- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

What L3Harris Technologies (LHX)'s Major Arkansas Expansion and UAE Pact Mean For Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, L3Harris Technologies and Arkansas Governor Sarah Sanders broke ground on the Arkansas Advanced Propulsion Facilities, a major expansion at the Camden site to increase solid rocket motor manufacturing capacity six-fold and add 230,000 square feet of production space.

- At the same time, L3Harris Technologies and EDGE Group signed a memorandum of understanding to pursue joint defense technology opportunities in the UAE, aiming to develop advanced solutions in artificial intelligence and autonomy.

- We'll look at how the new rocket motor production campus could reshape L3Harris Technologies' growth outlook and defense capabilities.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

L3Harris Technologies Investment Narrative Recap

To be a shareholder in L3Harris Technologies, you need confidence in the ongoing demand for advanced defense technologies and missile systems, supported by significant U.S. and international defense investments. The recent expansion in rocket motor manufacturing could help address evolving missile defense needs and support revenue from large programs, though risks like U.S. government budget constraints in the space sector remain significant catalysts and hurdles for the stock in the near term.

The groundbreaking of the Arkansas Advanced Propulsion Facilities is especially relevant as it uniquely aligns with the company’s focus on scalable missile manufacturing, providing flexibility to meet changing client demand. This expansion complements L3Harris’s other growth areas, such as new spacecraft manufacturing capabilities, positioning the company to respond quickly to shifts in customer and market priorities.

However, investors should be aware that while demand may be rising, budget constraints within the U.S. government could...

Read the full narrative on L3Harris Technologies (it's free!)

L3Harris Technologies' outlook anticipates $24.9 billion in revenue and $2.7 billion in earnings by 2028. Achieving this would require a 5.2% annual revenue growth rate and an earnings increase of $1.0 billion from the current $1.7 billion.

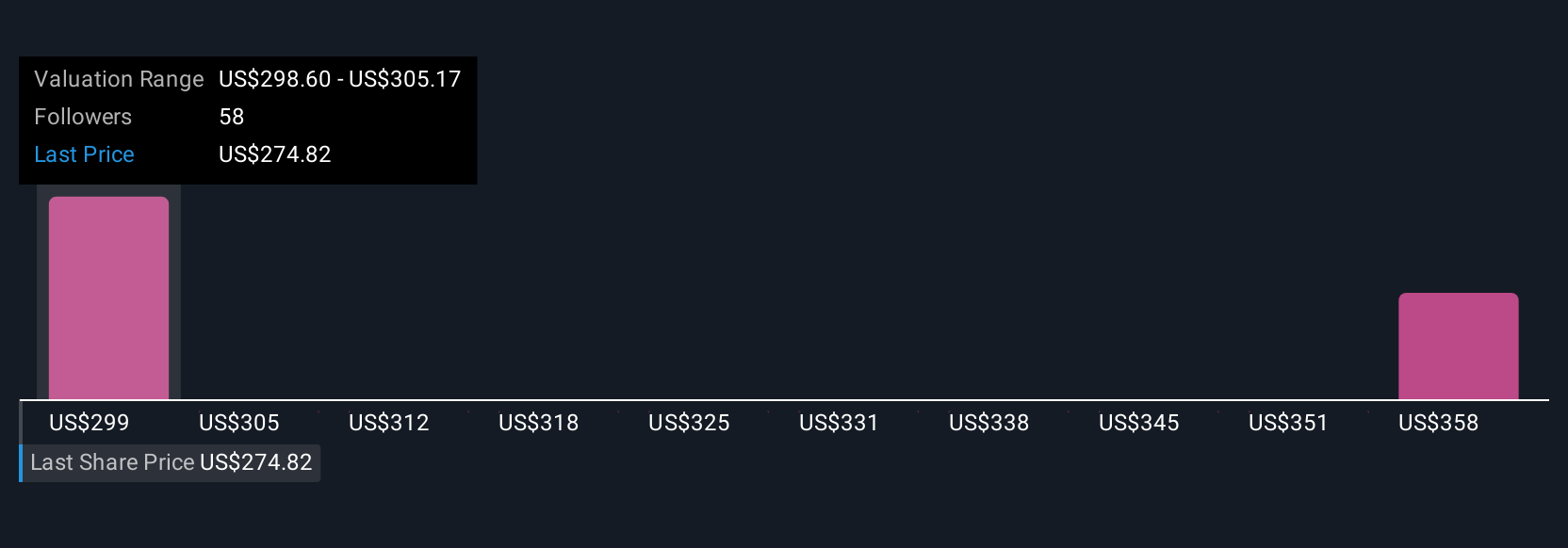

Uncover how L3Harris Technologies' forecasts yield a $334.16 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Two estimates from the Simply Wall St Community place L3Harris’s fair value between US$334 and US$383 per share. As investors weigh these differences, the risk of tighter U.S. defense budgets could influence the outlook in ways not yet reflected here.

Explore 2 other fair value estimates on L3Harris Technologies - why the stock might be worth just $334.16!

Build Your Own L3Harris Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your L3Harris Technologies research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free L3Harris Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate L3Harris Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success