- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

What Recent Contract Wins Could Mean for L3Harris Technologies Stock Value in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with your L3Harris Technologies stock? You are not alone. The defense and aerospace sector has been dynamic lately, and L3Harris is right in the thick of it. After a remarkable 40.4% rise year-to-date, it is easy to wonder whether the momentum can continue or if things are about to hit a plateau. A quick glance at the numbers shows the stock edged up 0.2% this past week, while the past month was slightly in the red at -0.8%. Longer-term investors, though, have seen impressive gains, up nearly 20% in the last year and an eye-catching 89.2% over five years.

The past year’s strong performance has been driven in part by L3Harris’ recent strategic partnerships and contract wins in areas like advanced communications and missile defense, both hot topics in the sector right now. These developments have contributed to shifting investor sentiment, hinting at growth potential while also shaping the current risk profile.

With share prices doing so much, the big question now is whether the current price still represents value. On a standard six-point valuation scorecard, L3Harris earns a 3, meaning it looks undervalued in half of the basic tests analysts use. But as you will see, not all valuation approaches tell the whole story on their own. Let us break down how the main valuation strategies stack up, and then we will explore an even more insightful way to assess value near the end.

Why L3Harris Technologies is lagging behind its peers

Approach 1: L3Harris Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to their value today. For L3Harris Technologies, this approach starts with the company’s most recent Free Cash Flow, which stood at $2.1 Billion over the last twelve months. Analyst estimates see this growing steadily, with projected Free Cash Flow reaching $3.5 Billion by year-end 2029. Simply Wall St extends the outlook another five years, with FCF forecast to top $4.1 Billion in 2035. This highlights expectations for strong, continuing growth.

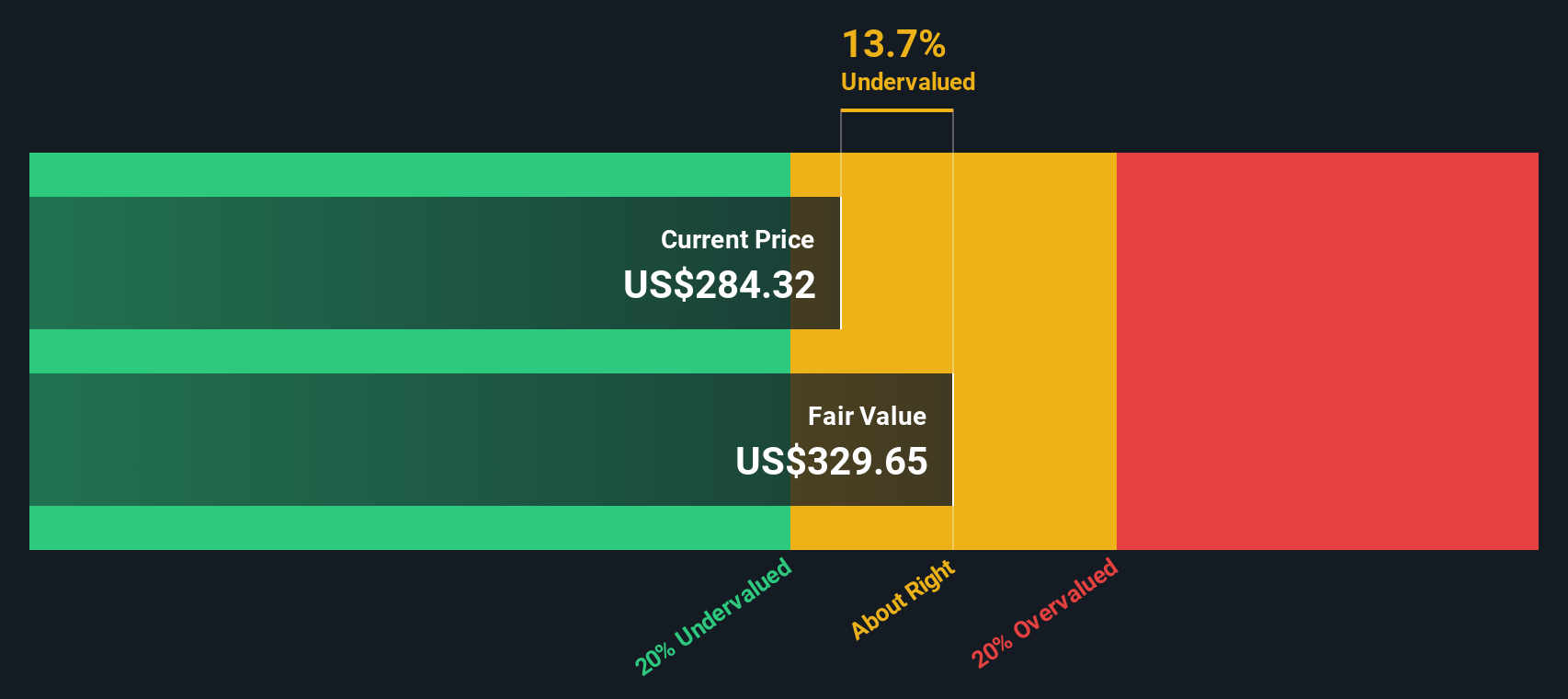

When these future cash flows are totaled and discounted back to present value, the intrinsic value per share comes out to $328.71. With L3Harris currently trading at an 11.4% discount to that intrinsic estimate, the DCF suggests the stock is undervalued relative to its underlying business prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests L3Harris Technologies is undervalued by 11.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: L3Harris Technologies Price vs Earnings (PE)

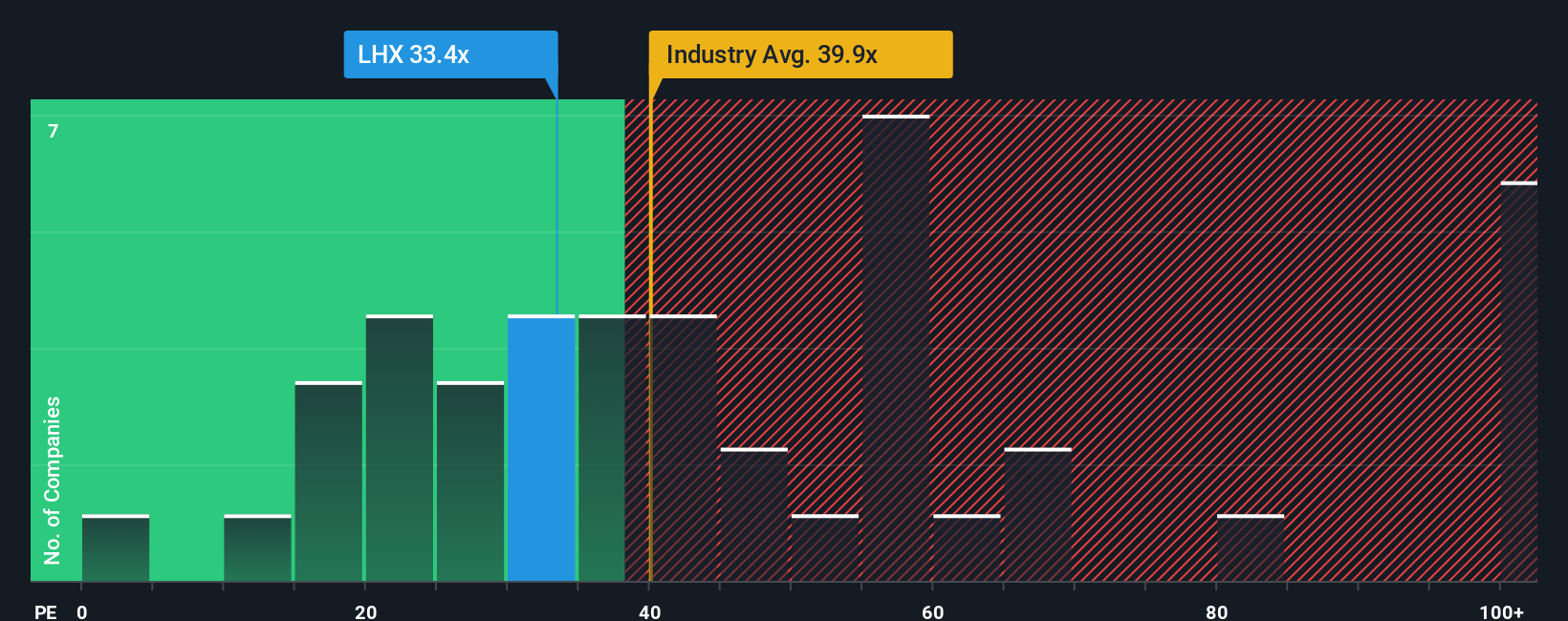

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like L3Harris Technologies because it relates the market price directly to current earnings. This makes it a useful shorthand for how much investors are willing to pay for each dollar of profit. PE ratios matter since stronger growth expectations and lower risk usually justify higher ratios, while slower growth or elevated risks call for a more conservative multiple.

Right now, L3Harris Technologies trades at a PE ratio of 32.1x. For context, this is lower than the Aerospace and Defense industry average PE of 40.9x and far below the peer group average of 76.2x. At first glance, this lower-than-average multiple might suggest the stock is favorably valued against its rivals and the broader sector.

However, a more customized assessment comes from Simply Wall St’s “Fair Ratio,” a proprietary metric that calculates what an appropriate PE multiple should be for L3Harris based on its earnings growth, profit margins, risk profile, industry segment, and market capitalization. This approach is considered superior to simple peer or industry comparisons since it factors in unique strengths, weaknesses, and growth prospects that broad averages can overlook. L3Harris’s Fair Ratio is 28.2x, just a few points below its current PE.

This close alignment between the Fair Ratio and the actual PE suggests the stock is about right by this valuation method.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your L3Harris Technologies Narrative

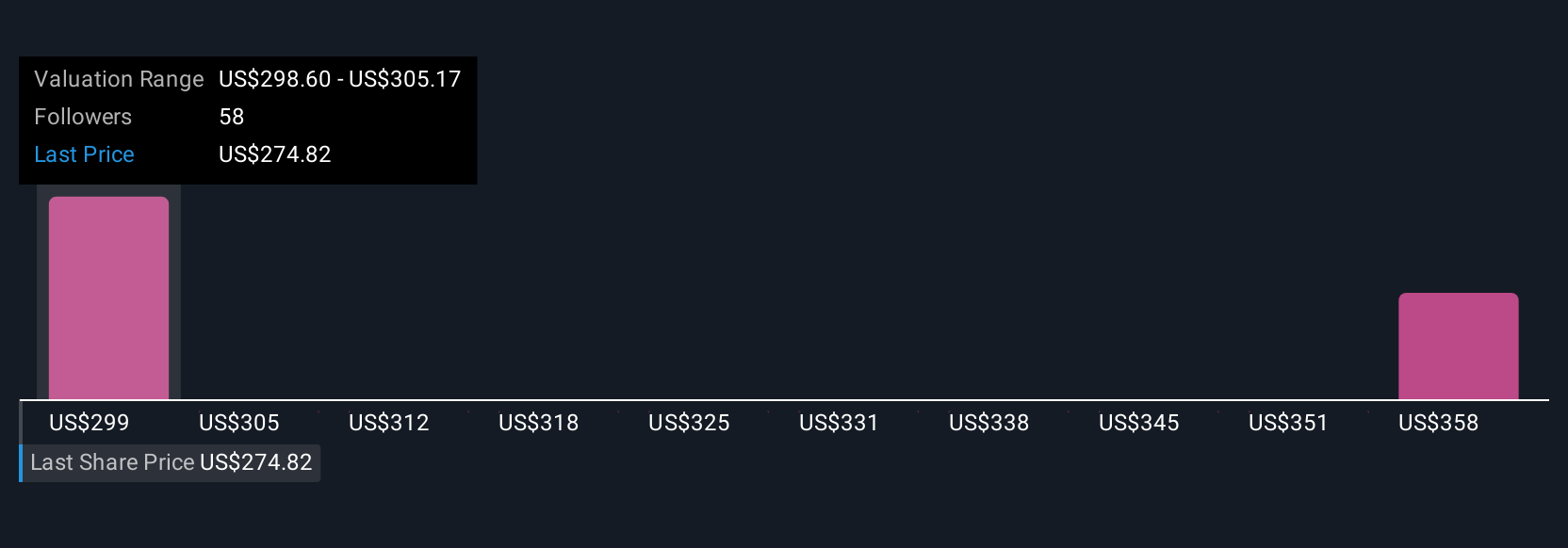

Earlier we mentioned that there is an even better way to assess valuation, so let us introduce you to Narratives. A Narrative is a powerful yet approachable tool that connects your perspective on a company, such as L3Harris Technologies, directly to its financial future and resulting fair value. Rather than relying on static numbers alone, Narratives let you set your own story, your expectations for growth, margins, and risks, which feed straight into a forecast and a personalized fair value estimate.

On Simply Wall St's widely used Community page, you can easily explore or create Narratives. This makes it not only accessible to everyday investors, but also dynamic, since Narratives automatically update when fresh information, such as earnings, news, or sector changes, comes in.

Narratives empower you to decide when to buy or sell by comparing your calculated fair value to the current price, allowing for truly personalized investing decisions. For example, some investors see L3Harris trading at a fair value above $327 per share, expecting ongoing growth and favorable defense budgets, while others are more cautious, assigning a fair value near $250 based on margin concerns or contract risks. Narratives capture all these perspectives and update as events unfold, so you are always working with the most current view, directly tailored to your own thinking.

Do you think there's more to the story for L3Harris Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives