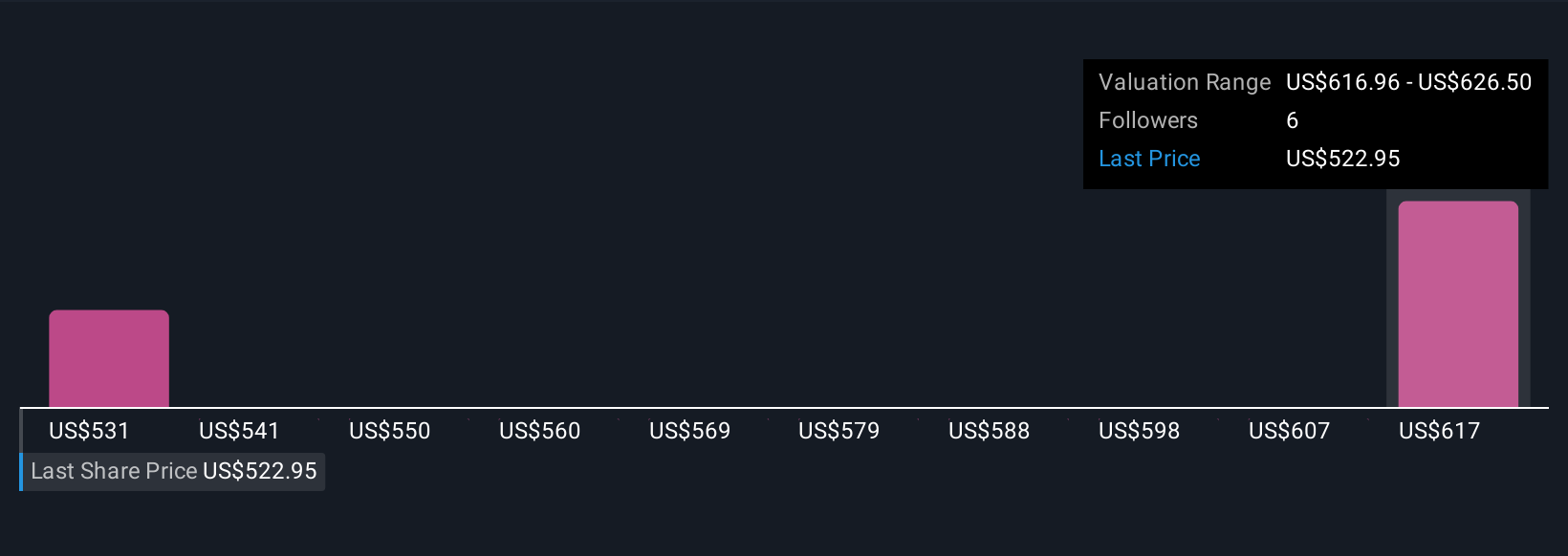

Uncover how Lennox International's forecasts yield a $572.12 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Two unique fair value estimates from the Simply Wall St Community range from US$449 to US$572 per share. While many expect regulatory changes to support replacement demand, uncertainty around market softness remains a key factor shaping Lennox’s performance outlook.

Explore 2 other fair value estimates on Lennox International - why the stock might be worth just $449.15!

Build Your Own Lennox International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennox International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lennox International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennox International's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LII

Lennox International

Designs, manufactures, and markets products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives