- United States

- /

- Building

- /

- NYSE:LII

How Investors Are Reacting To Lennox International (LII) Lowering 2025 Revenue Guidance Amid Inventory Pressures

Reviewed by Sasha Jovanovic

- Lennox International recently reported mixed third-quarter results, with earnings surpassing expectations but revenues falling short, prompting management to revise annual revenue guidance to a 1% decrease for 2025.

- Despite revenue headwinds, the company emphasized ongoing inventory challenges and highlighted continued efforts to enhance distribution and pursue bolt-on acquisitions amid a changing regulatory and demand landscape.

- We'll examine how Lennox's revenue shortfall and lowered outlook may affect its future investment narrative and analyst expectations.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Lennox International Investment Narrative Recap

To invest in Lennox International today, you need to believe in the company’s long-term ability to manage distribution, product innovation, and customer demand despite near-term revenue headwinds. The recent guidance cut, calling for a 1% revenue decline in 2025, has magnified focus on the risk that persistent softness in residential markets and slower new construction could pressure top-line results in the coming quarters; while impactful, this doesn’t fundamentally alter the story for long-term shareholders, but it keeps near-term sentiment cautious.

Among the latest announcements, Lennox’s search for bolt-on acquisitions stands out, as it targets opportunities to strengthen its distribution and product portfolio. This effort could support future catalysts, especially as the company contends with ongoing inventory and demand challenges that are central to its current short-term outlook.

In contrast, investors should be aware of how elevated inventories and uncertain demand trends could increase the risk of inventory markdowns if volumes weaken further...

Read the full narrative on Lennox International (it's free!)

Lennox International is projected to reach $6.2 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.7% and a $265 million increase in earnings from the current $834.6 million.

Uncover how Lennox International's forecasts yield a $575.25 fair value, a 16% upside to its current price.

Exploring Other Perspectives

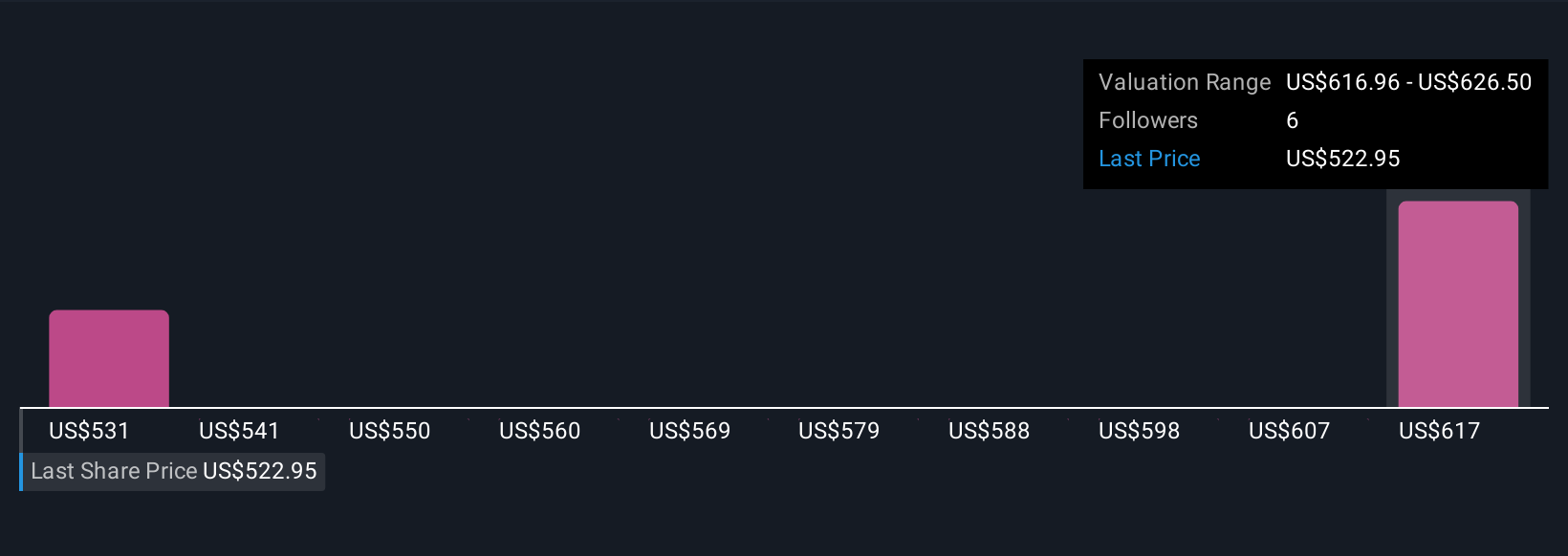

Community fair value estimates for Lennox International range from US$439.82 to US$575.25, based on two independent Simply Wall St Community perspectives. While inventory and demand risks heighten near-term uncertainty, your view on the company’s ability to manage these pressures could shape whether you see value at current levels.

Explore 2 other fair value estimates on Lennox International - why the stock might be worth as much as 16% more than the current price!

Build Your Own Lennox International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennox International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lennox International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennox International's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LII

Lennox International

Designs, manufactures, and markets products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives